AUTHOR : SOFI PARK

DATE : 20/12/2023

Introduction

Payment Gateway Professional Procurement involves the strategic acquisition of secure and reliable payment gateways tailored to meet the specific needs of businesses operating in the Indian market. It goes beyond a mere transaction facilitator, focusing on the integration of cutting-edge technology to ensure smooth and secure monetary transactions Procurement In India.

Significance of Efficient Payment Gateways in India

In a country with a burgeoning digital economy, the significance of efficient payment gateways cannot be overstated. From small Professional Procurement businesses to large enterprises, the seamless flow of financial transactions is vital for sustained growth and customer satisfaction.

The Landscape of Payment Gateways in India

Current Market Scenario

India boasts a diverse market of payment Professional gateway service providers, each offering unique features and capabilities. From industry giants to emerging players, the competition is fierce, driving innovation and efficiency in the sector.

Key Players in the Industry

Major players like Paytm, Razorpay, and Instamojo dominate the Indian payment gateway landscape. Understanding the strengths and weaknesses of each is crucial for businesses seeking the most suitable solution Procurement In India on payment.

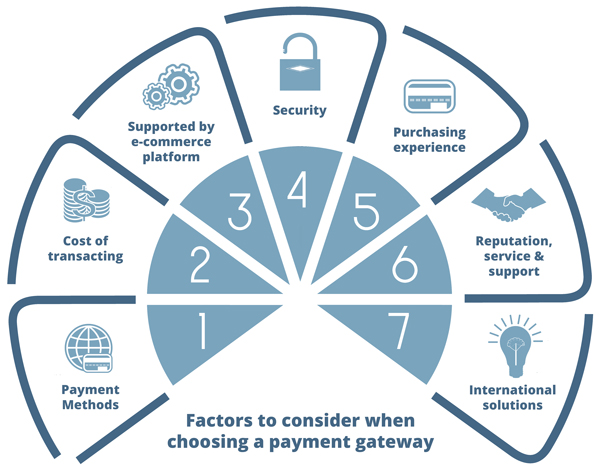

Factors to Consider in Payment Gateway Procurement

Security Features

The foremost concern in payment gateway procurement is the security of financial transactions. digital procurement[1] Robust encryption, secure sockets layer (SSL) certificates, and two-factor authentication are non-negotiable features for any payment gateway.

Integration Capabilities

Digital Procurement Transformation[2] Effortless integration with existing systems is essential. The chosen payment gateway should seamlessly integrate with the business’s website or application, ensuring a smooth user experience Every merchant wants to know how to get paid properly, and yet this is one of the least understood areas of business. Payment for ecosystem services[3].

Transaction Fees and Charges

Every merchant wants to know how to get paid properly, and yet this is one of the least understood areas of business. Payment processing[4] is an ecosystem. Understanding the fee structure is paramount. Procurement decisions should be based on a thorough analysis of these costs.

Regulatory Compliance

RBI Guidelines

Adherence to Reserve Bank of India (RBI) guidelines is mandatory. Procurement automation[5] Payment gateways must comply with regulations to ensure the legality and security of transactions. This means there is a complex and intricate set of processes that need to work together in order for your customers to pay you.

Data Protection Laws

With the increasing focus on data protection, businesses must choose payment gateways that align with India’s data protection laws This means there is a complex and intricate set of processes that need to work together in order for your customers to pay you..

Challenges Faced in Payment Gateway Procurement

Technical Challenges

Implementing a new payment gateway may pose technical challenges. Compatibility issues, system downtimes, and data migration concerns should be anticipated and addressed. Whether you’re an individual looking to accept payments at your website, or you’re a small business owner looking to find the right payment gateway for your growing business,

How to Choose the Right Payment Gateway Professional

Assessing Business Needs

Understanding the unique requirements of the business is the foundation for choosing the right payment gateway. A comprehensive assessment of transaction volume, customer base, and business model is essential. That means whether you’re looking at global payment processing or at the local level, each ecosystem is unique and consists of different networks of issuers, acquirers, and networks

Reading Reviews and Testimonials

That means whether you’re looking at global payment processing or at the local level, each ecosystem is unique and consists of different networks of issuers, acquirers, and networks Real-world experiences shared by other businesses provide valuable insights. Reading reviews and testimonials helps in gauging the performance and reliability of different payment gateways.

Future Trends in Payment Gateway Procurement

Technological Advancements

The future of payment gateway procurement in India is closely tied to technological advancements. Artificial intelligence, blockchain, and enhanced cybersecurity measures are expected to shape the industry.

Changing Consumer Behavior

Understanding evolving consumer behavior is crucial for anticipating future requirements. Payment gateways must adapt to changing preferences and expectations for continued success.

Tips for a Smooth Payment Gateway Integration

Collaborating with IT Professionals

Engaging with experienced IT professionals streamlines the integration process. Their expertise ensures a seamless transition without compromising on security or functionality. There are many different credit card schemes worldwide. In addition to Visa, Mastercard, American Express and Discover

Conducting Employee Training

In other words, it’s a set of rules and protocols for how cards are processed. Ensuring that employees are well-versed in utilizing the new payment gateway is essential.

Conclusion

the procurement of a payment gateway in India is a strategic decision that requires careful consideration of various factors. From security features to future trends, businesses must navigate the complex landscape to choose a gateway that aligns with their goals and values.

FAQs

- What is the significance of payment gateways in the Indian market?

Payment gateways play a crucial role in facilitating secure and efficient digital transactions in India’s growing digital economy. - How can businesses ensure regulatory compliance in payment gateway procurement?

Adherence to RBI guidelines and data protection laws is essential to ensure regulatory compliance. - What are the key challenges in payment gateway procurement?

Technical challenges and cost-related challenges are common hurdles businesses may face during the procurement process. - How can businesses stay updated on future trends in payment gateway technology?

Keeping an eye on technological advancements and consumer behavior trends is essential to stay ahead in the payment gateway landscape. - What role do case studies play in the decision-making process for payment gateway procurement? Case studies provide real-world examples of successful implementations, offering valuable insights for businesses making procurement decisions.