AUTHOR : JENNY

DATE :21-12-2023

Introduction:

The Role of Payment Providers in Indian Professional Networking

India’s professional networking landscape has witnessed a surge in recent years, with digital platforms fostering connections, collaborations, and career growth. Amidst this growth, the integration of efficient payment providers within these networks has become pivotal. Understanding the evolving dynamics of professional[1] networking in India is key to comprehending the significance of reliable payment systems within this sphere.

Understanding Professional Networking in India

Defining Professional Networking

Payment Provider For Professional networking encompasses the cultivation of relationships and also connections within a specific industry or career field. In India, networking has transcended traditional boundaries, leveraging digital platforms to connect professionals, entrepreneurs, and also freelancers.

Importance and Growth in India

India’s burgeoning startup ecosystem and the increasing gig economy have propelled the need for robust networking platforms. The country’s diverse industries and skilled workforce make professional networking[2] a cornerstone for career advancement and also business growth.

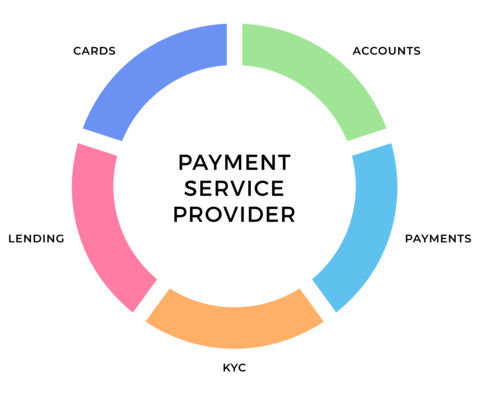

The Need for Payment Providers in Networking Platforms

Efficient payment providers For Professional Networking In India play a pivotal role in transactions within professional networks. Beyond mere monetary transactions, these systems instill trust and security, essential elements for fostering long-term relationships among network members.

Facilitating Transactions

A reliable payment provider[3] financial transactions, professionals to engage in monetary exchanges for services , collaborations, or product sales within the network.

Ensuring Security and Trust

Security remains in any financial transaction. Payment providers For Professional Networking In India, through and secure ensure the integrity of transactions, thereby trust among network members.

Key Features of an Ideal Payment Provider for Professional Networking

Seamless Integration

An ideal payment provider seamlessly integrates with the networking[4] platform, offering a user-friendly interface and also hassle-free transaction capabilities.

Secure Payment Processing

Robust security measures, such as and fraud detection mechanisms, guarantee the safety of financial confidence among users.

Cost-effectiveness

Affordability and fee structures are crucial for both networking platform operators and users, sustainable transactions without hefty costs.

Prominent Payment Providers in India’s Professional Networking Sphere

Several payment providers have emerged as frontrunners in catering to the specific needs of professional networking platforms in India. Case studies and analyses shed light on their functionalities, user experiences, and market penetration.

Challenges Faced by Payment Providers in this Domain

Regulatory Hurdles

Navigating through regulatory frameworks and also compliance standards poses challenges for payment providers[5], impacting their operations within professional ecosystems.

User Trust and Adoption

Building user trust and encouraging widespread adoption of payment systems within platforms remains a hurdle, often due to security concerns and also behavioral patterns.

The Future of Payment Providers in Indian Professional Networking

Technological , including integration, AI-driven security, and innovations, forecast an exciting future for payment providers within India’s professional landscape. Predictions and emerging trends highlight the potential of these systems.

Conclusion

The synergy between payment providers and also professional platforms in India marks a crucial evolution in the digital ecosystem. As these systems continue to and adapt, their role in meaningful connections and transactions will be indispensable.

FAQs

- What are the primary challenges faced by payment providers in professional networking platforms in India?Payment providers encounter regulatory hurdles, user trust issues, and the need for seamless integration within diverse networking platforms. Navigating these challenges while ensuring security and scalability remains a constant endeavor.

- How do payment providers enhance user trust within networking ecosystems?Trust-building measures include robust encryption, transparent transaction processes, and proactive fraud detection mechanisms. Additionally, fostering open communication and addressing user concerns regarding security bolster trust levels.

- Which technological advancements are shaping the future of payment systems in India’s professional networks?Emerging technologies like blockchain for transparent transactions, AI-driven security algorithms, and intuitive UX/UI designs are revolutionizing payment systems, enhancing efficiency, and user experience within professional networks.

- Are there specific regulatory barriers hindering the growth of payment providers in this domain?Regulatory frameworks often pose challenges in terms of compliance, licensing, and adapting to evolving financial regulations, impacting the operational scope and growth potential of payment providers in professional networking.