AUTHOR : NORA

DATE : 20-12-23

INTRODUCTION

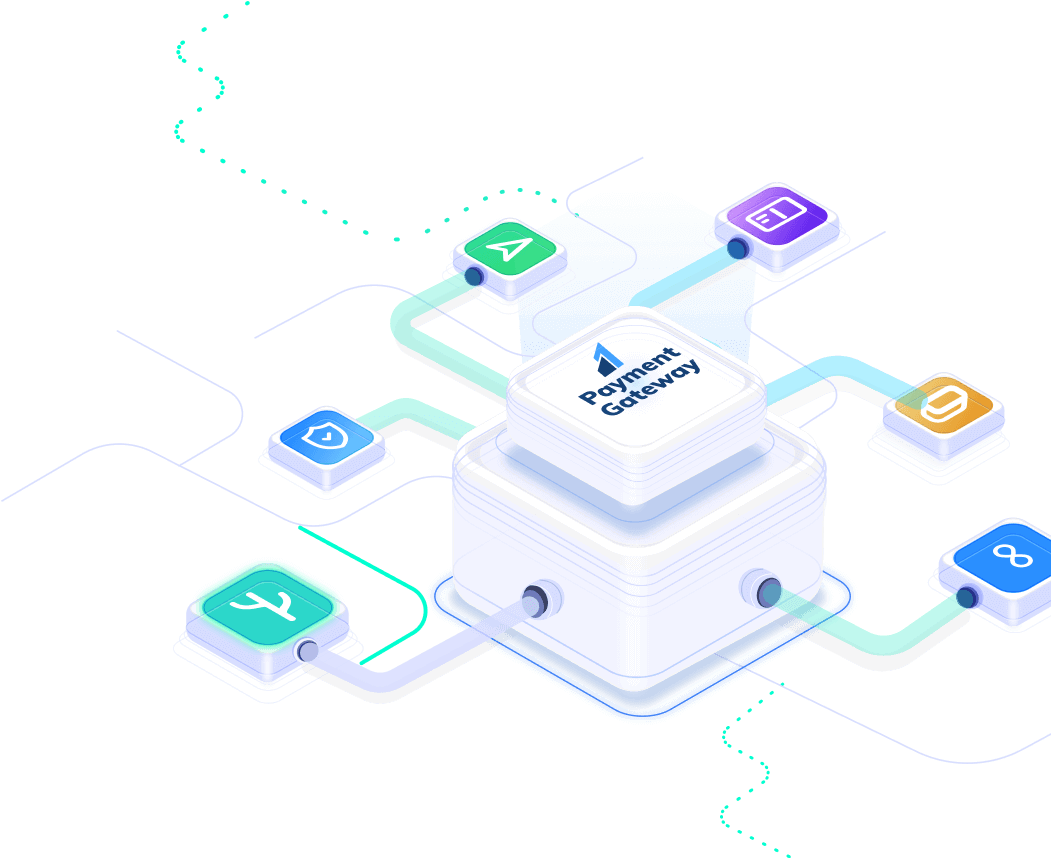

In a dynamic and ever-evolving digital landscape, the synergy between payment gateways and all so corporate partnerships has become a driving force in India’s financial technology sector. As businesses seek to streamline transactions and also enhance customer experience Industrial Partnerships strategic collaborations in the payment gateway space are witnessing unprecedented growth.

Evolution of Payment Gateway Corporate Partnerships

The journey of Corporate Partnerships In India corporate partnerships in India has seen significant milestones. From the early days of standalone gateways to the current era of collaborative ventures, the landscape has transformed. Key players in the market are actively shaping the industry through[5] innovative partnerships.

Benefits of Payment Gateway Corporate Partnerships

One of the primary advantages of such collaborations is the heightened security measures implemented. Payment Gateway Corporate Partnerships In India Additionally, these partnerships contribute to increased transaction efficiency and all so an overall improvement in the customer experience, setting the stage for a more seamless financial ecosystem.

