NAME : KIM FERNANDEZ

DATE : 21/12/2023

Introduction

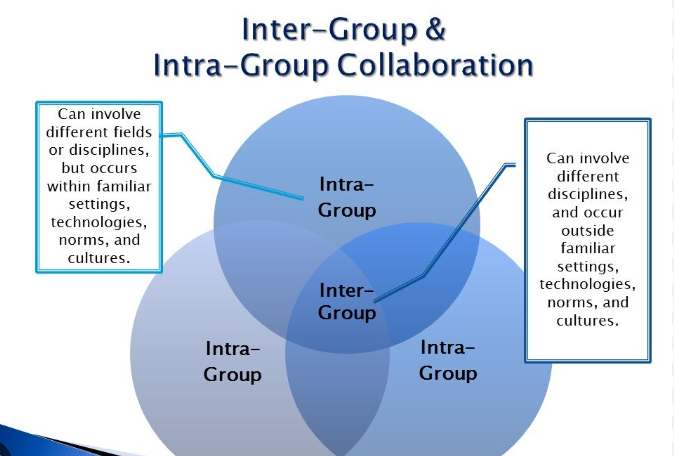

In the dynamic landscape of business collaborations, efficient payment processing plays a pivotal role in fostering seamless transactions between corporations. This article delves into the nuances of payment processing for inter-corporate collaborations in India, shedding light on its importance, challenges, popular methods, security measures, government regulations, and also future trends.

Importance of Efficient Payment Processing

Efficient payment processing is the backbone of successful inter-Payment for collaborations. Streamlining financial transactions not only ensures timely payments but also strengthens the trust and rapport between collaborating entities. In the world of business, where time is money, a smooth payment process is a key contributor to sustained partnerships.

Challenges in Payment Processing

Despite its significance, payment processing in inter-corporate Collaborations In India comes with its own set of challenges. Currency conversion issues, regulatory compliance hurdles, and differences in financial systems can create bottlenecks. Navigating through these challenges requires a strategic approach and a thorough understanding of the financial landscape.

Popular Payment Methods in Inter-Corporate Collaborations

In the Indian Processing For Inter-Corporate business ecosystem, various payment methods facilitate inter-corporate transactions. From traditional methods like NEFT and RTGS to modern solutions like UPI and digital wallets, corporations have a plethora of options to choose from. Additionally, cross-border payment[1] solutions have gained prominence, ensuring seamless transactions in the global marketplace.

Security Measures in Payment Processing

Security is paramount in inter-corporate payment processing. Robust encryption, secure gateways, and two-factor authentication are essential components of a secure payment ecosystem[2]. As cyber threats evolve, corporations must stay vigilant and also invest in cutting-edge security measures to protect their financial transactions.

Government Regulations and Compliance

The Reserve Bank of India (RBI) sets the guidelines for inter-corporate payment processing[3]. Adhering to these guidelines is crucial to avoid legal complications and financial penalties. Additionally, corporations must be cognizant of the tax implications associated with cross-border transactions, ensuring compliance with Indian tax laws.

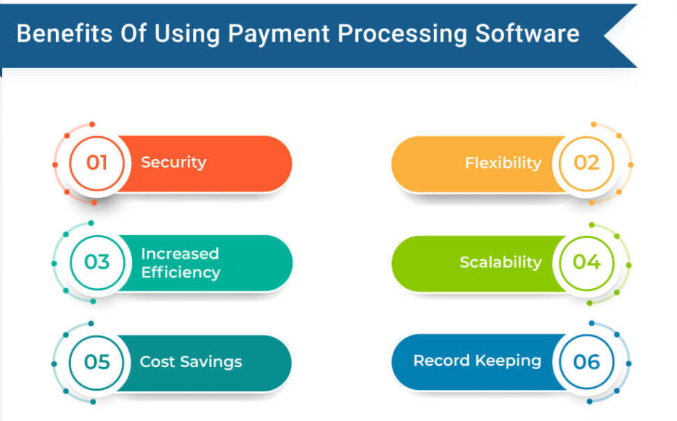

Benefits of Using Digital Payment Solutions

Digital payment solutions offer a myriad of benefits in inter-corporate collaborations, as faster transactions, reduced paperwork, and improved accuracy contribute to a more efficient financial ecosystem. Corporations embracing digital payment methods[5] not only experience enhanced operational efficiency but are also better positioned for seamless transactional processes that facilitate sustained growth.

Case Studies

Examining real-life examples of successful inter-corporate collaborations provides valuable insights into best practices. E-commerce payment system[4] Case studies showcase how corporations have overcome challenges and achieved mutually beneficial outcomes through effective and streamlined transaction processing, offering practical lessons for others in the business landscape.

Future Trends in Payment Processing

The future of payment processing in inter-corporate collaborations is shaped by technological advancements. Blockchain technology, contactless payments, and innovative financial solutions are on the horizon, promising a more secure and streamlined payment landscape.

Choosing the Right Payment Processor

Selecting the right payment processor is a critical decision for corporations engaged in inter-corporate collaborations. Factors such as transaction fees, processing speed, and integration capabilities must be carefully considered. A comparative analysis of popular payment processors aids corporations in making informed choices.

Tips for Smoother Payment Transactions

Clear communication between collaborating entities is essential for smooth payment transactions. Regularly updating financial systems, maintaining transparency, and addressing issues promptly contribute to a hassle-free payment process.

Impact of Payment Processing on Business Growth

Efficient payment processing goes beyond financial transactions; it positively impacts overall business growth. It facilitates better financial management, boosts operational efficiency, and contributes to a positive reputation in the business ecosystem.

Real-life Challenges and Solutions

Testimonials from businesses highlight the challenges faced in inter-corporate transaction processing and the strategies implemented to overcome them. Sharing real-life experiences adds a practical and insightful dimension to the article, offering valuable transaction-related insights to readers seeking a deeper understanding of effective business practices.

Conclusion

In conclusion, payment processing is a critical aspect of inter-corporate collaborations in India. Navigating through challenges, adopting secure payment methods, staying compliant with regulations, and embracing future trends are key elements in ensuring the success of collaborative ventures. As corporations evolve in their payment processing strategies, the landscape of business collaborations in India will witness unprecedented growth and efficiency.

FAQs

- What are the common challenges in inter-corporate payment processing?

- Addressing currency conversion issues, regulatory compliance hurdles, and differences in financial systems are common challenges.

- How do digital payment solutions benefit inter-corporate collaborations?

- Digital payment solutions offer faster transactions, reduced paperwork, and improved accuracy, enhancing operational efficiency.

- What role does government regulation play in inter-corporate payment processing?

- Government regulations, set by the RBI, guide the process and ensure compliance with legal and tax requirements.

- How can corporations choose the right payment processor for collaborations?

- Corporations should consider factors such as transaction fees, processing speed, and integration capabilities when selecting a payment processor.

- What is the impact of efficient payment processing on business growth?

- Efficient payment processing contributes to better financial management, operational efficiency, and a positive business reputation.