AUTHOR : RIVA BLACKLEY

DATE : 20/12/2023

Introduction

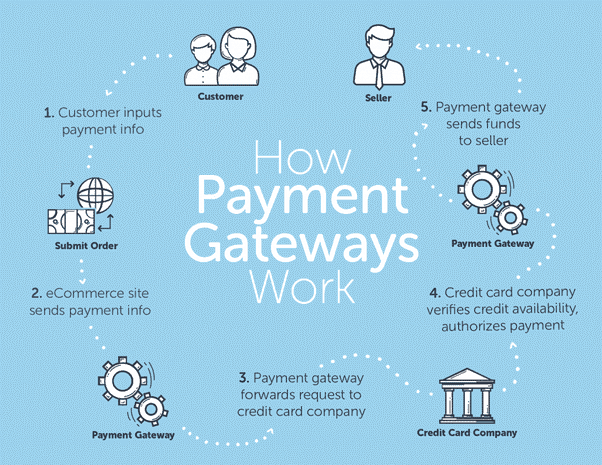

In the fast-paced world of digital transactions, payment gateways have become the backbone of online commerce. In India, where e-commerce is booming, the connection between payment gateways and suppliers plays a role in shaping the landscape of financial transactions Supplier Connections.

Evolution of Payment Gateways in India

The journey of payment for Supplier portal in India is a fascinating one. From their inception to the current state of technological marvels, these portal have evolved significantly. Technological advancements and the growth of online businesses have propelled payment portal to the forefront of financial transactions.

Significance of Supplier Connections

Building strong connections In India between payment portal and suppliers is more than just a transactional process. It goes beyond the mere exchange of funds; it’s about establishing trust and reliability in business relationships. A seamless connection ensures smoother transactions and fosters long-term partnerships.

Key Players in the Indian Payment Gateway Market

India boasts a vibrant market of payment gateway providers. Understanding the major players, their market share, and influence is crucial for businesses navigating the digital landscape. Merchant payment solutions[1] From traditional banking solutions to modern fintech companies, the options are diverse. Payment Gateway Supplier Connections In India.

Challenges in Supplier Connections

Despite the advantages, establishing and also maintaining supplier connections through payment portal come with their share of challenges. Payment Gateway Supplier Connections In India Whether it’s technical issues, communication barriers, or regulatory hurdles, businesses must navigate these obstacles strategically.

Benefits of Strong Supplier Connections

A robust connection between payment gateway s and suppliers can revolutionize payment processing and enhance overall business efficiency. Digital payment solutions[2]

Streamlining transactions and minimizing delays contribute to the growth and success of businesses. Payment Gateway Supplier Connections In India.

Technology Trends Shaping Supplier Connections

In the ever-changing technological landscape, artificial intelligence and blockchain are emerging as game-changers in payment portal. Payment service provider[3]

These technologies not only enhance security but also provide innovative solutions for seamless supplier connections.

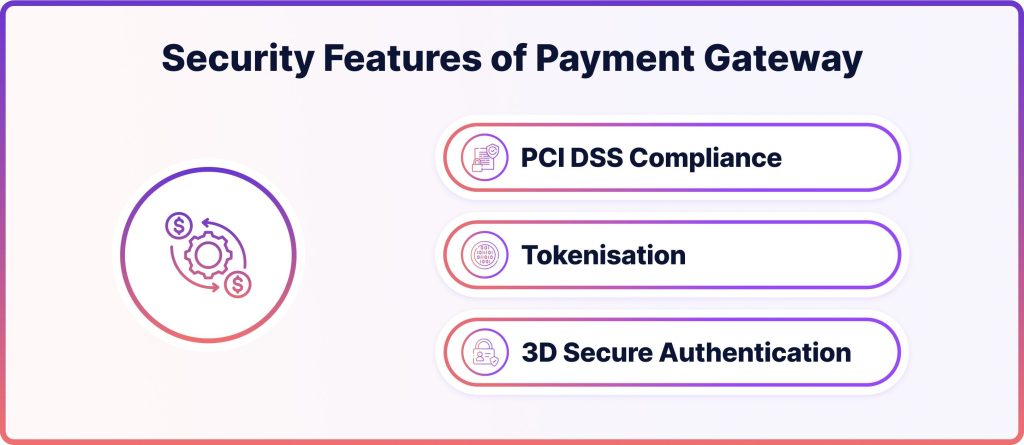

Security Measures in Payment Gateways

Ensuring secure transactions is paramount in the digital age. Streamline Supplier Payments[4] “This is the way we have always done it.” Encryption and fraud prevention measures are integral components of payment gateways, safeguarding businesses and consumers alike from potential threats. A comprehensive guide to understanding everything you need to know about payment service providers

Regulatory Landscape for Payment Gateways in India

Compliance with regulatory requirements is a critical aspect of payment portal. Understanding the legal framework and its impact on supplier management[5] is essential for businesses operating in the Indian market. Payment service providers (PSPs) enable businesses to accept all types of payment methods from customers.

Case Studies: Successful Supplier Connections

Real-world examples of businesses that have successfully navigated the complexities of payment portal and also built strong supplier connections provide valuable insights. These case studies offer lessons and best practices for businesses looking to optimize their processes.

Strategies for Effective Supplier Relationship Management

Communication and collaboration are key elements in maintaining strong supplier connections. Implementing effective strategies for relationship management ensures that businesses can adapt to changing dynamics and foster mutually beneficial partnerships.

Future Outlook of Payment Gateways in India

As technology continues to advance, the future of payment portal in India looks promising. Emerging trends such as contactless payments and voice-enabled transactions are reshaping the landscape, providing exciting possibilities for businesses and consumers alike.

Technology Trends Shaping Supplier Connections

In the ever-changing technological landscape, artificial intelligence and blockchain are emerging as game-changers in payment gateways. These technologies not only enhance security but also provide innovative solutions for seamless supplier connections.

Artificial intelligence (AI) is revolutionizing the way payment portal operate. Machine learning algorithms analyze transaction patterns, detect anomalies, and enhance fraud detection. This not only provides a layer of security but also ensures that genuine transactions proceed without unnecessary delays.

Conclusion

In conclusion, the interplay between payment portal and supplier connections is a crucial factor in the success of businesses in India. Emphasizing the importance of these connections, businesses are encouraged to adapt to technological trends, overcome challenges, and build resilient and trustworthy relationships with their suppliers.

FAQS

- Are payment gateways secure for online transactions?

- Answer: Yes, payment gateways employ robust security measures, including encryption, to ensure the safety of online transactions.

- How do supplier connections impact business efficiency?

- Answer: Strong supplier connections lead to smoother transactions, reducing delays and improving overall business efficiency.

- What role does AI play in payment portal?

- Answer: AI enhances security and provides innovative solutions for seamless payment processing and supplier connections.

- How can businesses overcome challenges in establishing supplier connections?

- Answer: Strategies such as effective communication, collaboration, and adapting to technological trends can help overcome challenges.

- What are the regulatory requirements for payment gateways in India?

- Answer: Payment portal must comply with legal frameworks, including data protection and financial regulations.