AUTHOR : RIVA BLACKLEY

DATE : 11/12/2023

Introduction

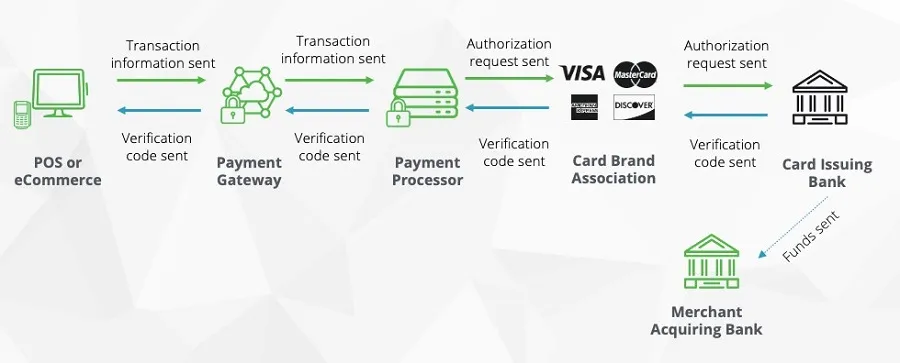

In the dynamic landscape of business transactions, payment processors play a pivotal role, especially in the context of business-to-business (B2B) dealings. These financial intermediaries facilitate the smooth transfer of funds, ensuring that transactions are efficient, secure, and well-documented.

Evolution of Payment Processors in India

India’s journey in adopting payment processors[1] for B2B transactions is a fascinating tale of evolution. From traditional methods to embracing cutting-edge technologies, the country has witnessed a significant shift in how businesses handle financial transactions. Payment Processor Business to Business in India

Key Features of B2B Payment Processors

When it comes to B2B transactions, the features of payment processors become paramount. Robust security measures, seamless integration capabilities, and customizable options are essential for businesses engaging in large-scale transactions. Payment Processor Business to Business in India

Popular B2B Payment Processors in India

Several payment processors have emerged as leaders in the Indian market. A comparative analysis of these services provides businesses[2] with valuable insights into choosing the most suitable option for their unique needs.

Advantages of Using Payment Processors in B2B Transactions

The adoption of B2B payment processors brings numerous benefits to businesses. From increased efficiency and speed to cost-effectiveness and enhanced security, these advantages contribute to the overall growth and success of enterprises.

Challenges Faced by B2B Payment Processors

However, the journey of B2B payment processors[3] is not without challenges. Navigating regulatory hurdles and overcoming technological obstacles are crucial aspects that demand attention for sustained success.

Trends Shaping the B2B Payment Processor Landscape

As technology advances, so do the trends in payment processing. The rise of digital wallets and the integration of blockchain and cryptocurrency are transforming the B2B payment processor[4] landscape, offering new possibilities for businesses.

How B2B Payment Processors Support Small Businesses

One of the remarkable aspects of B2B payment[5] processors is their ability to support small businesses. Tailored solutions, accessibility, and affordability empower smaller enterprises to participate in and benefit from the broader economic landscape.

Case Studies

Real-world case studies highlight the successful implementation of B2B payment processors. These stories shed light on the tangible impact these processors have on businesses, demonstrating their value in diverse sectors.

Future Outlook of B2B Payment Processors in India

Looking ahead, the future of B2B payment processors in India appears promising. Emerging technologies and market predictions suggest continued growth and innovation in this crucial sector.

Factors to Consider When Choosing a B2B Payment Processor

For businesses looking to adopt a B2B payment processor, several factors demand consideration. Security features, integration capabilities, and scalability are key aspects that can significantly influence the effectiveness of the chosen processor.

Tips for Smooth B2B Transactions Using Payment Processors

Smooth B2B transactions require proactive measures. Effective communication, transparency, and meticulous documentation are among the tips that businesses can follow to ensure a seamless payment process.

Industry Regulations and Compliance

Understanding and adhering to industry regulations are non-negotiable for B2B payment processors. This section provides an overview of relevant regulations and emphasizes the importance of compliance for sustainable operations.

Emerging Trends in B2B Payment Processors

As technology continues to evolve, new trends are emerging in the realm of B2B payment processors, further enhancing their capabilities. One such trend is the increasing reliance on artificial intelligence (AI) and machine learning algorithms. These technologies enable payment processors to analyze vast amounts of data, detect patterns, and enhance decision-making processes, ultimately leading to more efficient and accurate transactions.

Enhanced Integration Capabilities

B2B payment processors are now focusing on providing seamless integration with various business platforms. This ensures that transactions are not only secure but also effortlessly integrated into existing accounting and enterprise resource planning (ERP) systems. The ability to synchronize financial data across different channels simplifies the overall financial management process for businesses.

Conclusion

In conclusion, the role of B2B payment processors in India is transformative. From revolutionizing traditional practices to fostering innovation, these processors are the backbone of efficient and secure financial transactions in the business realm.

FAQS

- What is the role of payment processors in B2B transactions?

- Payment processors facilitate secure and efficient fund transfers in business-to-business transactions, streamlining financial processes.

- How do B2B payment processors ensure security?

- Robust security measures, encryption technologies, and compliance with industry standards ensure the secure handling of sensitive financial information.

- Can small businesses benefit from using payment processors?

- Absolutely. B2B payment processors offer tailored solutions that make financial transactions accessible and affordable for small businesses.

- What trends are influencing the B2B payment processor landscape?

- The rise of digital wallets and the integration of blockchain and cryptocurrency are notable trends shaping the B2B payment processor landscape.

- How can businesses navigate regulatory challenges?

- Businesses can navigate regulatory challenges by staying informed about industry regulations, implementing compliance measures, and seeking professional guidance when needed.