AUTHOR : RIVA BLACKLEY

DATE : 21/12/2023

Introduction

In the dynamic landscape of procurement in India, the choice of payment provider plays a pivotal role in shaping efficient and streamlined processes. As businesses embrace digital transformation, the traditional methods of payment are giving way to more sophisticated and technologically advanced solutions. Payment Provider for Procurement Strategies In India.

Importance of Payment Providers in Procurement

Managing finances is a critical aspect of any business, and in the realm of procurement, it becomes even more crucial. Payment providers contribute significantly to the efficiency and accuracy of financial transactions, ultimately impacting the overall success.

Current Landscape of Procurement in India

Traditionally, businesses Procurement Strategies In India in India have relied on conventional methods for procurement transactions. However, this approach comes with its own set of challenges, including delays, manual errors, and a lack of transparency. As businesses evolve, there is a growing need for innovative solutions.

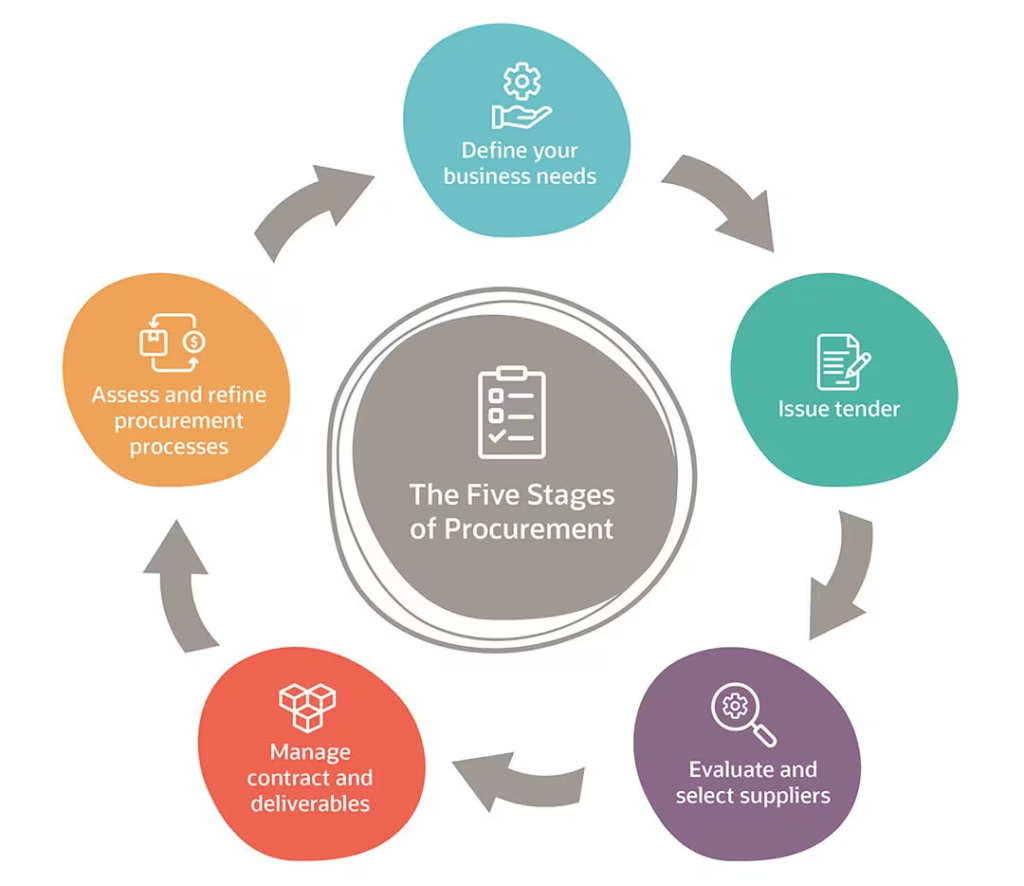

Role of Technology in Procurement Strategies

The advent of digital payment solutions has brought about a revolution in Provider For Procurement. Technology is now seamlessly integrated into procurement processes, providing a faster and more reliable way to handle financial transactions. This shift not only saves time but also reduces the likelihood of errors.

Key Features of Payment Providers in Procurement

Payment providers offer a range of features to enhance the procurement experience. From robust security measures to customizable options and integration capabilities with software, these providers cater to the diverse needs of businesses. Payment Provider for Procurement Strategies in India.

Benefits for Businesses

The adoption of payment providers in procurement brings numerous benefits. Cost-effectiveness, time-saving advantages, and improved accuracy in financial transactions are just a few advantages that businesses can leverage Procurement Analytics Payment service providers enable businesses to accept a wide range of payment methods, facilitate global commerce, and ensure the security and efficiency of electronic payment transactions[1].

Popular Payment Providers in India

A closer look at the leading payment service providers[2] in India reveals a diverse array of offerings. From established players to innovative startups, each provider brings unique features to the table. A comparative analysis helps businesses make informed decisions.

