AUTHOR : JAYOKI

DATE : 20/12/2023

Introduction

Payment processing refers to the mechanism through which financial transactions are executed, enabling the transfer of funds between parties involved in a commercial interaction. In the context of India, where traditional and modern coexist, understanding the intricacies of payment processing becomes paramount.

Importance in Commercial Interactions

Efficient payment processing plays a pivotal role in enhancing the overall experience of commercial interactions. It facilitates the seamless Interactions In India flow of money, reducing the friction associated with traditional payment methods.

Evolution of Payment Systems in India

– Traditional Methods

Historically, India has been reliant on cash transactions and checks. However, the digital revolution has brought about a paradigm shift Payment for Commercial .

– Digital Transformation

The advent of digital payment[1] systems and the government’s push for a cashless economy have propelled India into a new era of payment processing.

Prominent Figures Shaping The Indian Financial Landscape Digital payments entail the movement of money or value exchange through electronic methods, primarily utilizing digital devices and the internet.

Navigating the complex landscape of Online payment systems[2] in India involves understanding the major players driving the industry forward.

Regulatory Framework

The Reserve Bank of India (RBI) plays a crucial role in regulating and guiding the payment processing landscape, ensuring the security and reliability of transaction Payment gateway integration[3] When compared to traditional paper-oriented payment ways such as cash, this method of transaction has gained considerable favor due to its enhanced convenience.

Popular Payment Methods

India boasts a diverse range of payment methods, with UPI (Unified Payments Interface), cards, and mobile wallets leading the chargeayment gateway is an intermediary between your customers and banking services, such as payment processing. In this customer-facing interface, buyers can review billing info and enter card details.

Security Measures

payment gateway is an intermediary between your customers and banking services, such as payment processing. In this customer-facing interface, buyers can review billing info and enter card details. With the rise of digital transactions, ensuring the security of payment processes has become a top priority. Stringent measures are in place to safeguard users against potential threats.

Future Trends in Payment Technology

The future of payment processing in India is marked by innovations like blockchain technology and contactless payments, promising a more efficient and secure system Payment Gateway[4].

Global Comparisons

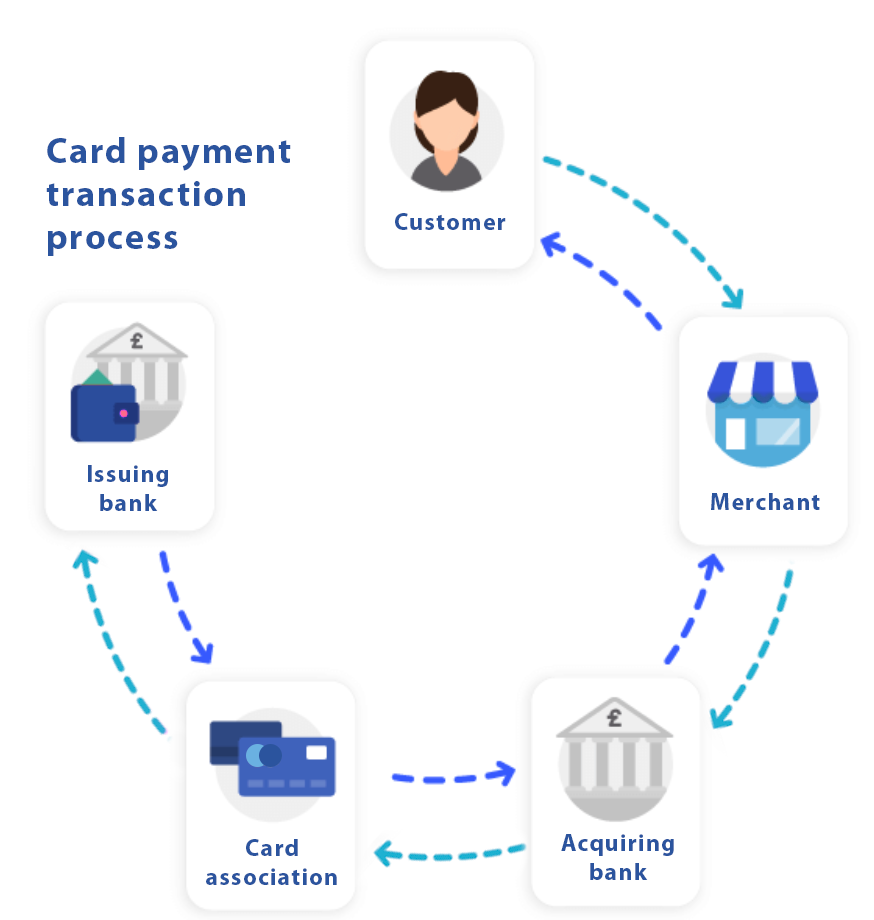

Comparing India’s payment processing landscape with other economies sheds light on the unique challenges and opportunities the country faces The payment industry ecosystem[5] operates with multiple intermediaries collaborating harmoniously to ensure a seamless transaction..

Tips for Choosing Payment Processors

The digital payment ecosystem operates with multiple intermediaries collaborating harmoniously to ensure a seamless transaction. For businesses looking to navigate the payment processing landscape, understanding the factors that contribute to the selection of suitable payment processors is crucial.

The Role of Fintech in Payment Processing

Fintech companies are disrupting traditional models, ushering in a new era of innovation in payment processingetect patterns, and enhance fraud prevention measures. Machine learning, on the other hand, enables systems to adapt and evolve based on transaction data, improving accuracy .

Future Trends in Payment Processing

Looking ahead, the future of payment processing in India holds exciting possibilities. Emerging technologies such as artificial intelligence (AI) and machine learning are poised to redefine how transactions are processed. AI-driven algorithms can analyze user behavior, detect patterns, and enhance fraud prevention measures.

Social Impact of Digital Payments

Beyond the business realm, the widespread adoption of digital payments has notable social implications.[4] Financial inclusion is a key aspect, as digital payment platforms enable individuals in remote areas to access banking services and participate in the formal economy. This inclusivity empowers individuals, fostering economic growth and reducing disparities in financial access.

Customer Education and Awareness

As the payment landscape evolves, customer education becomes paramount. Ensuring that users are well-informed about the various payment options, security measures, and the benefits of digital transactions is crucial. Financial literacy campaigns and user-friendly interfaces play a pivotal role in encouraging a smooth transition to digital payment methods.

Conclusion

In conclusion, payment processing for commercial interactions in India is undergoing a remarkable transformation, with technology, regulation, and consumer behavior shaping its trajectory. As businesses adapt to the changing landscape, the importance of selecting the right payment processing solutions cannot be overstated.

FAQs

- Is digital payment safe in India?

- Yes, digital payments in India are secured through advanced encryption and authentication measures.

- What role does the RBI play in payment processing?

- The Reserve Bank of India regulates and oversees the payment processing landscape, ensuring stability and security.

- Are there challenges in adopting digital payments for businesses?

- Businesses may face challenges such as fraud risks and technical issues, but the benefits often outweigh the challenges.

- How is India’s payment processing different from other countries?

- India’s payment processing landscape is unique, balancing traditional methods with cutting-edge technologies, unlike many other economies.

- Can small businesses benefit from advanced payment processing solutions?

- Yes, advanced payment processing solutions can enhance efficiency and customer experience for businesses of all sizes.