Name: Buddy Kim

Date: 20/12/23

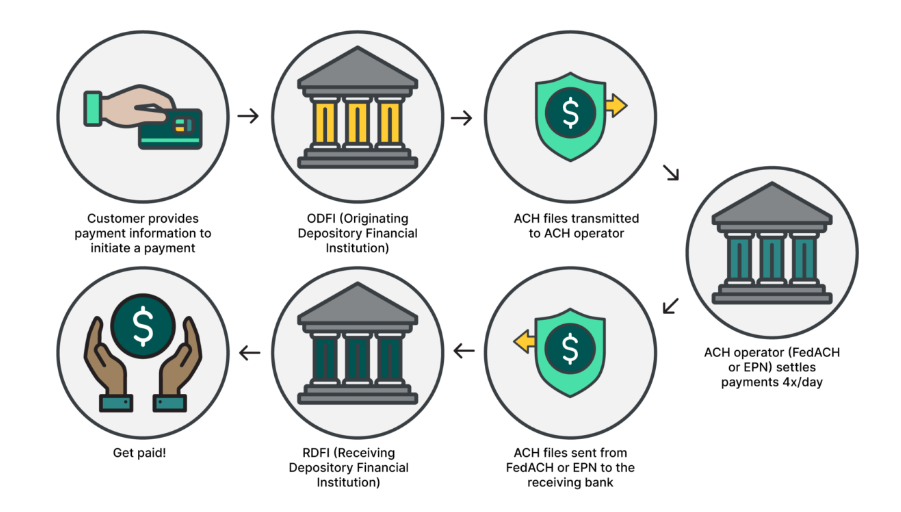

Introduction

In the dynamic landscape of business, the term “payment processing” has taken on a new significance, especially in the realm of business-to-business (B2B) transactions. In India, where the business ecosystem is rapidly evolving, efficient payment processing is becoming increasingly crucial. These are typically between financial institutions, either to support the financial institution’s customers’ activities or its own cross-border activities.

Importance of B2B Payment Processing

In the intricate dance of commerce, payment processing for B2B plays a pivotal role in ensuring the seamless flow of transactions between businesses. The traditional methods are giving way to digital solutions, streamlining Solutions In India processes and fostering efficiency.

Key Challenges in B2B Payment Processing

However, this transition is not without its challenges. Security concerns loom large, and businesses must grapple with finding solutions that not only expedite transactions but also safeguard sensitive financial information. Cross-border payments can be made in several different ways. Bank transfers, credit card payments and alternative payment methods

Emerging Trends in India

Amidst these challenges, India is witnessing a digital transformation in Business-to-Business Solutions In India. The adoption of advanced payment processing technologies is on the rise, promising a future where businesses can operate with unprecedented speed and efficiency.

Advantages of Digital Payment Solutions

The allure of digital payment solutions lies in their speed and efficiency. Digital payment solutions[1]

Businesses can now conduct transactions in real-time, eliminating the delays associated with traditional banking methods the payment industry has undergone an enormous transformation, moving from a purely paper-based exchange to plastic and metal cards to payment via mobile phone. Today, digital payments are mainstream.

Popular B2B Payment Platforms

A plethora of B2B payment platforms has emerged, each offering unique features. Online transaction processing[2]

From secure transaction gateways to customizable interfaces, businesses have a myriad of options to choose from.

Case Studies

Real-world success stories underscore the benefits of embracing digital payments. Businesses that have integrated efficient payment processing solutions report increased productivity, reduced errors, and enhanced customer satisfaction Cross-border payments[3].

Factors to Consider When Choosing a Payment Solution

Selecting the right payment solution is a critical decision for businesses. Security features, customization options, and ease of integration are factors that demand careful consideration we are convinced that digital-first does not necessarily mean digital-only. In fact, different payment forms can, and do, coexist.

Regulatory Framework in India

Navigating the regulatory landscape is essential for businesses implementing B2B payment solutions. Compliance with the guidelines set by the Reserve Bank of India (RBI) ensures a secure and legally sound financial environment Enterprise Payment Processing[4]

Steps to Implement Efficient B2B Payment Processing

Implementing efficient payment processing involves more than just adopting a new platform. Integration with existing systems, employee training, and a phased approach are vital components of a successful transition. Cross-border payments are financial transactions where the payer and the recipient are based in separate countries. They cover both wholesale and retail payments, including remittances.

