AUTHOR:AYAKA SHAIKH

DATE:21/12/2023

Introduction

What is Payment Processing?

Payment processing is the method by which transactions are approved and funds are transferred between the payer and the recipient. Think of it as the lifeline of any financial transaction, Guaranteeing that funds move securely and also swiftly Industry collaborations .

Importance in Industry Collaborations

In the ever-evolving landscape of industry partnerships, payment processing plays an increasingly vital role. Picture two companies collaborating on a project; without reliable payment systems, delays could hinder progress, resulting in lost opportunities and higher expenses.

Current Payment Trends in India

Digital Payment Revolution

India has Observed a digital payment revolution, with platforms like UPI (Unified Payments Interface) transforming the way businesses operate. This surge in digital transactions has paved the way for Flawless industry collaborations in India.

Regulatory Landscape

While Progressions have been achieved, India’s regulatory framework still poses considerable hurdles. Strict guidelines and compliance obligations require businesses to Proceed carefully, Guaranteeing clarity and accountability. and payment processing for Industry Compliance to legal standards.

Challenges Faced

Infrastructure Limitations

Infrastructure remains a significant challenge, as urban areas benefit from advanced payment systems, whereas rural regions often face a shortage of critical resources, Industry collaborations in India efforts.

Regulatory Hurdles

Navigating the complex regulatory maze remains a daunting task. From taxation to compliance, companies face numerous hurdles that can complicate Digital payment solutions[1]. the payment industry has undergone an enormous transformation, moving from a purely paper-based exchange,

Solutions and Innovations

Unified Payment Interfaces

digital payments are mainstream, and the industry continues to evolve with services such as cryptocurrency UPI has emerged as a game-changer, offering a unified platform for transactions. payment industry ecosystem[2] By leveraging UPI, companies can simplify payment processing, smoother collaborations

Blockchain and also Smart Contracts

Blockchain technology, along with smart contracts, presents innovative solutions. Together, these technologies offer transparency, security, and efficiency, thereby Simplifying B2B Payments Processing[3] and minimizing disputes Business to business or B2B, is a term that specifies with whom business is conducted..

Case Studies

Successful Collaborations

Payment card industry[4] Several industry collaborations in India have thrived, thanks to robust payment processing systems. Companies digital platforms have achieved unprecedented success, setting for others to follow.

Adoption of AI and Machine Learning

As we delve deeper into the digital age, the adoption of artificial intelligence (AI) and also machine learning (ML) in payment processing is inevitable. These technologies can analyze vast datasets, predict transaction patterns, and enhance security protocols, paving the way for more efficient and also secure Collaborative software[5].

Enhanced Security Protocols

With cyber threats on the rise, ensuring robust security protocols is paramount. Industry collaborations must prioritize cybersecurity, implementing advanced encryption techniques and also multi-factor authentication to safeguard sensitive information.

Collaborative Ecosystems

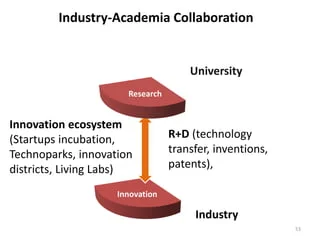

Integration of Financial Ecosystems

The integration of financial ecosystems is crucial for fostering collaborative environments. By connecting diverse platforms and systems, companies can not only streamline processes but also reduce transaction costs, thereby accelerating growth opportunities. Moreover, this integration enhances overall efficiency and adaptability in a competitive market.

Role of Financial Institutions

Financial institutions play a pivotal role in shaping industry collaborations. By offering tailored financial solutions, guidance on regulatory compliance, and expertise in payment processing, they facilitate smoother collaborations and drive innovation.

Future Outlook

Emerging Technologies

Emerging technologies like quantum computing and decentralized finance (DeFi) are poised to revolutionize payment processing. These innovations promise enhanced scalability, security, and transparency, reshaping the landscape of industry collaborations in India.

Strategic Partnerships

Forming strategic partnerships is essential for navigating the evolving landscape.By collaborating not only with fintech startups but also with tech giants and regulatory bodies, companies can harness collective expertise, resources, and insights to both drive sustainable growth and foster innovation. Furthermore, these partnerships enable a more adaptable and resilient approach to industry challenges.

Conclusion

Payment processing remains a cornerstone of industry collaborations in India. Although challenges persist, innovations such as UPI and blockchain nonetheless offer promising solutions. Moreover, these technologies could potentially reshape the landscape by addressing critical issues and enhancing efficiency.

FAQs

- What is the significance of payment processing in industry collaborations?

- Payment processing ensures seamless transactions, fostering trust and efficiency between collaborating entities.

- How has UPI transformed payment processing in India?

- UPI has revolutionized payment processing, offering a unified platform for swift and secure transactions, driving industry collaborations.

- What challenges do companies face in payment processing?

- Companies grapple with infrastructure limitations, regulatory hurdles, and compliance requirements, complicating payment processing.

- How can blockchain technology enhance payment processing?

- Blockchain technology offers transparency, security, and efficiency, streamlining payment processes and minimizing disputes.

- What lessons can companies learn from successful collaborations?

- Embracing technology, prioritizing compliance, and fostering transparency are key lessons, driving growth and innovation.