AUTHOR : MICKEY JORDAN

DATE : 20/12/2023

Introduction

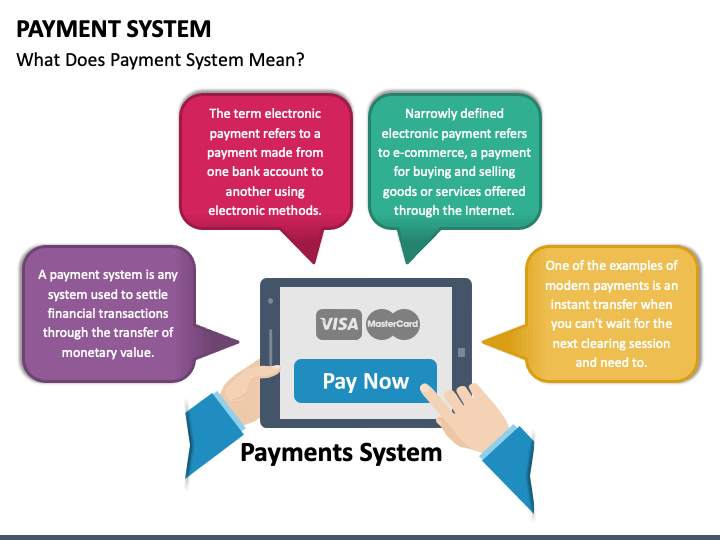

In the dynamic landscape of in India, efficient payment processing plays a pivotal role in ensuring seamless transactions and financial operations. As businesses continue to evolve, the need for advanced payment processing solutions becomes increasingly evident.

The Landscape of Enterprise Solutions in India

India has witnessed a remarkable growth in the adoption of enterprise solutions across various industries. From streamlined operations to enhanced customer experiences, these solutions have become integral to the success of businesses operating in the country.

The Need for Advanced Payment Processing

Despite the advancements in Processing for Enterprise many businesses grapple with challenges related to payment processing. Delays, errors, and lack of transparency in financial transactions can hinder the overall efficiency of an enterprise Solutions in India.

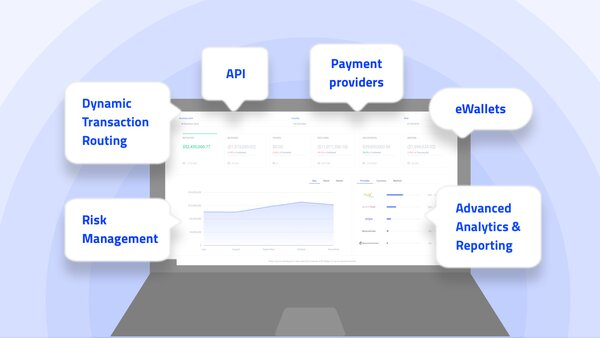

Key Features of Enterprise Payment Processing

To address these challenges, it’s crucial for enterprises to prioritize payment processing solutions with key features such as real-time processing, multi-currency support, and robust security protocols.

Security Concerns in Payment Processing

Security is paramount in the world of payment for enterprises Solutions in India. The article explores the importance of encryption, tokenization, and other security measures to safeguard sensitive financial information.

Popular Payment Processing Solutions in India

Several payment processing platforms cater specifically to the needs of enterprises in India. Ecommerce Payment Processing[1] Understanding how ecommerce payment processing works is a crucial part of opening an online business From industry giants to innovative startups, the article highlights platforms that have gained prominence in the market.

Integration with Business Systems

Seamless integration with existing business systems is a vital consideration for enterprises adopting Payment for ecosystem services[2] processing solutions. The article delves into the benefits of a well-integrated financial But let’s be honest, if you’re not a financial wizard or very technical, you might find the whole concept of ecommerce credit card processing complex and hard .

Customization Options for Enterprises

Enterprises vary in their requirements, and payment processing solutions should offer customization options. The article discusses the need for tailored solutions that align with the specific needs of each enterprise The payment gateway secures the data and sends it to the payment processor..

Cost-Effectiveness and ROI

While investing in payment processing solutions, enterprises must evaluate the cost-effectiveness and the potential return on investment. Digital payment solutions[3] The customer enters their credit or debit information at checkout. The article provides insights into assessing the financial impact of these solutions.

Regulatory Compliance

Adhering to regulatory standards is non-negotiable in the Indian business landscape. The article sheds light on the importance of compliance with Indian regulations in the realm of The ERP Payment Integrations[4]

checks with the credit card network to ensure that the customer has the funds to cover the purchase.

Future Trends in Enterprise Payment Processing

As technology continues to advance, the article explores emerging trends and technologies that are shaping the future of payment processing for enterprises in India Payment Reconciliation[5].

Challenges and Solutions

The article addresses common challenges faced by enterprises during the implementation of payment processing solutions and provides practical solution she customer’s credit card issuing bank either accepts or rejects the payment request.

Emerging Technologies: Transforming Payment Processing for Enterprises

As the business landscape continues to evolve, the integration of emerging technologies is reshaping the way enterprises approach payment processing. This section explores the cutting-edge technologies that are revolutionizing the payment landscape for businesses in India.

Blockchain Integration for Transparent Transactions

Blockchain technology has gained immense popularity for its ability to provide a decentralized and transparent ledger. In the context of payment processing for enterprises, blockchain ensures secure and tamper-resistant transactions. The article delves into real-world examples where enterprises in India have leveraged blockchain to enhance the transparency and traceability of financial transactions.

Conclusion

In conclusion, efficient payment processing is not just a technical necessity but a strategic imperative for enterprises in India. The article summarizes key takeaways and emphasizes the critical role payment processing plays in the success of enterprise solutions.

FAQs

- Are there specific payment processing regulations for enterprises in India?

- The regulatory landscape for payment processing in India is dynamic, and enterprises must stay informed to ensure compliance.

- How can enterprises ensure the security of financial transactions?

- Implementing encryption, tokenization, and regular security audits are essential steps to safeguard financial data.

- What are the cost considerations when adopting payment processing solutions?

- Enterprises should evaluate the total cost of ownership, considering implementation, maintenance, and potential ROI.

- Can payment processing solutions be customized to fit unique enterprise requirements?

- Yes, many payment processing providers offer customizable solutions to align with specific enterprise needs.

- What future trends should enterprises watch out for in payment processing?

- The integration of AI, blockchain, and contactless payments are among the trends shaping the future of payment processing for enterprises.