Name: Buddy Kim

Date: 21/12/23

Introduction

Payment processing is the backbone of any business, facilitating seamless transactions between buyers and sellers. In India, a diverse and dynamic market, the landscape of payment processing has witnessed significant evolution in recent years. This article explores the intricacies of payment processing for business integration in India, shedding light on the key players, regulatory framework, integration solutions, advantages, challenges, case studies, future outlook, and practical considerations.

Payment Processing Landscape in India

In the vast expanse of India’s business landscape, payment processing Integration In India plays a pivotal role. The current scenario reflects a blend of traditional methods and cutting-edge technologies. Emerging trends, such as the rise of digital wallets and contactless payments, indicate a shift towards a more tech-savvy consumer base.

Key Players in the Indian Payment Processing Market

Established companies and innovative startups are shaping the payment processing market in India. Payment Business Integration In India While industry giants provide stability and reliability, startups bring innovation and agility. Understanding the competitive landscape is crucial for businesses seeking to integrate seamless payment For Business processing solutions.

Regulatory Framework

The Reserve Bank of India (RBI) sets the guidelines for payment processing, ensuring a secure and transparent ecosystem. However, Integrating Multiple Payment Methods businesses often face compliance challenges, navigating the complex regulatory landscape to stay on the right side of the law.

Integration Solutions

The integration of Enterprise Payments Platform[1] is becoming increasingly vital for businesses. This section delves into the importance of integration and explores various solutions available, from API-based integration to hosted payment pages.

Advantages of Payment Processing Integration

Automated Payment Systems[2] Efficiency and customer experience are two key areas where integration can make a significant impact. Enhanced efficiency streamlines operations, while improved customer experience fosters loyalty and trust. multiple payment choices increases, Integrated payments industry leader[3]. businesses need help implementing seamless payment gateway integration. Providing a seamless and versatile payment experience in online transactions is paramount.

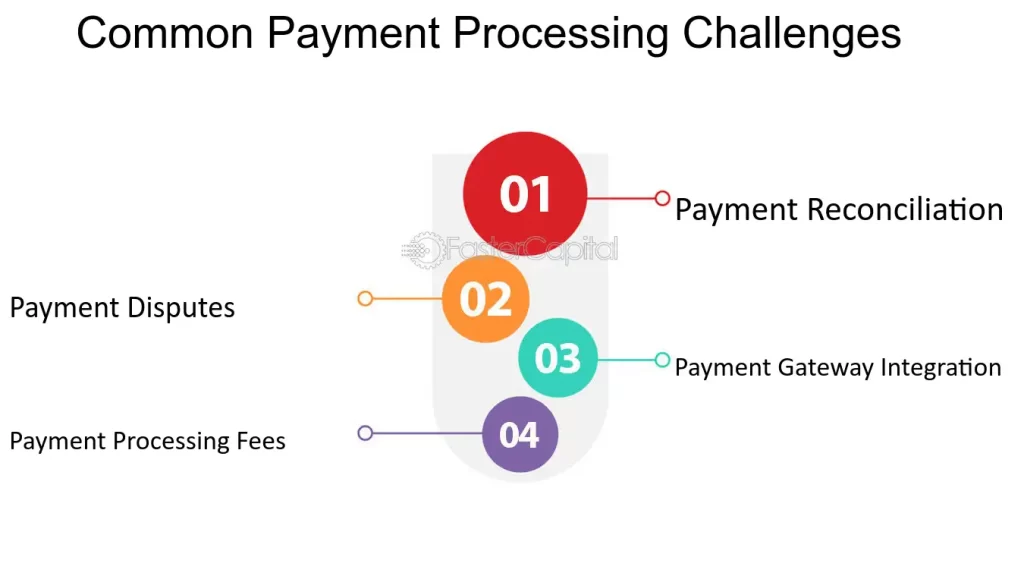

Common Challenges in Payment Processing Integration

Security concerns and technical issues are common stumbling blocks in the integration journey. E-commerce payment system[4] Understanding these challenges is the first step toward finding effective solutions.

Case Studies

Real-world examples of successful payment processing integration[5] provide valuable insights. From e-commerce giants to small businesses, case studies highlight the benefits and lessons learned from seamless integration multiple payment choices increases, businesses need help implementing seamless payment gateway integration. Providing a seamless and versatile payment experience in online transactions is paramount..

Future Outlook

As technology continues to evolve, the payment processing landscape in India is set for further transformation. From blockchain to artificial intelligence, the article explores the anticipated changes and their implications for businesses.

Choosing the Right Payment Processor

Selecting the right payment processor is a critical decision. Factors such as transaction fees, security features, and customer support must be carefully considered, along with case-specific considerations based on the nature of the business.

Steps to Seamless Integration

Preparing your business for integration and collaborating effectively with payment processors are crucial steps toward a seamless integration experience. This section provides practical guidance for businesses embarking on this journey.

Cost Considerations

While there is an initial investment involved in payment processing integration, the long-term benefits far outweigh the costs. This article explores the intricacies of payment method integration and the challenges faced and presents effective solutions. While businesses strive to stay competitive, it is necessary to understand the nuances of payment gateway integration.

Customer Education

Educating customers about new payment methods is often overlooked. This section explores the financial aspects, helping businesses make informed decisions. This section emphasizes the importance of customer education and provides strategies for businesses to ensure a smooth transition for their clientele.

Troubleshooting Integration Issues

This section explores the financial aspects, helping businesses make informed decisions. No integration process is without challenges. This section identifies common problems in payment processing integration and offers solutions and best practices for troubleshooting.

Conclusion

In conclusion, payment processing integration is not just a technological upgrade; it is a strategic move that can redefine a business’s efficiency and customer relationships. Embracing the evolving landscape of payment processing in India is not an option but a necessity for businesses aiming for sustained growth.

FAQs

- What are the key factors to consider when choosing a payment processor for business integration?Choosing the right payment processor involves considering factors such as transaction fees, security features, and customer support. Tailoring the choice to your business’s specific needs is crucial.

- How can businesses address security concerns in payment processing integration?Businesses can enhance security by implementing encryption technologies, conducting regular security audits, and staying updated on the latest cybersecurity trends.

- What role does customer education play in the success of payment processing integration?Customer education is vital to ensure a smooth transition and build trust. Businesses should communicate changes, provide tutorials, and offer support to customers adapting to new payment methods.

- Is payment processing integration suitable for small businesses?Yes, payment processing integration is beneficial for businesses of all sizes. Small businesses can streamline operations, enhance efficiency, and offer a more convenient payment experience to customers.

- How can businesses troubleshoot common issues during payment processing integration?Businesses can troubleshoot issues by having a dedicated support team, staying informed about updates, and collaborating closely with their payment processor to address any technical challenges.