AUTHOR :HAANA TINE

DATE :21/12/2023

Introduction

Corporate payment providers are financial entities that offer specialized services catering to the unique needs of businesses, ensuring seamless and secure financial transactions Corporate Clientele.

Significance in Corporate Landscape

The reliance on traditional payment methods has led to inefficiencies in corporate transactions. The need for specialized solutions has grown, prompting businesses Payment Provider for Corporate to explore innovative payment providers[1].

The Current Corporate Payment Scenario in India

Traditional Methods

Historically, businesses in India have heavily relied on conventional payment methods[2], causing delays and hindrances in financial processes.

Challenges Faced by Corporates

Inefficiencies, security concerns, Corporate Clientele in India and lack of customization options are some of the challenges faced by corporates relying on outdated payment methods.

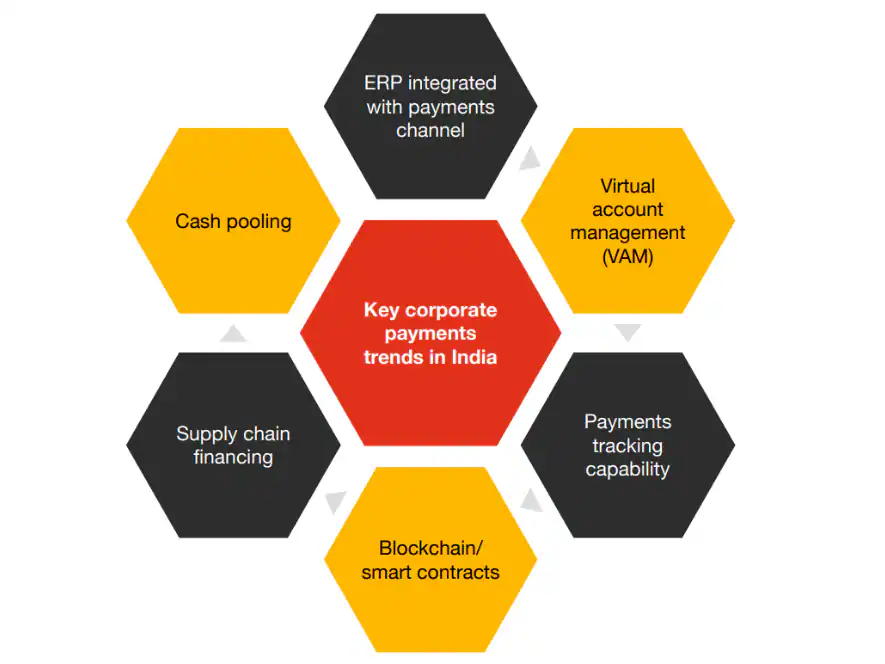

Emerging Trends in Corporate Payment Solutions

Digital Transformation

The advent of digital technologies has ushered in a new era of payment solutions, allowing businesses to transition from manual to automated processes Payment Provider for Clientele .

Role of Fintech Companies

Fintech companies play a pivotal role in reshaping the corporate payment[3] landscape, offering innovative and flexible solutions.

Criteria for Choosing a Payment Provider

Security and Compliance

Ensuring the security of financial transactions and compliance with regulations are non-negotiable aspects when selecting a payment provider.

Integration Capabilities

The seamless integration of payment solutions[4] with existing systems is crucial for a smooth transition and operational continuity.

Customization Options

Businesses vary in their needs, and a good payment provider should offer customizable solutions to meet specific requirements Corporate Client Service Centers[5].

Key Players in the Indian Corporate Payment Sector

Overview of Prominent Providers

An in-depth look at leading payment providers catering to corporate clientele in India, highlighting their features and strengths.

Comparative Analysis

A comparative analysis of key players, examining factors such as fees, security features, and customer support.

Benefits of Opting for Specialized Corporate Payment Services

Specialized payment solutions streamline financial processes, reducing manual efforts and enhancing efficiency.

Cost-Efficiency

Corporate payment providers often offer cost-effective solutions, reducing overall transaction costs for businesses.

Enhanced Security Measures

Advanced security features ensure the protection of sensitive financial data, instilling confidence in corporate clients.

Successful Implementations

Real-world Examples of Corporate Clients

Explore case studies showcasing successful implementations of specialized payment solutions, highlighting the positive impact on operational efficiency.

Positive Impact on Operations

Understand how businesses have benefited from adopting advanced payment services, improving their overall financial landscape.

Challenges and Considerations

Potential Hurdles in Adopting New Payment Methods

Addressing common challenges faced by businesses during the transition to specialized payment solutions.

Mitigation Strategies

Proactive strategies to mitigate challenges, ensuring a smooth adoption process for corporate clients.

Future Outlook of Corporate Payment Solutions in India

Anticipated Innovations

A glimpse into the future, exploring anticipated innovations in corporate payment solutions and their potential impact.

Evolution of the Industry

Charting the evolution of the industry and its transformative journey toward more sophisticated payment solutions.

How Businesses Can Transition to Advanced Payment Solutions

Step-by-Step Guide

A comprehensive guide for businesses looking to transition to advanced payment solutions, ensuring a well-planned and smooth process.

Common Pitfalls to Avoid

Highlighting common pitfalls that businesses should be aware of and avoid during the transition phase.

Client Testimonials

Feedback from Corporate Users

Direct feedback from corporate users who have experienced the benefits of specialized payment solutions firsthand

Experiences with Payment Providers

Insights into the experiences of businesses with various payment providers, helping potential clients make informed decisions. Payment Provider for Corporate Clientele in India

Conclusion

Reiterating the significance of embracing specialized payment solutions for corporates in India. A call to action, encouraging businesses to proactively embrace change and leverage advanced payment services for a competitive edge.

(FAQs)

How secure are corporate payment solutions?

Corporate payment solutions prioritize security with advanced encryption and authentication measures, ensuring the protection of sensitive financial data.

Can these solutions be integrated with existing systems?

Yes, most corporate payment solutions are designed for seamless integration with existing systems, ensuring a smooth transition without disrupting operations.

What advantages do Fintech payment providers offer?

Fintech payment providers bring innovation and flexibility to the table, offering customizable solutions, cost-efficiency, and enhanced user experiences.

Are there any regulatory considerations for businesses?

Businesses adopting specialized payment solutions should be mindful of relevant regulations and ensure compliance to avoid legal complications.

How can a company choose the right payment provider for its needs?

Choosing the right payment provider involves considering factors like security, integration capabilities, customization options, and conducting a comparative analysis of available options. Payment Provider for Corporate Clientele in India