AUTHOR: MICKEY JORDAN

DATE: 21/12/2023

Introduction

India, a land of diverse cultures and rich traditions, has undergone a significant transformation in the way business transactions are conducted. The evolution of payment processing in vendor relationships has played a pivotal role in shaping the business landscape. In this article, we will delve into the intricacies of payment processing for vendor relationships in India, exploring challenges, technological advancements, and best practices that contribute to the efficiency of financial transactions .

Evolution of Payment Processing in India

In the not-so-distant past, Processing for Vendor cash transactions dominated the Indian business ecosystem. However, with the advent of technology, there has been a notable shift towards digital payment methods. The government’s push towards a cashless economy has further accelerated this transition, making digital transactions the norm rather than the exception Relationships in India.

Key Challenges in Vendor Payment Processing

Despite the progress, Payment for Vendor certain challenges persist in the realm of vendor payment processing. The diversity of currencies, regulatory hurdles, and delayed transactions pose obstacles that businesses must navigate. ERP Payment Integrations[1] Overcoming these challenges is crucial for fostering seamless financial transactions between vendors and businesses.

Role of Technology in Overcoming Challenges

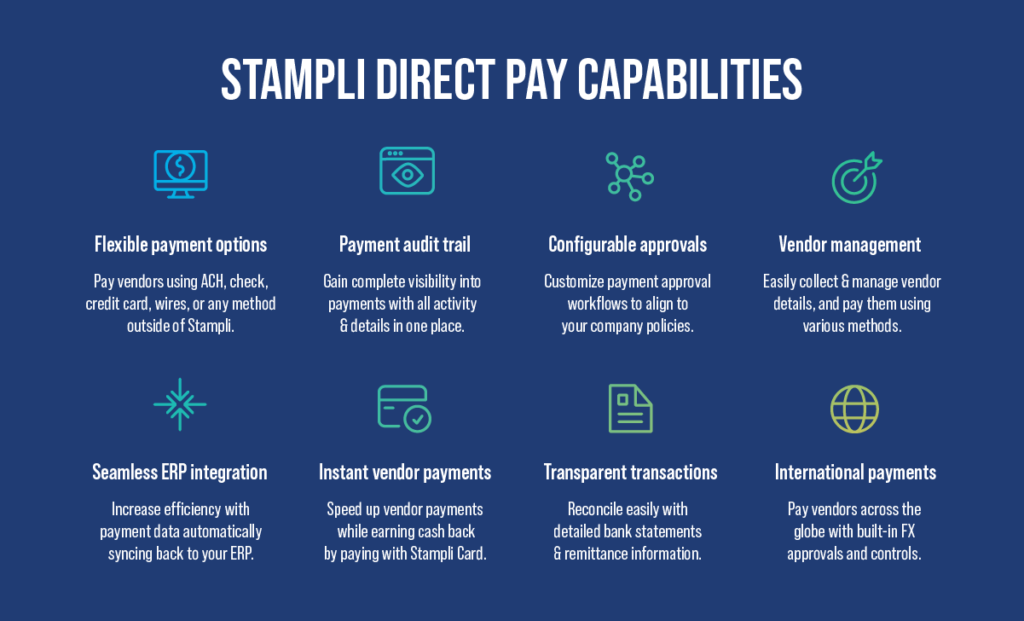

Technological advancements have been instrumental in addressing the challenges faced in vendor payment processing. Digital wallets, mobile banking solutions, bulk payment processing[2] and real-time payment systems have emerged as powerful tools, providing businesses with efficient means to process payments and manage financial transactions effectively.

Vendor-Friendly Payment Platforms

Several Payment Systems Management[3] have gained popularity for their vendor-friendly features. These platforms not only facilitate quick and secure transactions but also offer additional functionalities tailored to the needs of vendors. Understanding these platforms is essential for businesses seeking to enhance their payment processing capabilities.

Security Measures in Payment Processing

Securing financial transactions is absolutely crucial in the era of digital advancements Encryption, secure gateways, B2B Payment System[4] and fraud prevention techniques play a crucial role in safeguarding the integrity of payment processing systems. Businesses must prioritize these security measures to build trust in their vendor relationships.

Importance of Transparent Transactions

Transparency in financial transactions is the foundation of a healthy vendor relationship. Clear communication, honest dealings, and transparent transactions contribute to building trust and establishing long-term partnerships. Businesses that prioritize transparency reap the benefits of stronger and more enduring collaborations with their vendors.

Government Initiatives Supporting Payment Processing

The Indian government has introduced various initiatives to support digital transactions and ease the payment process for businesses. Understanding these policies and leveraging the incentives provided can significantly contribute to the efficiency of vendor payment processing.

Best Practices for Vendors in Payment Processing

Vendors, too, play a crucial role in ensuring smooth payment processing. Efficient invoice management, negotiating favorable payment terms, and embracing digital solutions are among the best practices that vendors should adopt to streamline their financial transactions with businesses.

Impact of Efficient Payment Processing on Vendor Relationships

Efficient payment processing positively impacts vendor relationships by improving cash flow and creating an environment conducive to collaboration. Vendor Payments[5] Businesses that prioritize seamless financial transactions foster a positive reputation and attract vendors looking for reliable and trustworthy partners.

Future Trends in Payment Processing

As technology continues to evolve, so do payment processing methods. Emerging technologies such as blockchain and artificial intelligence are expected to reshape the future of financial transactions in vendor relationships. Staying abreast of these trends is crucial for businesses aiming to stay ahead in the dynamic landscape of payment processing.

Expert Opinions on Payment Processing

Industry experts offer valuable perspectives on effective payment processing strategies. Their insights, recommendations, and best practices serve as a guide for businesses seeking to optimize their vendor payment processes and establish themselves as industry leaders.

Common Misconceptions About Payment Processing in Vendor Relationships

Dispelling myths and clarifying misconceptions is essential to understanding the intricacies of payment processing. Addressing common misconceptions fosters a more informed approach to financial transactions and helps businesses make decisions based on accurate information.

Conclusion

In conclusion, payment processing for vendor relationships in India is a multifaceted aspect of business operations that demands careful consideration. Efficient and transparent financial transactions contribute not only to the success of individual businesses but also to the overall growth of the Indian economy. By embracing modern payment solutions, adhering to best practices, and staying informed about industry trends, businesses can forge strong and lasting relationships with their vendors.

FAQs

- Q: How can businesses overcome currency diversity in vendor payments?

- Businesses can use multi-currency accounts and negotiate contracts in a standardized currency to mitigate the impact of currency diversity.

- Q: What security measures should businesses prioritize in payment processing?

- Encryption, secure gateways, and real-time fraud detection are essential security measures to ensure the integrity of payment processing systems.

- Q: Are there government incentives for businesses adopting digital payment methods?

- Yes, the government offers various incentives and subsidies to encourage businesses to transition to digital payment methods.

- Q: How do transparent transactions contribute to building trust in vendor relationships?

- A: Transparent transactions create a sense of openness and honesty, building trust between businesses and their vendors over time.

- Q: What role do case studies play in understanding the impact of efficient payment processing?

- A: Case studies provide real-world examples of businesses successfully improving vendor relationships through