AUTHOR : JAYOKI

DATE : 20/12/2023

Introduction

In the vast landscape of digital transactions, payment gateways have emerged as crucial facilitators, revolutionizing the way take place in. From traditional methods to the present-day online transactions, the journey has been transformative Commercial Interactions

Evolution of Transaction Gateway in India

Emergence of Online Transactions

With the advent of the internet, a shift towards online transactions began. Businesses and consumers started exploring the digital realm for more convenient and faster options Interactions In India. An electronic transaction refers to the exchange of goods or services conducted between businesses, individuals, households, governments, and other public or private organizations.

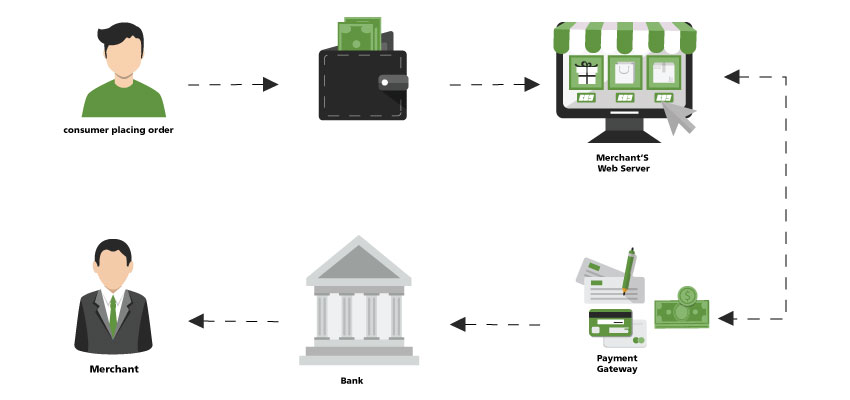

Introduction of Transaction Gateway

Recognizing the demand for secure online transactions, Transaction on Business gateways were introduced, Serving as virtual connectors between buyers and sellers, facilitate smooth and secure financial transactions. A mobile e-commerce transaction is an online purchase made using a mobile device, Gateway on Commercial such as a smartphone or laptop, through a wireless network or short-range connection.

Significance of Transaction Gateway

Facilitating Secure Transactions

One of the primary roles of Transaction Gateway Business Exchanges is to provide a secure environment for financial transactions. Payment Interactions In India and strong security safeguard sensitive data, with OECD defining e-commerce transactions from business and statistical viewpoints. The parties above can be individual customers.

Enhancing Customer Convenience

Transaction Gateway contribute significantly to customer convenience by offering various payment options. From credit/debit cards to digital wallets, E-commerce payment system[1] users have the flexibility to choose their preferred mode of payment An electronic transaction is the sale or purchase of goods or services, whether between businesses, households, individuals, governments, and other public or private organizations.

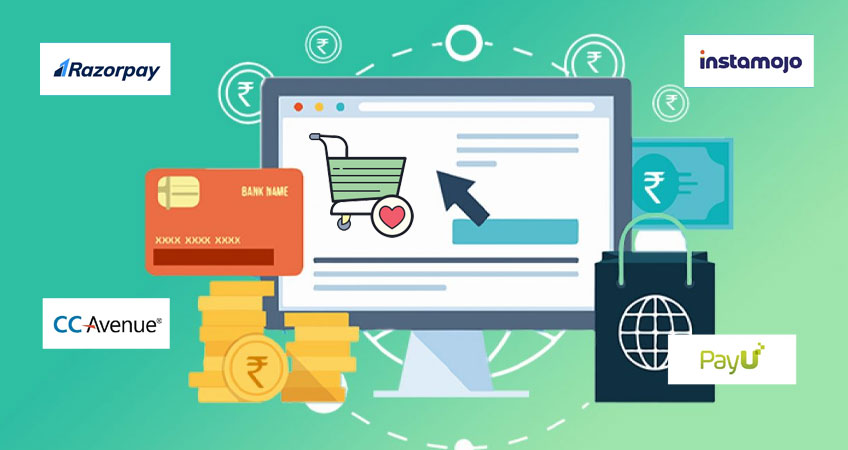

Industry Leaders

Established players in the Transaction Gateway sector have played a pivotal role in shaping the industry. Their experience and expertise have set benchmarks for others to follow e-Commerce Transactions[2].was defined by OECD from business and statistical perspective. The parties above can be individual customers

Rising Startups

India’s market has seen the rise of numerous groundbreaking startups in the Transaction Gateway sector. These newcomers bring fresh concepts that fuel intense competition. Transaction Gateway in India ensure security through access controls and monitoring tools, safeguarding businesses and maintaining compliance

