AUTHOR : LISA WEBB

DATE : DECEMBER 22, 2023

Introduction

Entrepreneurship in India has been rapidly evolving, fostering an environment where innovative ideas flourish. However, amidst this growth, aspiring entrepreneurs face various challenges, and one critical aspect is handling payments effectively during training programs. This article delves into the landscape of payment processors tailored for entrepreneurship training in India and also explores the solutions they offer.

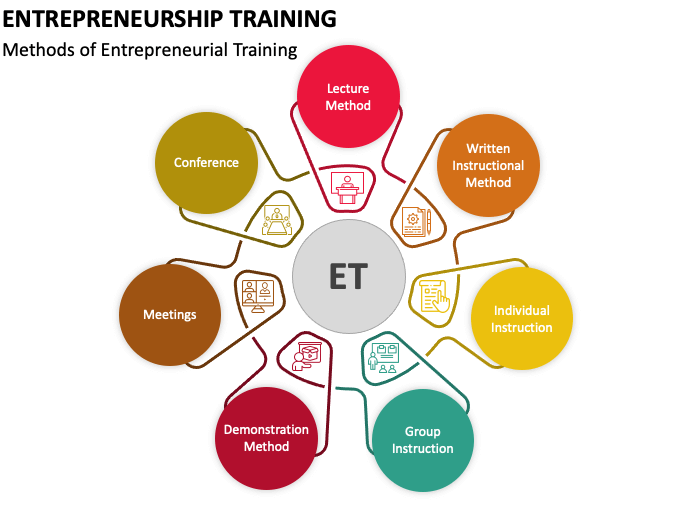

Understanding Entrepreneurship Training in India

Entrepreneurship training plays a pivotal role in honing the skills and knowledge[2] necessary to thrive in the competitive business landscape of India. It encompasses various aspects, including idea incubation, business plan development, marketing strategies, and also financial management. Such training programs are instrumental in empowering budding entrepreneurs to navigate the complexities of establishing and also scaling their ventures.

Challenges in Payment Processing for Entrepreneurship Training

Despite the burgeoning entrepreneurial ecosystem, payment processing remains a significant challenge for training programs. The lack of tailored solutions, coupled with regulatory hurdles and security concerns, creates bottlenecks in facilitating seamless transactions.

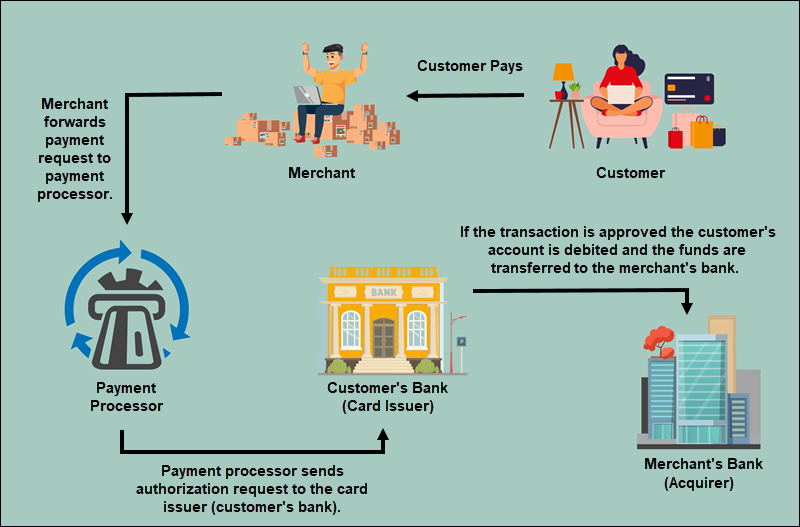

Role of Payment Processors in Entrepreneurship Training

Payment processors serve as crucial enablers in simplifying financial transactions for entrepreneurship training. They ensure secure payment gateways, offer customized solutions, and also facilitate hassle-free transactions, enhancing the overall learning experience.

Top Payment Processors for Entrepreneurship Training in India

Several payment processors cater specifically to the needs of entrepreneurship training[1] in India. Companies like Company A, with its feature-rich solutions; Company B, known for its startup-friendly services; and Company C, offering cost-effective and reliable services, stand out among the options available.

Comparative Analysis of Payment Processors

Analyzing various aspects such as fee structures, integration ease with training platforms, and customer support aids in making an informed choice when selecting a payment processor.

Future Trends and Innovations in Payment Processing

The evolution of Entrepreneurial leadership[2] processing for entrepreneurship[3] training in India is anticipated to witness several advancements. Technological innovations are expected to revolutionize the way transactions are conducted, enhance security measures, and provide a more seamless experience for both trainers and trainees.

Artificial intelligence (AI) and machine learning (ML) are poised to play a pivotal role in detecting fraudulent activities, thereby bolstering security measures. These technologies will enable payment processors[4] to analyze patterns, identify anomalies, and prevent potential risks, ensuring secure transactions within entrepreneurship training programs[5].

Furthermore, the integration of blockchain technology is anticipated to transform the landscape of payment processing. The decentralized nature of blockchain offers heightened transparency, increased security, and reduced transaction costs. Its implementation can potentially eliminate intermediaries, leading to quicker and more cost-effective transactions.

Conclusion

The integration of efficient payment processors in entrepreneurship training programs is pivotal for empowering aspiring entrepreneurs. Streamlined payment methods not only enhance the learning experience but also contribute significantly to the growth and success of budding ventures.

FAQs

- Q: Are payment processors necessary for entrepreneurship training in India?

A: Absolutely, as they streamline financial transactions and enhance the overall learning experience for aspiring entrepreneurs. - Q: What factors should one consider when choosing a payment processor?

A:Factors like flexibility in payment methods, compatibility with training software, and scalability are crucial considerations. - Q: How do payment processors contribute to the success of entrepreneurship training?

A:They simplify transactions, ensure data security, and optimize the user experience, contributing to the growth and expansion of ventures. - Q: Can payment processors help mitigate regulatory hurdles in India?

A: While they can’t eliminate regulatory hurdles, they offer tailored solutions that comply with regulations, easing the payment process. - Q: What future trends can we expect in payment processing for entrepreneurship training? A:Advancements in technology are expected to drive innovations in payment processing, making transactions more seamless and secure.