Adoption Challenges and Solutions

Navigating through the currents of transformation, resistance becomes a prevalent hurdle when ushering in novel technologies. Procure to Pay Addressing this requires a strategic approach, including employee training and effective communication. Successful adoption strategies ensure a smooth transition[3].

Regulatory Landscape

Real-Time Payments[4] Compliance with regulations is paramount in the selection of a payment provider. Understanding the regulatory landscape helps businesses navigate legal requirements and make informed decisions about the most suitable provider.

Case Studies

Examining real-world case studies provides insights into the practical application of payment providers in procurement. Successful examples showcase the transformative impact on businesses Payment service providers enable businesses to accept a wide range of payment methods, facilitate global commerce, and ensure the security and efficiency of electronic payment transactions.

Future Trends in Payment Solutions for Procurement

The future holds exciting possibilities for payment solutions in procurement. Payment Gateway Integration[5] Technological advancements, including blockchain and artificial intelligence, are expected to shape the landscape and redefine how businesses handle transactions.

User Experience and Interface Design

A user-friendly interface is a critical aspect of any payment provider. Ensuring a positive user experience contributes to the overall satisfaction of users, making the procurement process more accessible and efficient.

Customization for Industry-specific Needs

Different industries have unique requirements when it comes to procurement. Payment providers that offer Payment service providers enable businesses to accept a wide range of payment methods, facilitate global commerce, and ensure the security and efficiency of electronic payment transactions. Customization options tailored to specific industry needs are likely to gain prominence in the market.

Integration with ERP Systems

Payment service providers enable businesses to accept a wide range of payment methods, facilitate global commerce, and ensure the security and efficiency of electronic payment transactions. Seamless integration with ERP systems is key to a cohesive business operation. Payment providers collaborating with ERP systems create a unified platform that enhances overall efficiency.

Real-time Data Synchronization

Future integration with ERP systems will prioritize real-time data synchronization. This ensures that financial data is up-to-date and accurate across the entire business ecosystem. Real-time synchronization enhances decision-making processes and reduces the risk of errors caused by outdated information.

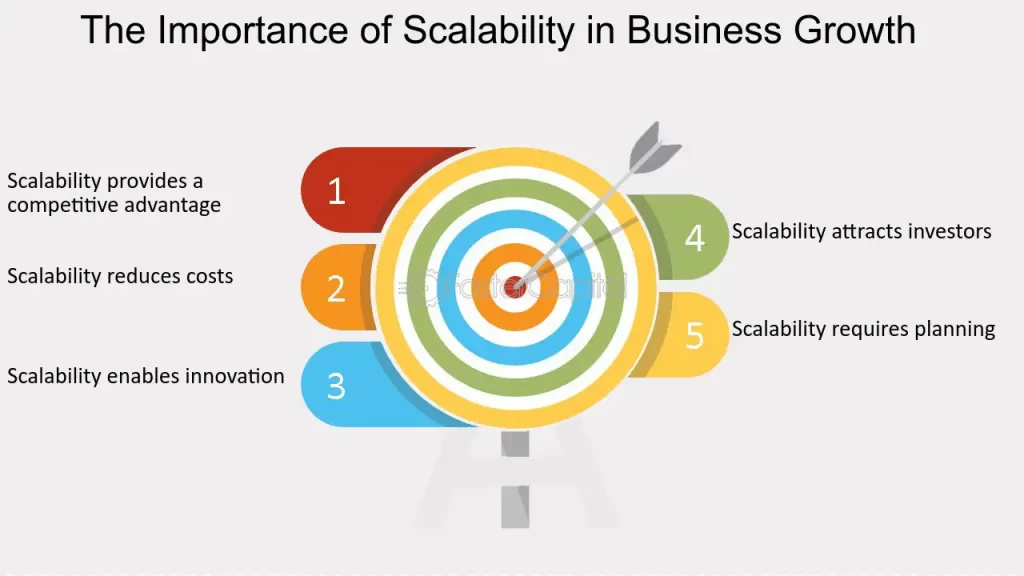

Scalability for Growing Businesses

As businesses grow, so do their transaction volumes. Future integration solutions will prioritize scalability, ensuring that the payment provider can handle increased loads without compromising performance. This is crucial for businesses looking to expand their operations seamlessly.

Conclusion

In conclusion, the role of payment providers cannot be overstated. As businesses continue to embrace digital transformation, the right payment solution can make a significant difference in streamlining processes and ensuring the success of procurement endeavors.

FAQS

- Are payment providers secure for procurement transactions?

- Yes, payment providers employ robust security measures to safeguard transactions.

- How can businesses overcome resistance to adopting new payment technologies?

- Employee training and effective communication are key to overcoming resistance.

- What are the regulatory considerations when choosing a payment provider?

- Businesses should ensure compliance with local regulations governing financial transactions.

- Can payment providers be customized for specific industry needs?

- Yes, many payment providers offer customization options tailored to different industries.

- What is the future of payment solutions in procurement?

- The future holds exciting possibilities with advancements in blockchain and artificial intelligence.