AUTHOR : RIVA BLACKLEY

DATE : 21/12/2023

Introduction

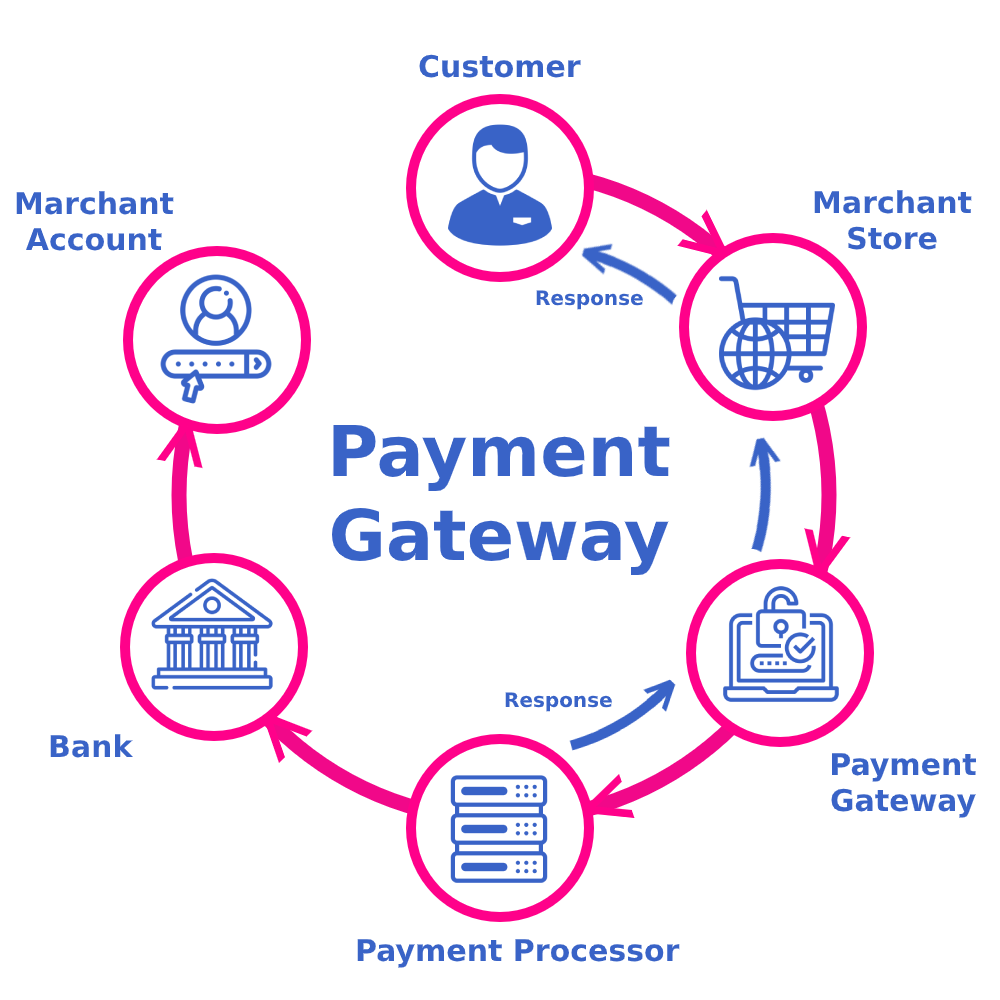

In the dynamic landscape of financial coaching. payment gateways play a crucial role in facilitating seamless transactions between coaches and clients. These gateways are digital tools that allow the secure transfer of funds, ensuring a smooth and reliable payment process.

Understanding Financial Coaching in India

Financial coaching involves providing individuals with personalized guidance to achieve their financial goals. With the rising awareness of the importance of financial literacy, more people in India are turning to coaches for expert advice on managing their finances effectively.

Challenges in Payment Processing for Financial Coaching

While traditional payment gateways may suffice for general transactions, financial coaching has its own set of challenges. The need for secure, personalized, and compliant payment processing becomes evident in this context.Payment Gateway For Financial Coaching In India.

Benefits of Tailored Payment Gateways

Tailored payment gateways address the specific needs of financial coaching services. They streamline payment processes[1], enhance security measures, and offer customized features that cater to the nuances of financial transactions in this industry.

Popular Payment Gateways in India

Several payment gateways operate in India, each with its features and advantages. From industry giants to emerging players, coaches must evaluate the pros and cons to make an informed choice.

Criteria for Choosing the Right Payment Gateway

Financial coaches[2] must consider factors such as integration capabilities, transaction fees, and user experience when selecting a payment gateway. The chosen gateway should align with the unique requirements of financial coaching services.

User-Friendly Interfaces for Coaches and Clients

An intuitive dashboard and a user-friendly interface are essential for both coaches and clients. A seamless payment experience[3] enhances client satisfaction and simplifies financial management for coaches.

Security Measures in Payment Processing

Security is a top priority in financial transaction s. Encryption, fraud prevention measures, and adherence to financial regulations are vital components of a reliable payment gateway for financial coaching.

Case Studies: Successful Implementation of Payment Gateways

Examining real-world examples showcases how tailored payment gateways have positively impacted financial coaching businesses[4]. From increased efficiency to client satisfaction, these case studies highlight the benefits of choosing the right payment solution.

Future Trends in Payment Gateway Technology

The landscape of payment gateways is continually evolving. Financial coaches should stay informed about the latest innovations and advancements to future-proof their payment[5] processes.

How to Set Up a Payment Gateway for Financial Coaching

Setting up a payment gateway can be a complex process. A step-by-step guide, along with insights into common challenges and troubleshooting tips, can assist financial coaches in the implementation.

Customer Reviews and Testimonials

The experiences of others in the industry are valuable in making informed decisions. Positive customer reviews and testimonials provide insights into the reliability and effectiveness of different payment gateways.

Comparison with Global Practices

Understanding how payment gateways operate in other countries can provide valuable insights. By comparing global practices, financial coaches can glean ideas and best practices to enhance their own payment processes.

Ensuring Accessibility and Inclusivity

Financial coaching aims to serve a diverse audience with varying financial needs. Coaches should prioritize making their services accessible to all by choosing payment gateways that cater to a broad range of users.

Why Generic Gateways Fall Short

Generic payment gateways, while suitable for many industries, often lack the flexibility and tailored features required for financial coaching. Security measures and compliance standards may not be specific enough to meet the unique demands of financial transactions in this sector.

The Rise of Industry-Specific Solutions

Enter the era of industry-specific payment gateways. These solutions are designed with the intricacies of financial coaching in mind. From subscription-based models to variable billing cycles, these gateways offer a range of features that cater to the specific needs of financial coaches.

Conclusion

In conclusion, selecting the right payment gateway is a critical decision for financial coaches in India. The tailored solutions available can significantly impact the efficiency, security, and overall success of financial coaching businesses.

FAQS

- Q: What makes a payment gateway suitable for financial coaching?

- A: Tailored features, security measures, and user-friendly interfaces are key considerations.

- Q: Are there specific challenges in payment processing for financial coaching?

- A: Yes, unique requirements and security concerns make payment processing challenging.

- Q: How can financial coaches choose the right payment gateway?

- A: Evaluate factors like integration capabilities, transaction fees, and user experience.

- Q: What role do case studies play in the decision-making process?

- A: Case studies offer real-world examples of successful payment gateway implementations.

- Q: What are the future trends in payment gateway technology?

- A: Continuous innovations and advancements are shaping the future of payment gateways.