AUTHOR : PUMPKIN KORE

DATE : 21/12/2023

Introduction

In the vibrant landscape of Indian business collaboration, the role of payment providers cannot be overstated. As technology continues to advance, the need for efficient and secure financial transactions becomes paramount. This article delves into the evolution, benefits, challenges, and future trends of payment providers in the context of fostering collaboration[1] among businesses in India. payment provider for Business collaboration in india

The Evolution of Payment Providers

The journey of payment systems in India has seen a remarkable transformation over the years. From traditional cash transactions to the digital era, the evolution has been swift and revolutionary. The emergence of digital payment solutions has paved the way for faster, more accessible, and secure transactions, creating a conducive environment for business collaboration. payment provider for Business collaboration in india

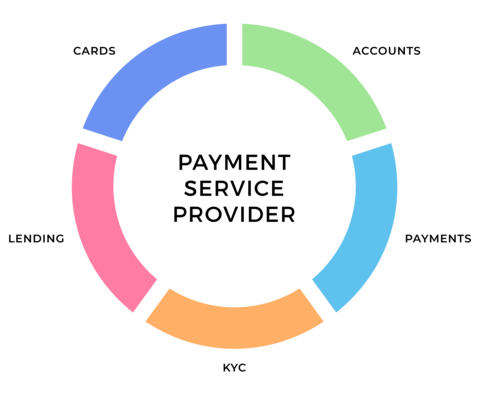

Security, speed, and reliability are the cornerstones of effective payment solutions. Payment providers[2] offer a robust framework ensuring the safety of financial transactions. The speed of processing and reliability of these platforms make them indispensable for businesses[3] seeking seamless collaboration. Compatibility with various business models further enhances the appeal of payment providers.

Popular Payment Providers in India

In a diverse market, several payment providers have gained prominence. From traditional banking solutions to innovative fintech startups, businesses have a myriad of options. A comparative analysis of these providers helps businesses make informed choices based on their specific needs, contributing to successful collaborations.

The advantages of integrating payment providers into collaborative[4] endeavors are multifaceted. The efficiency of transactions, enhanced financial control, and the facilitation of cross-border collaborations are among the key benefits. Businesses find that incorporating these solutions streamlines their financial processes, fostering a more productive and collaborative environment.

Challenges and Solutions

While the benefits are evident, challenges such as security concerns, technological barriers, and regulatory compliance need addressing. This section explores viable solutions, ensuring that businesses can harness the full potential of payment providers without compromising on security or compliance.

Real-world examples speak volumes. Examining successful Payment Provider For business collaborations that have leveraged payment providers provides valuable insights into the practical applications of these solutions. From startups to established enterprises, the cases demonstrate the versatility and adaptability of payment providers across industries.

Future Trends in Payment Solutions

The future of payment solutions holds exciting possibilities. Technological advancements, including blockchain and artificial intelligence, are shaping the landscape. Anticipated innovations promise even more convenience, speed, and security, setting the stage for a dynamic future in business collaboration[5].

Selecting the right payment provider is crucial for businesses. This section offers practical tips, guiding businesses through the decision-making process. Consideration factors such as transaction fees, integration capabilities, and customer support play a pivotal role in choosing the most suitable provider.

Integration of Payment Providers in Business Strategies

Embedding payment solutions in overall business strategies is essential for maximizing their potential. This section explores how businesses can align payment provider choices with their overarching goals, enhancing the collaborative aspects of their operations.

Hearing from businesses that have already embraced payment providers provides authenticity to the narrative. User testimonials highlight first-hand experiences, showcasing the tangible benefits and positive impacts on collaboration that these businesses have experienced.

The Impact of Digital Transformation on Collaboration

Digital payments are at the forefront of the ongoing digital transformation. This section explores how the adoption of digital payment methods is revolutionizing business dynamics and, in turn, influencing collaboration strategies.

In an era of increased corporate social responsibility, businesses are also considering the ethical practices of payment providers. Sustainable collaboration is explored through the lens of responsible financial choices, aligning business objectives with social and environmental goals.

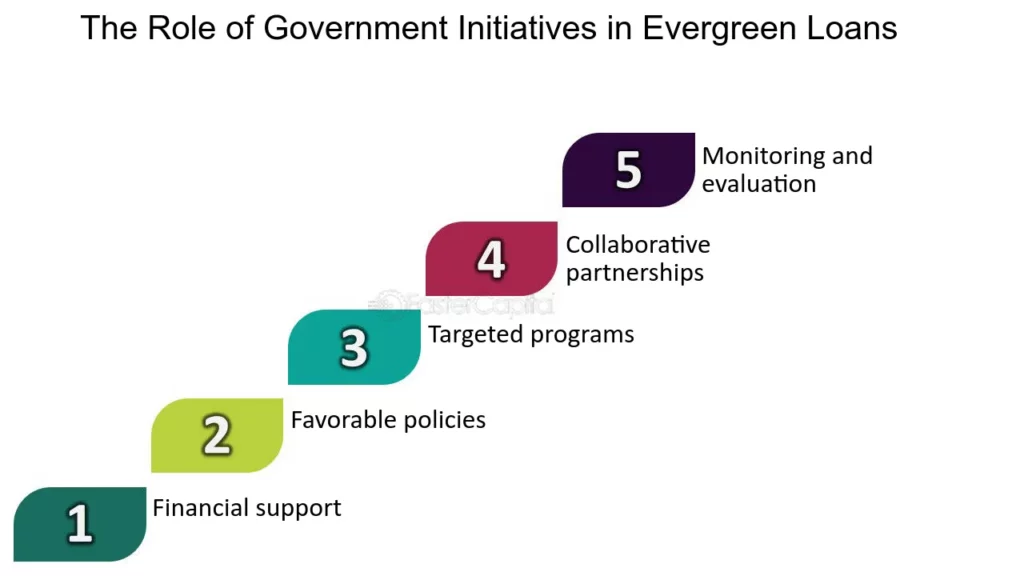

The Role of Government Initiatives

Governmental policies and initiatives play a pivotal role in shaping the landscape of digital transactions. This section provides an overview of policies encouraging businesses to adopt digital payment methods, along with incentives designed to facilitate a smoother transition.

Conclusion

In conclusion, the integration of payment providers into business collaboration strategies holds transformative potential. The evolution, benefits, challenges, and future trends discussed highlight the dynamic nature of this space. As businesses continue to embrace digital solutions, payment providers stand as pillars supporting the collaborative endeavors that drive economic growth in India.

FAQs

- Are payment providers safe for business transactions?

- Yes, payment providers implement robust security measures to ensure the safety of business transactions.

- How do payment providers enhance financial control for businesses?

- Payment providers offer real-time tracking and reporting, enabling businesses to have better control over their financial processes.

- Can payment providers facilitate cross-border collaborations?

- Absolutely, many payment providers offer services that simplify cross-border transactions, making global collaborations seamless.

- What factors should businesses consider when choosing a payment provider?

- Businesses should consider transaction fees, integration capabilities, customer support, and compatibility with their business model.

- How do government initiatives impact the adoption of digital payment methods?

- Government initiatives, such as incentives and policies, play a significant role in encouraging businesses to adopt digital payment methods.