AUTHOR : JAYOKI

DATE : 20/12/2023

Introduction

In the dynamic landscape of corporate procurement in India, efficient payment processing plays a pivotal role in ensuring smooth transactions and fostering strong business relationships. As businesses evolve, so do the methods and technologies involved in payment processing.

Importance of Efficient Payment Processing

Efficient payment processing is crucial for streamlining financial transactions within corporate procurement. It enhances transparency, allowing businesses to maintain a clear record of their transactions, thereby minimizing errors and discrepancies Procurement In India.

Challenges in Corporate Procurement Payments

Despite the advancements, challenges persist in the realm of corporate procurement payments. Currency conversion issues, delayed processing times, and security concerns are common hurdles that businesses face in their payment processes For Corporate.

Popular Payment Methods in Corporate Procurement

Electronic Funds Transfer (EFT), corporate credit cards, mobile wallets, and digital payment platforms are among the popular methods employed in corporate procurement payments.

Every approach brings forth a distinct array of benefits and factors to contemplate, tailoring the choice to the specific needs and circumstances at hand.

Government Regulations Impacting Payment Processing

Government regulations play a significant role in shaping the payment processing landscape. Businesses must stay abreast of relevant regulations and ensure compliance to avoid legal complications Gain a competitive edge with cardholders and onboard merchants faster. Create the platforms, tools and infrastructure needed for seamless, secure transactions..

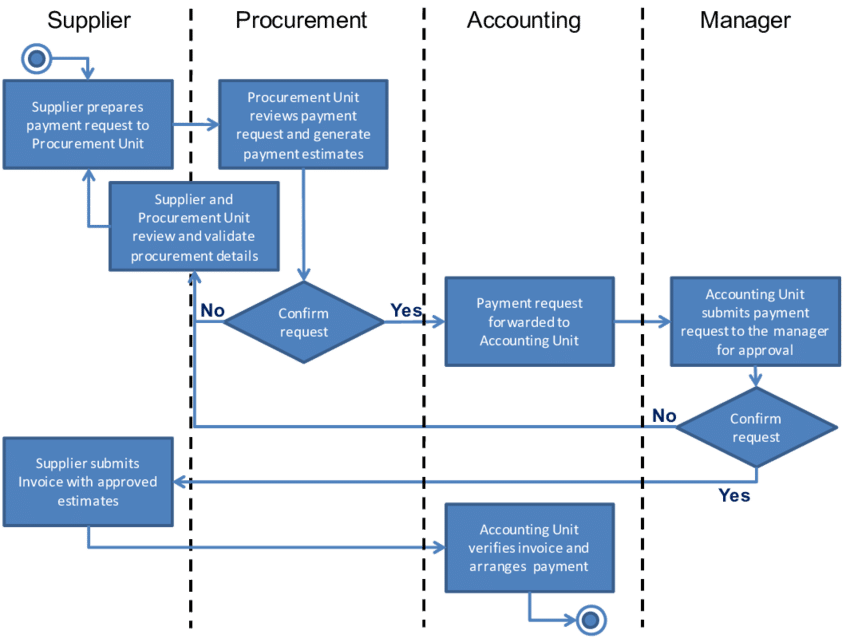

Integration of Technology in Payment Systems

Technological integration, including the use of blockchain and automation, is revolutionizing centralized payments[1] in corporate procurement. These innovations contribute to increased efficiency and reduced processing times.

Benefits of Efficient Payment Processing

Efficient payment processing leads to cost savings, improved cash flow, and enhanced vendor relationships. Businesses that invest in streamlined E-Procurement payment systems often find themselves at a Move payment processing engines to the cloud and expand capabilities for new payment rails and alternative payment methods[2]. competitive advantage.

Security Measures in Corporate Procurement Payments

Security is paramount in payment processing. Digital payment solutions[3] Gain a competitive edge with cardholders and onboard merchants faster. Create the platforms, tools and infrastructure needed for seamless, secure transactions. Encryption, tokenization, and multi-factor authentication are key measures implemented to safeguard financial transactions.

Future Trends in Payment Processing for Corporate Procurement

The future of payment processing in corporate procurement automation[4] involves continuous innovation. Predictions include the rise of new technologies and methodologies that will further enhance efficiency. Transform your payment network and processing ecosystem. Launch new products with faster time to market and self-service capabilities for merchants and partners.

Tips for Choosing the Right Payment Processing Solution

Selecting the right payment processing solution requires careful consideration of factors such as business needs, scalability, Digital Procurement Solutions[5] Transform your payment network and processing ecosystem. Launch new products with faster time to market and self-service capabilities for merchants and partners. and customization options. A one-size-fits-all approach may not be suitable for every enterprise.

The Role of Fintech Companies

Process automation in procurement, particularly when deployed in tandem with collaborative tools and platforms, can significantly improve the business-vendor relationship Fintech companies play a crucial role in supporting and innovating payment solutions. Their expertise often leads to the development of cutting-edge technologies that benefit businesses.

Comparative Analysis of Payment Processors in India

A comparative analysis of major payment processors in India sheds light on their strengths and weaknesses. Understanding these aspects helps businesses make informed decisions when choosing a payment processor. as supply chains have become increasingly more complicated and potentially volatile, automation platforms have provided businesses with tools to adapt quickly to unforeseen

Educational Resources for Corporate Procurement Professionals

For professionals in the field, ongoing education is essential. Training programs and certifications provide valuable resources to stay updated on the latest trends and best practices in payment processing. Process automation in procurement, particularly when deployed in tandem with collaborative tools and platforms, can significantly improve the business-vendor relationship

The Role of Fintech Companies

Fintech companies continue to reshape the financial landscape, offering innovative solutions that go beyond traditional payment methods. Their agility and focus on user experience make them valuable partners for corporations seeking to stay ahead in payment processing. Collaborations with fintech companies can provide access to cutting-edge technologies and expertise.

Comparative Analysis of Payment Processors in India

Examining the major payment processors in India reveals a diverse landscape. While some specialize in seamless cross-border transactions, others focus on offering cost-effective solutions for local businesses. A detailed comparative analysis helps businesses make informed decisions based on their specific requirements, ensuring they align with a processor that best serves their needs.

Conclusion

In conclusion, efficient payment processing is the backbone of successful corporate procurement in India. By addressing challenges, embracing technological innovations, and staying compliant with regulations, businesses can ensure smooth and secure financial transactions.

FAQs

- What are the common challenges in corporate procurement payments?

- Currency conversion issues, delayed processing times, and security concerns are common challenges.

- Which payment methods are popular in corporate procurement?

- Electronic Funds Transfer (EFT), corporate credit cards, mobile wallets, and digital payment platforms are popular choices.

- How do government regulations impact payment processing?

- Government regulations shape the payment processing landscape and necessitate compliance to avoid legal complications.

- What security measures are crucial in corporate procurement payments?

- Encryption, tokenization, and multi-factor authentication are crucial security measures.

- How can businesses choose the right payment processing solution?

- Businesses should consider factors such as scalability, customization options, and specific business needs when choosing a payment processing solution.