Challenges and Solutions

Payment Gateway Corporate Partnerships In India While regulatory hurdles and technological advancements pose challenges, E-commerce payment system[1] collaborative problem-solving has emerged as an all so solution. The ability to navigate these challenges collectively has become a hallmark of successful payment gateway partnerships in India.

Success Stories

Several success stories illustrate the positive impact of Payment Gateway Corporate Partnerships In India Corporate Partnerships In India corporate partnerships on the Indian business landscape. These partnerships have not only elevated the efficiency of transactions but have also reshaped the way businesses operate in the digital realm. and all so

Future Trends

Looking ahead, industry partnerships and emerging technologies are set to play a pivotal role in shaping the future of .Payment Gateway[2] Corporate Partnerships Understanding potential areas for growth and also innovation will be crucial for businesses aiming to stay at the forefront of the evolving landscape.

Tips for Choosing the Right Payment Gateway Partner

Selecting the right Corporate Partnerships In India Corporate Partnerships with Indian partner is a critical decision for businesses. Considering specific business needs, Corporate Partnership[3] evaluating reputation and reliability, and ensuring scalability and adaptability are essential factors for making an informed choice.

Case Study Analysis

A detailed examination of a prominent Corporate Partnerships in Education[4] insights into the dynamics at play. By analyzing the strategies employed and lessons learned, businesses can glean valuable information for their own partnerships Access to Industry Resources and Expertise: Industry partnerships provide.

Expert Opinions

Industrial Automation Partners experts share their perspectives on the future of payment gateway partnerships[5], offering valuable insights and predictions. These opinions provide a comprehensive view of the evolving landscape and its potential impact on businesses.

How Businesses Can Benefit

Tailoring payment solutions to specific industries and maximizing return on investment through strategic partnerships are key considerations for businesses aiming to leverage the advantages of payment gateway collaborations.

The Role of Technology

The integration of cutting-edge technologies not only enhances user experience but and also contributes to heightened security measures. Understanding the impact of technology on payment gateways is vital for businesses seeking to stay competitive.

Regulatory Framework

Navigating the legal landscape and ensuring compliance with regulations are crucial aspects of payment gateway corporate partnerships. An in-depth understanding of the regulatory framework is essential for successful collaborations.

Consumer Trust and Data Privacy

Building and maintaining consumer trust is paramount. Ensuring data security and privacy in payment transactions is not only a legal requirement but and also a fundamental aspect of fostering trust among users.

Comparative Analysis

Comparing payment gateway partnerships in India with global trends provides valuable insights. Understanding the unique challenges and opportunities in the Indian market allows businesses to tailor their strategies for maximum impact.

Conclusion

In conclusion, payment gateway corporate partnerships in India represent a pivotal force in the digital transformation of financial services. The strategic collaborations, coupled with evolving technologies and all so dynamic regulatory landscape, are reshaping the industry and offering businesses new avenues for growth and innovation.

FAQ

- How do payment gateway partnerships enhance transaction security? Payment gateway partnerships implement advanced security measures, such as encryption and multi-factor authentication, to ensure the secure transmission of sensitive financial data all so .

- What factors should businesses consider when choosing a payment gateway partner? Businesses should consider their specific needs, the partner’s reputation and reliability, and the scalability and adaptability of the payment gateway to align with their growth strategies.

- How can emerging technologies impact the future of payment gateways? Emerging technologies, including blockchain and artificial intelligence, are poised to revolutionize payment gateways, offering improved efficiency, security, and also user experience.

- What role does consumer trust play in the success of payment gateway partnerships? Consumer trust is crucial for the success of payment gateway partnerships. Building and maintaining trust involve transparent practices, robust security measures, and adherence to data privacy regulations.

- How does the Indian regulatory framework influence payment gateway partnerships? The Indian regulatory framework sets guidelines for secure and compliant financial transactions. Payment gateway partnerships must navigate this landscape to ensure legal compliance and operational success.