AUTHOR :HAANA TINE

DATE :21/12/2023

Introduction

In the dynamic landscape of inter-enterprise relations in India, the choice of a reliable payment provider[1] plays a pivotal role in ensuring smooth transactions and fostering business growth. As businesses increasingly rely on digital platforms for financial interactions, the evolution of payment systems has become a critical aspect of the economic ecosystem.

Evolution of Payment Systems in India

India’s journey in the realm of payment systems has witnessed a remarkable transformation. From traditional cash transactions to the surge in digital payments, the evolution has been driven by technological advancements and changing consumer preferences. As businesses adapt to this shift, the need for efficient payment providers for inter-enterprise relations becomes evident.

Challenges in Inter-enterprise Transactions

Inter-enterprise transactions, especially in a diverse and complex market like India, pose unique challenges. B2B transactions involve intricate processes, diverse payment terms[2], and varying business models. This complexity necessitates specialized payment solutions that can address the specific needs of businesses engaged in inter-enterprise relations.

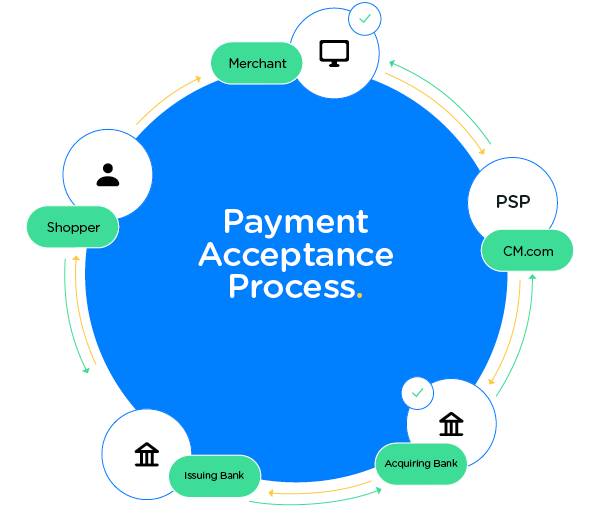

Role of Payment Providers in Inter-enterprise Relations

Payment providers act as facilitators, bridging the gap between businesses engaged in inter-enterprise transactions[3]. Payment Provider for Inter-enterprise Relations in India Their role extends beyond the conventional processing of payments; they play a crucial part in ensuring the security, efficiency, and transparency of financial interactions between enterprises.

Key Features of Ideal Payment Providers

An ideal payment provider for inter-enterprise relations should possess key features such as seamless integration with existing systems, customization options to accommodate diverse business needs, and scalability to support the growth of enterprises.

Popular Payment Providers in India

Several payment providers have emerged as key players in the Indian market. A comparative analysis of these providers helps businesses make informed decisions based on factors such as transaction fees, user interface, and customer support.

Regulatory Landscape

Government regulations play a significant role in shaping the landscape of payment providers for Inter-enterprise Relations in India. Businesses must navigate compliance requirements to ensure the legality and security of their inter-enterprise transactions.

Benefits of Using Payment Providers in B2B Transactions

The adoption of payment providers for Inter-enterprise in B2B transactions brings forth various benefits, including increased efficiency, faster processing times, and a significant reduction in the risks and errors associated with traditional payment methods[4].

Case Studies

Examining real-world case studies provides valuable insights into the successful implementation of payment providers. Businesses can learn from these examples to understand the impact on operations and overall business performance.

Future Trends in Payment Solutions for Inter-enterprise Relations

As technology continues to evolve, so do payment solutions. Exploring future trends in the industry, such as blockchain technology[5] and artificial intelligence, allows businesses to stay ahead of the curve and adapt their payment strategies accordingly.

Choosing the Right Payment Provider for Your Business

Selecting the right payment provider involves careful consideration of factors such as the provider’s reputation, integration capabilities, and alignment with the specific needs of the business. This section guides businesses through the decision-making process.

Customer Testimonials

Real-world experiences shared by businesses that have utilized payment providers offer valuable insights into user satisfaction. These testimonials provide a glimpse into the practical benefits and challenges encountered in the implementation of payment solutions.

Security Measures in B2B Transactions

Ensuring the security of financial transactions is paramount. This section explores the importance of secure payment channels and outlines strategies to safeguard sensitive information in inter-enterprise transactions.

Cost Considerations

Understanding the pricing models of payment providers is crucial for businesses seeking cost-effective solutions. This section provides insights into different cost structures and considerations for businesses evaluating their payment options.

Conclusion

In conclusion, the role of payment providers in facilitating inter-enterprise transactions in India cannot be overstated. Businesses must carefully assess their needs, navigate the regulatory landscape, and embrace innovative solutions to stay competitive in a rapidly evolving market.

FAQs

- Q: Are payment providers suitable for all types of businesses engaged in inter-enterprise relations?

- A: Payment providers can be customized to suit various business models and sizes, making them adaptable for a wide range of enterprises.

- Q: How do payment providers address security concerns in B2B transactions?

- A: Payment providers employ robust security measures, including encryption and authentication protocols, to safeguard financial transactions.

- Q: What factors should businesses consider when choosing a payment provider?

- A: Factors such as integration capabilities, customization options, reputation, and cost-effectiveness should be carefully evaluated.

- Q: Can payment providers help businesses save time in processing transactions?

- A: Yes, payment providers contribute to increased efficiency by streamlining the transaction process and reducing processing times.

- Q: How do future trends in payment solutions impact businesses engaged in inter-enterprise relations?

- A: Businesses staying abreast of technological trends can leverage innovative payment solutions to gain a competitive edge in the market.