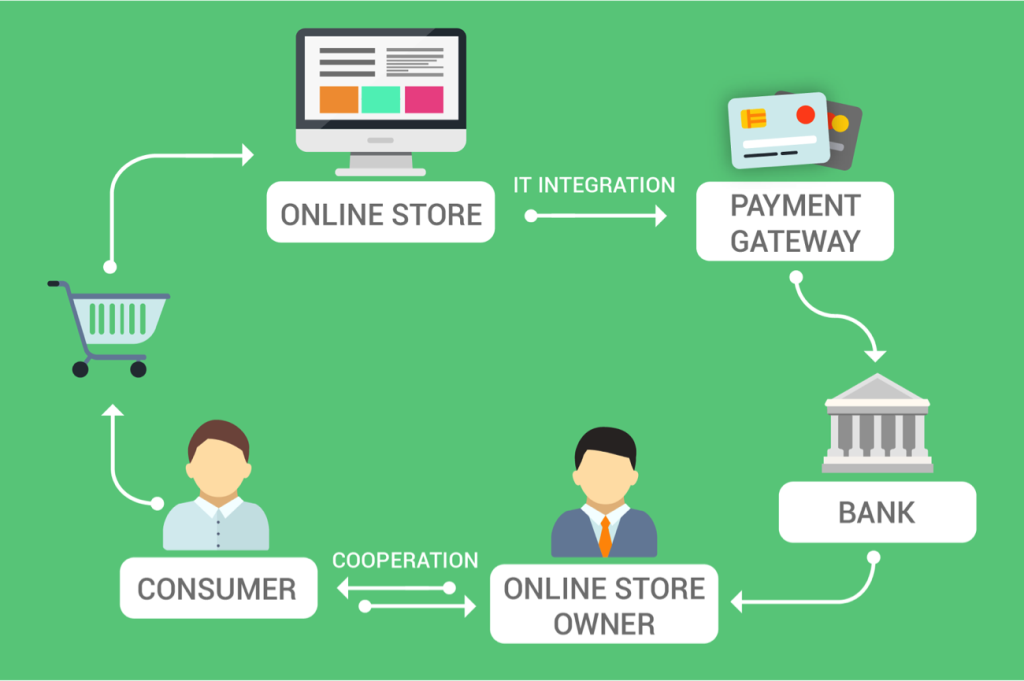

Integration of transaction Gateway in E-commerce

Streamlining Online Transactions

E-commerce platforms leverage Transaction Gateway to streamline the checkout process, Contactless Transaction[3] reducing friction for users and increasing conversion rates. Access control measures and transaction monitoring systems operate in unison to maintain your company’s ongoing security and regulatory compliance.

Boosting Business Revenue

Transaction Gateway Business Exchanges In India Secure Payment System[4] For businesses, integrating gateways opens up new revenue streams. By reaching a broader audience and providing various payment options, businesses can improve their financial outcomes. Secure payment systems operate by establishing a safe online payment gateway that encrypts and tokens sensitive customer information.

Mobile Wallets vs. Traditional Payment Gateways

Comparison of Features

Mobile wallets and traditional payment gateways each have their unique features .Recognizing differences helps users make choices aligned with their preferences. Secure payment systems[5] Transaction Gateway Business Exchanges ongoing security and compliance.

User Preferences

Consumer preferences play a crucial role in the adoption of payment methods. Consumer choices are shaped by elements like simplicity, reliability, and meeting expectations. eCommerce acts as a flexible tool across multiple sectors, driving sales and strengthening online brand presence, making it an essential component of any digital marketing plan. Cutting-edge SPS solutions offer features to streamline the checkout process, enhance customer experience, and collect valuable transactional insights for smarter business planning.

Future Trends in Payment Gateways

Adoption of Blockchain

Incorporating blockchain technology offers enhanced security, greater transparency, and improved efficiency in payment processes. Business-to-business (B2B) eCommerce involves transactions where suppliers sell products in bulk directly to other businesses. Business to consumer (B2C) is where a business sells its product

Impact on Small Businesses

Leveling the Playing Field

Payment gateways provide small businesses with the necessary tools to compete on equal terms with larger companies in the digital marketplace. By analyzing visitor behavior data on your website and using the insights to make informed decisions, you can optimize your eCommerce sales channels and maximize returns.

Consumer Trust in Payment Gateways

Building Trust Through Transparency

Clear communication about security practices and operational transparency help establish trust with consumers, nurturing lasting relationships. A collection of integrated software tools on a business’s website allows the company to provide products or services, facilitating the entire online sales experience.

Customer Reviews and Testimonials

Customer reviews and testimonials serve as social proof, reinforcing the reliability and trustworthiness of a payment gateway for prospective users. A collection of software tools embedded in a business’s website enables the company to offer products or services, effectively driving the entire online sales process.

Globalization of Indian Payment Gateways

Expanding Services Beyond Borders

Indian payment gateways are rapidly broadening their global reach, enhancing the country’s standing in the international fintech sector. The practice of enhancing your business website to rank in relevant online search results is referred to as search engine optimization (SEO)

Social and Economic Impacts

Contributions to GDP

The expansion of the payment gateway sector plays a crucial role in enhancing the country’s GDP, emphasizing the increasing significance of digital commerce in driving economic progress. By analyzing your website’s visitor behavior data and making informed business decisions based on the insights gathered, you can optimize growth potential.

Conclusion

In conclusion, the development of payment gateway systems has been transformative, acting as a central force in reshaping the digital commerce environment. From addressing security concerns to contributing to financial inclusion, payment gateways have become indispensable in the modern economy.

FAQs

- How do payment gateways ensure the security of online transactions?To protect the integrity of online transactions, payment gateways employ sophisticated encryption techniques and multi-factor authentication.

- What role do mobile wallets play in the payment gateway ecosystem? Mobile wallets offer users an alternative payment method, and understanding their features helps users make informed choices.

- How do payment gateways impact small businesses? Payment gateways level the playing field for small businesses, although they may face challenges in initial setup costs and competition.

- What are the future trends in payment gateways? Continuous technological advancements and the adoption of blockchain are key trends shaping the future of payment gateways.

- How do payment gateways contribute to financial inclusion? The widespread adoption of payment gateways contributes to financial inclusion by providing digital transaction access to a larger segment of the population.