AUTHOR : RIVA BLACKLEY

DATE : 06/12/2023

Introduction

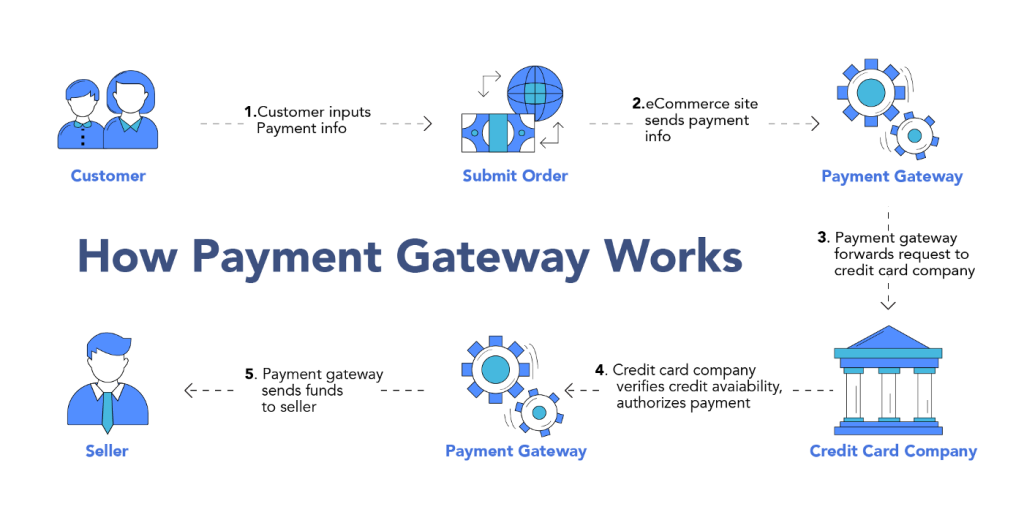

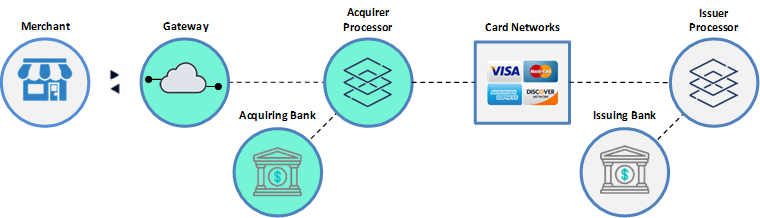

In the dynamic landscape of digital transactions, payment gateways play a pivotal role in facilitating seamless financial transactions between buyers and sellers. An integral aspect of this ecosystem is the management of credit and collections ensuring a smooth and also secure flow of funds. This article delves into the nuances of Payment Gateway Credit & Collections in India, shedding light on its importance and intricacies.

Understanding Payment Gateway Credit

Payment Gateway Credit involves the extension of credit to merchants and businesses, allowing them to transact without immediate payment. This not only provides flexibility for businesses but also fosters growth in the digital economy. Factors influencing credit approval include the financial health of the business, transaction history, and risk assessment.

Collections in the Payment Gateway System

Collections, on the other hand, revolve around the recovery of funds from transactions. It’s a crucial aspect that ensures the sustainability of payment gateways. Challenges in collections include late payments, disputes, and regulatory hurdles, impacting the cash flow of businesses relying on these gateways.

Popular Payment Gateway Credit Models

Navigating the Indian Payment Gateway Landscape

Various credit models exist in the payment gateway[1] realm, each with its own set of advantages and disadvantages. From flat-rate pricing to interchange-plus models, businesses need to carefully choose the model that aligns with their operations and financial goals. India, with its burgeoning digital economy, hosts several payment gateway providers. Understanding the market trends, innovations, and regulatory environment is essential for businesses to make informed decisions regarding credit and collections strategies[2].

Strategies for Efficient Credit Management

Effective credit management is paramount for payment gateways. Credit & Collection[3] Businesses must adopt strategies to mitigate risks, ensure timely payments, and foster a healthy financial relationship with their clients. Real-world case studies provide valuable insights into successful credit management approaches.

Enhancing Collections Practices

Collections efficiency is a key determinant of a Payment Gateways in E-commerce Success[4] Best practices, technological integration, and also case studies showcasing successful collections strategies offer a roadmap for businesses to streamline their collections processes.

Addressing Challenges in Credit and Collections

The Future of Payment Gateway Credit & Collections

Common challenges such as fraud, disputes, and regulatory changes can impede the smooth functioning of payment gateways. This section explores solutions and mitigation strategies to tackle these challenges head-on. As technology evolves, so does the landscape of payment gateways. Emerging trends, technological advancements, and their potential impact on businesses are discussed, providing a glimpse into the future of credit and collections in the industry.

Case Studies

Expert Insights

Highlighting success stories in Indian payment gateway credit and collections, this section illustrates how businesses have overcome challenges and achieved financial stability through effective credit and collections management. Exclusive interviews with industry experts provide a deeper understanding of the evolving dynamics of payment gateway debt collection landscape changing in india[5]. Their perspectives offer valuable insights into the industry’s future trajectory.

Comparison with Global Practices

User Experience in Credit and Collections

Contrasting Indian practices with global standards allows businesses to identify areas for improvement. Lessons learned from global practices can inform strategies for enhancing credit and also collections in the Indian context. The impact of credit and collections on end users is explored in this section. Strategies for improving user experience, transparency, and communication are crucial for maintaining trust and also ensuring customer satisfaction.

Importance of Cybersecurity in Payment Gateways

Leveraging Technology for Efficient Credit and Collections

With the rise of digital transactions, the importance of cybersecurity cannot be overstated. In the ever-evolving landscape of payment gateways, technology plays a pivotal role in optimizing credit and collections processes. Navigating the complex regulatory environment is crucial for payment gateways in India. Businesses must stay abreast of these regulations to avoid legal complications and ensure a seamless operation.

Conclusion

Summarizing the key points discussed throughout the article, it’s evident that effective credit and also collections management is foundational for the success of payment gateways in India. As the industry continues to evolve, businesses must stay agile and adapt to emerging trends to thrive in the digital economy.

FAQS

- What is the significance of credit management in payment gateways? Effective credit management ensures financial stability for businesses and fosters growth in the digital economy.

- How do payment gateways address challenges in collections? Payment gateways employ best practices, technological integration, and also strategic approaches to enhance collections efficiency.

- What are the emerging trends in payment gateway credit and collections? The future holds trends such as increased use of AI, blockchain, and innovative credit models in payment gateways.

- How can businesses improve user experience in credit and collections? Transparency, communication, and user-friendly interfaces contribute to a positive user experience in credit and collections.

- Why is cybersecurity crucial for payment gateways? The rise of digital transactions necessitates robust cybersecurity measures to safeguard sensitive financial information.