AUTHOR:HAZEL DSOUZA

DATE:27/12/2023

In the ever-evolving landscape of payment service providers (PSPs), India has witnessed the rise of high-risk PSPs, posing unique challenges and opportunities for businesses. This article explores the intricacies of high-risk PSP collection strategies, providing insights into the factors contributing to risk, effective management strategies, legal considerations and future trends.

Introduction

Definition of High-Risk PSP Collection Strategy

In the dynamic world of digital transactions, a high-risk PSP collection strategy refers to the approach businesses take when dealing with payment service providers that pose elevated levels of risk. These risks may stem from regulatory challenges, fraud, or industry-specific factors.

Importance in the Indian Market

As India experiences rapid digital transformation, understanding and navigating high-risk PSP collections are crucial for businesses aiming to thrive in the digital economy. The Indian market presents unique challenges that demand tailored strategies for successful payment collections.

Understanding the High-Risk PSP Landscape

Overview of Payment Service Providers (PSPs)

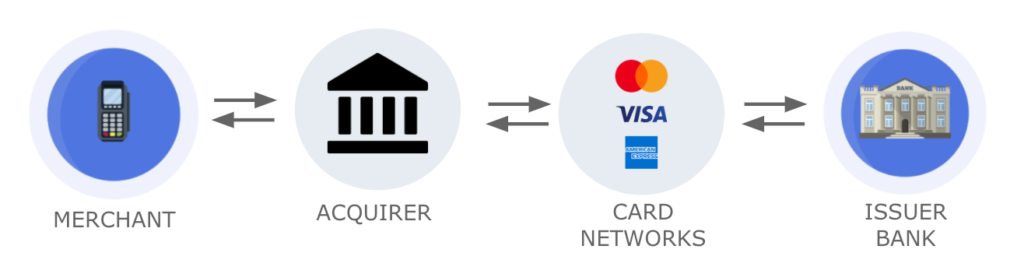

Payment service providers[1] play a pivotal role in facilitating transactions between merchants and consumers. However, not all PSPs are created equal, and understanding the landscape is crucial for businesses to make informed decisions.

Identifying High-Risk PSPs in India

India’s diverse market demands a nuanced approach to identifying high-risk PSPs. Collection development[2] Factors such as regulatory challenges, fraud history, and industry-specific risks contribute to the classification of PSPs as high-risk.

Factors Contributing to High-Risk PSPs

Regulatory Challenges

Navigating the complex regulatory environment Debt collection[2] is a significant factor in determining the risk associated with PSPs. Understanding and complying with regulations are essential for businesses to avoid legal pitfalls.

Fraud and Chargeback Risks

High-risk PSPs are often susceptible to fraudulent activities and chargebacks. Businesses need robust mechanisms, such as advanced fraud detection tools, to mitigate these risks effectively.

Industry-specific Factors

Certain industries inherently carry higher risks in Payment system[3] collections. Identifying and addressing industry-specific challenges are vital for businesses operating in these sectors.

Strategies for Managing High-Risk PSP Collections

Robust KYC (Know Your Customer) Processes

Implementing thorough KYC processes is the first line of defence against high-risk transactions. Businesses must verify the identity of their customers to mitigate the risk of fraudulent activities.

Implementing Advanced Fraud Detection Tools

Technology plays a Debtor collection period[4] role in managing high-risk PSP collections. Advanced fraud detection tools leverage artificial intelligence and machine learning to identify and prevent fraudulent transactions.

Industry Collaboration for Risk Mitigation

Collaboration within industries can enhance risk mitigation strategies. Sharing insights and best practices can help businesses stay ahead of emerging threats and challenges.

Case Studies

Successful High-Risk PSP Collection Strategies

Examining successful case studies provides valuable insights into effective strategies employed by businesses to navigate high-risk PSP collections successfully.

Learning from Failures: Lessons from Past Incidents

Analysing failures in high-risk PSP collections offers essential lessons for businesses. Understanding pitfalls helps in refining Strategic planning[5] for future success.

Compliance and Legal Considerations

Navigating Regulatory Compliance

Compliance with regulatory requirements is non-negotiable. Businesses must stay abreast of changes in regulations and adjust their strategies accordingly to avoid legal consequences.

Legal Frameworks for PSPs in India

Understanding the legal frameworks governing PSPs in India is crucial for businesses to operate within the bounds of the law. Legal compliance is an integral part of a successful high-risk PSP collection strategy.

The Role of Technology

Innovations in Payment Security

Continual advancements in payment security technologies provide businesses with tools to stay ahead of evolving threats. Adopting these innovations is key to building a secure payment environment.

Adopting Blockchain for Secure Transactions

Blockchain technology offers a decentralized and secure method of transaction verification. Exploring the potential of blockchain in high-risk PSP collections can enhance security and transparency.

Building Trust with Consumers

Transparent Communication

Building trust with consumers requires transparent communication. Businesses must be open about their high-risk PSP collection strategies and reassure customers about the security measures in place.

Customer Education on High-Risk PSPs

Educating customers about the risks associated with high-risk PSPs empowers them to make informed decisions. Clear communication fosters a sense of security and trust in the business.

Challenges and Opportunities

Addressing Challenges in High-Risk PSP Collections

Acknowledging and addressing challenges head-on is crucial for businesses. Proactive measures can turn challenges into opportunities for growth and improvement.

Opportunities for Growth in the Market

Despite the challenges, high-risk PSP collections present unique opportunities for businesses to tap into underserved markets and explore innovative solutions.

Future Trends in High-Risk PSP Collection

Emerging Technologies and Strategies

Anticipating future trends is vital for businesses to stay ahead of the curve. Exploring emerging technologies and strategies ensures preparedness for the evolving landscape of high-risk PSP collections.

Predictions for the Next Decade

Industry experts offer insights into their predictions for the next decade, helping businesses align their strategies with the expected changes in high-risk PSP collections.

Conclusion

navigating high-risk PSP collections in India requires a multifaceted approach. Businesses must understand the landscape, implement robust strategies, comply with regulations, leverage technology, and build trust with consumers.

FAQs

- What defines a high-risk PSP in India?

A high-risk PSP in India is characterized by factors such as regulatory challenges, fraud susceptibility, and industry-specific risks. - How can businesses effectively manage high-risk PSP collections?

Effective management involves implementing robust KYC processes, advanced fraud detection tools, and collaborating with industry peers for risk mitigation. - Why is transparent communication crucial in high-risk PSP collections?

Transparent communication builds trust with consumers by providing clarity on the security measures in place, fostering a sense of confidence. - What role does technology play in securing high-risk PSP transactions?

Technology, including innovations in payment security and blockchain adoption, plays a pivotal role in ensuring secure high-risk PSP transactions. - What are the future trends in high-risk PSP collections?

Future trends include the adoption of emerging technologies and strategic shifts in response to evolving challenges in the payment service provider landscape.