AUTHOR : BELLA

DATE : 22/12/2023

Introduction

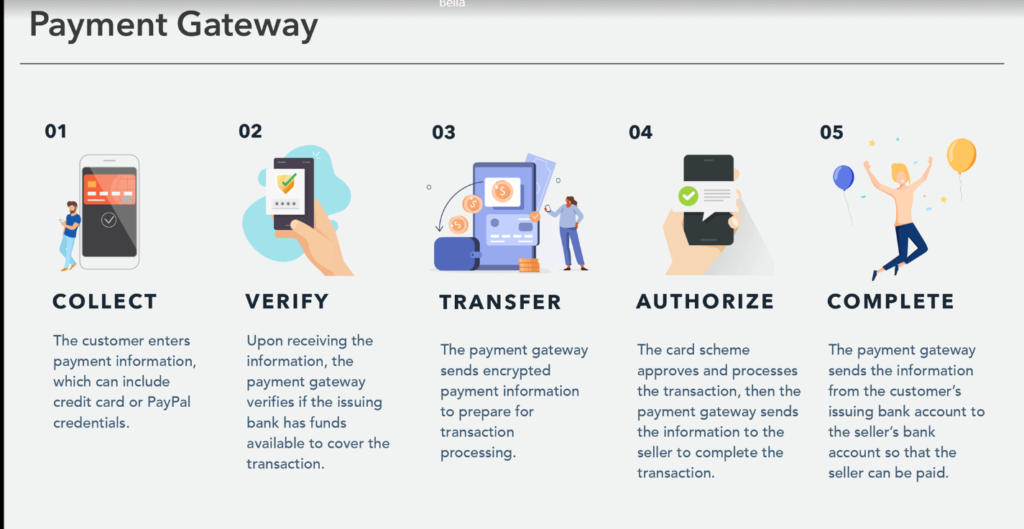

Definition of a Payment Gateway

At its core, a payment gateway is a technology driven service that facilitates the seamless transfer of money between a customer and a business. It acts as the intermediary that authorizes and also processes payment transactions securely.

Importance of Payment Gateways in Strategic Planning

In the modern business landscape, strategic planning involves meticulous consideration of various factors, and also the payment gateway is a linchpin in this process. Efficient financial transactions not only impact customer satisfaction but also influence strategic decision-making.

Evolution of Payment Gateways in India

Early Challenges

In the early days of e-commerce in India, businesses faced challenges such as limited payment options, security concerns, and also technological constraints. This hindered the effective integration of payment gateways into strategic planning[1].

Technological Advancements

With the advent of advanced technologies, payment gateways in India[2] underwent a revolutionary transformation. Secure protocols, encryption techniques, and robust interfaces became standard, paving the way for their seamless integration into strategic business operations.

Impact on Strategic Planning

The evolution of payment gateways in India has significantly explored strategic planning. Real-time transaction processing[3], enhanced security features, and also diverse payment options have become integral components of formulating effective business strategies[4].

III. Key Features of an Effective Payment Gateway

Security Measures

One of the paramount features of a payment gateway is its security[5] protocols. Businesses prioritize gateways that employ advanced encryption, two-factor authentication, and fraud detection mechanisms to ensure secure transactions.

User-Friendly Interface

An intuitive and also user-friendly interface is essential for both customers and also businesses. The ease of navigation and a simple checkout process contribute to a positive customer experience, influencing strategic decisions related to customer retention.

Integration Capabilities

Efficient integration with various platforms and business systems is crucial. An effective Payment Gateway for Strategic Planning in India seamlessly integrates with e-commerce websites, mobile applications, and also other business software, streamlining strategic planning processes.

Customization Options

Businesses thrive on uniqueness, and also payment gateways that offer customization options become valuable assets. Tailoring payment processes to align with specific business requirements enhances strategic flexibility.

Role of Payment Gateways in E-commerce

Facilitating Transactions

At the heart of e-commerce lies the transactional process. Payment gateways play a pivotal role in facilitating secure and swift transactions, directly impacting the revenue generation aspect of strategic planning.

Enhancing Customer Experience

The overall customer experience is a critical factor in strategic planning. Payment gateways contribute to this by offering a smooth and also hassle-free payment process, leaving a positive impression on customers.

Data Analytics for Strategic Decision-Making

Payment gateways generate a wealth of transactional data. Utilizing analytics derived from these transactions provides businesses with valuable insights, aiding strategic decision-making in areas such as pricing, inventory management, and also customer targeting.

Trends in Payment Gateways for Strategic Planning

Mobile Wallets

The rise of mobile wallets has reshaped the payment landscape. Integrating mobile wallet options into strategic planning allows businesses to tap into the growing trend of digital payments.

Contactless Payments

In a world increasingly focused on hygiene, contactless payments have gained prominence. Businesses that incorporate contactless payment options align with evolving customer preferences, impacting strategic positioning.

Blockchain Integration

The integration of blockchain technology in payment gateways adds an extra layer of security and also transparency. Exploring blockchain options becomes a strategic move for businesses prioritizing trust and security.

Artificial Intelligence in Transactions

Artificial intelligence (AI) is revolutionizing payment gateways by enhancing fraud detection, personalizing customer experiences, and optimizing transaction processes. Businesses adopting AI in their payment systems stay ahead in strategic planning.

Challenges and Solutions

Cybersecurity Concerns

The digital landscape is fraught with cybersecurity challenges. Businesses must adopt robust cybersecurity measures and stay abreast of evolving threats to ensure the security of their payment gateways and, consequently, their strategic plans.

Regulatory Compliance

Payment gateways operate within a framework of regulations. Ensuring compliance with local and also international laws is paramount for businesses engaged in strategic planning, avoiding legal pitfalls that could impede progress.

Seamless Integration with Business Systems

Effective integration with existing business systems is a common challenge. Choosing payment gateways that seamlessly integrate with enterprise resource planning (ERP) systems and also other critical platforms is essential for strategic planning efficiency.

Case Studies

Successful Implementation Stories

Examining successful case studies highlights best practices and demonstrates the positive impact of integrating payment gateways into strategic planning.

Lessons Learned from Failures

Analyzing failures provides valuable insights into potential pitfalls, guiding businesses away from strategic planning missteps related to payment gateways.

Future Prospects

Innovations in Payment Technologies

The future of payment gateways involves continuous innovation. Businesses need to stay informed about emerging technologies and also anticipate how these innovations can be strategically incorporated.

Global Integration of Payment Systems

As businesses expand globally, payment gateways that facilitate international transactions seamlessly become integral to strategic planning on a global scale.

Conclusion

In conclusion, the journey of payment gateways in India reflects a remarkable evolution, deeply intertwined with the strategic planning landscape. From addressing early challenges to embracing cutting-edge technologies, payment gateways have become indispensable for businesses aiming to stay competitive in an ever-changing market.

FAQs

- How do payment gateways contribute to strategic planning in e-commerce? Payment gateways facilitate secure transactions, enhance customer experience, and also provide valuable data for strategic decision-making.

- What are the key security features businesses should look for in a payment gateway? Advanced encryption, two-factor authentication, and robust fraud detection mechanisms are crucial security features.

- How can businesses address the challenge of regulatory compliance in payment gateways? Businesses must stay informed about local and also international regulations, ensuring their payment gateways comply with legal requirements.

- What role does artificial intelligence play in modern payment gateways? Artificial intelligence enhances fraud detection, personalizes customer experiences, and optimizes transaction processes in payment gateways.

- How can businesses prepare for the future of payment gateways in strategic planning? Staying informed about emerging technologies and also global integration trends is key to preparing for the future of payment gateways.