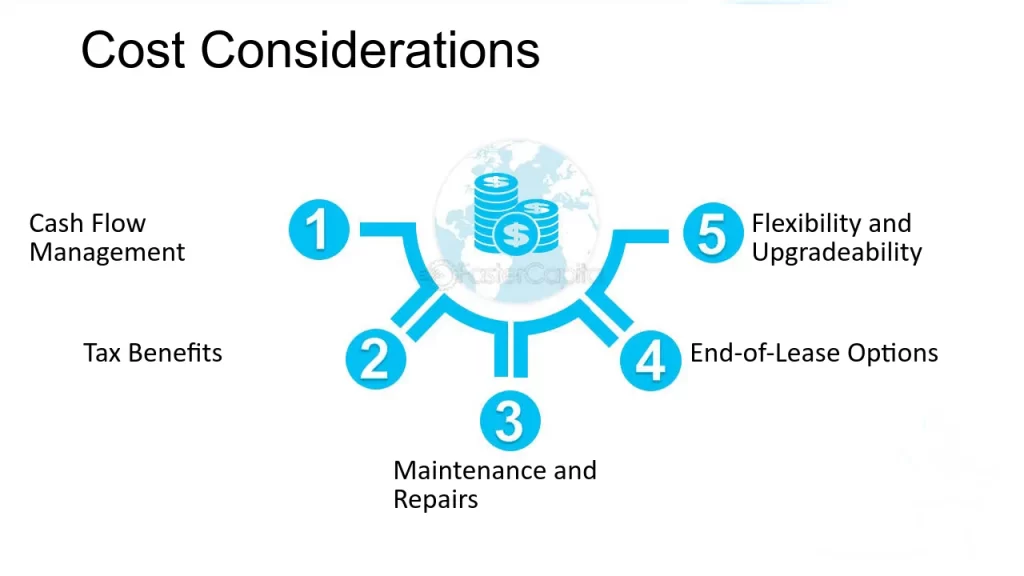

Cost Considerations

While the benefits of B2B payment processing[5] are evident, businesses must also weigh the costs associated with different solutions. Comparing pricing structures and assessing long-term value are crucial steps in the decision-making process.

Future Outlook

The future of B2B payments in India looks promising, with continued innovation and technological advancements. Businesses that stay ahead of the curve in adopting cutting-edge payment solutions are poised for sustained success.

Expert Opinions

Industry leaders provide valuable insights into the evolving landscape of B2B payments. Their perspectives shed light on the direction in which the industry is heading and Cross-border payments are financial transactions where the payer and the recipient are based in separate countries. They cover both wholesale and retail payments, including remittances. the innovations that will shape its future.

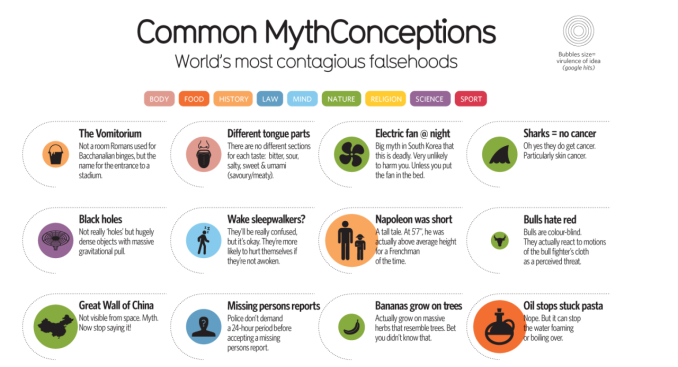

Common Misconceptions

Debunking myths surrounding B2B payment processing is essential for businesses looking to make informed decisions. Clearing misconceptions ensures that businesses embrace digital solutions with confidence.

Conclusion

In conclusion, the evolution of payment processing for B2B solutions in India is a testament to the ever-changing nature of commerce. Embracing digital transformation offers businesses the opportunity to thrive in a fast-paced, interconnected world.

Frequently Asked Questions

- Are digital payment solutions secure for B2B transactions?

- Absolutely. Advanced encryption and security protocols make digital payment solutions a secure choice for B2B transactions.

- How do I choose the right B2B payment platform for my business?

- Consider factors such as security features, customization options, integration ease, and long-term costs when selecting a payment platform.

- What role does regulatory compliance play in B2B payment processing in India?

- Regulatory compliance, especially with RBI guidelines, is crucial to ensure a secure and legally sound financial environment for B2B transactions.

- Are there success stories of businesses benefiting from digital payment solutions?

- Yes, many businesses have reported increased productivity, reduced errors, and enhanced customer satisfaction after adopting efficient payment processing solutions.

- How can businesses stay ahead in the evolving landscape of B2B payments?

- Staying informed about emerging trends, consulting industry experts, and embracing technological innovations are key strategies for businesses to stay ahead in the B2B payment landscape.