AUTHOR : KHOKHO

DATE : 23/12/2023

Introduction

In today’s fast-paced business landscape, managing financial transactions efficiently is crucial for success. One aspect that businesses often grapple with is the challenge of delinquent accounts. payment Gateway On Delinquent Accounts In India This article explores the role of payment gateways in addressing and managing delinquent accounts in the context of the Indian market.

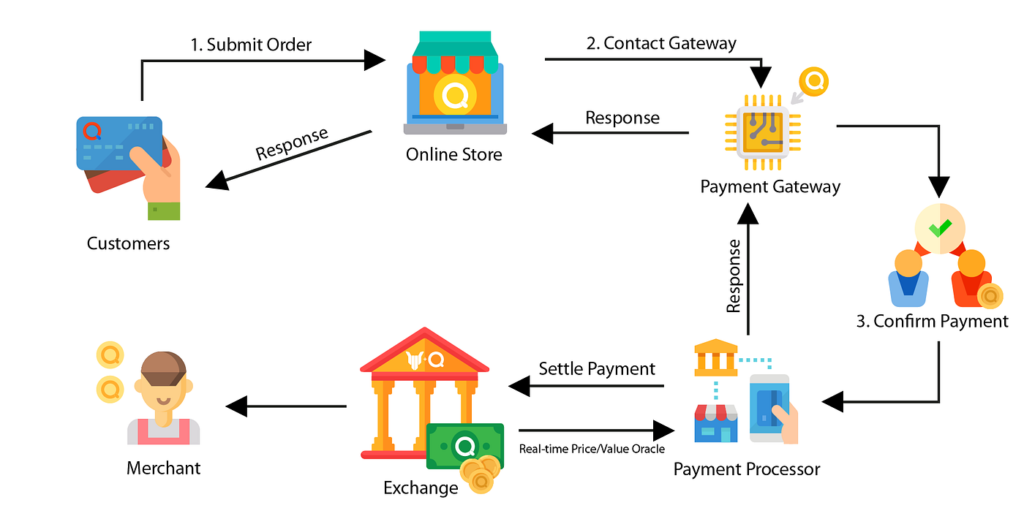

Payment gateways play a pivotal role in facilitating secure and seamless online transactions for businesses. They act as a bridge between customers and merchants, ensuring that payments are processed efficiently. In the Indian business ecosystem, where digital transactions are on the rise, understanding how payment gateways can contribute to the management of delinquent accounts is essential.

Delinquent Accounts: An Overview

Delinquent accounts[1] refer to accounts where payments are overdue or have not been received by the specified due date. This can happen for various reasons, such as financial difficulties, oversight, or disputes. Businesses often face challenges when dealing with delinquent accounts, affecting their cash flow and overall financial health.

Challenges Faced by Businesses with Delinquent Accounts

Managing delinquent accounts poses several challenges for businesses. The financial impact is immediate, with cash flow disruptions affecting day-to-day operations. Moreover, strained relationships with customers can lead to a loss of trust and loyalty. Online Payment Service Providers[2] Legal implications add another layer of complexity, making it imperative for businesses to find effective solutions.

Role of Payment Gateways in Managing Delinquent Accounts

Payment gateways[3] can be powerful tools for businesses dealing with delinquent accounts. Automation features, such as payment reminders and flexible payment options, can significantly improve the chances of recovering overdue payments. Integrating payment gateways with debt collection agencies streamlines the process, offering a comprehensive solution for businesses.

Security Measures in Payment Gateways

Security is paramount in financial transactions, especially when dealing with Delinquent Account Credit Card[4] employ advanced encryption techniques and fraud prevention measures to ensure that transactions are secure. This not only protects businesses but also instills confidence in customers, encouraging them to make timely payments.

Popular Payment Gateways in India

India has witnessed a surge in the use of digital payment methods[5], and several payment gateways cater to the diverse needs of businesses. Understanding the features and benefits of these gateways is crucial for businesses looking to manage delinquent accounts effectively.

Customizing Payment Gateways for Delinquent Accounts

One size does not fit all when it comes to managing delinquent accounts. Businesses need to customize payment gateway solutions to align with their specific requirements. Real-life case studies illustrate how customization has been instrumental in helping businesses recover overdue payments successfully.

Legal Considerations for Managing Delinquent Accounts

Navigating the legal landscape is essential when dealing with delinquent accounts. Payment gateways must comply with Indian regulations, and businesses must prioritize protecting customer rights. This section delves into the legal considerations that businesses should keep in mind when implementing payment gateways.

Steps to Implement Payment Gateways for Delinquent Accounts

Implementing payment gateways for delinquent accounts requires a strategic approach. Businesses need to assess their needs, choose the right payment gateway provider, and seamlessly integrate the solution into their existing systems.

Benefits of Implementing Payment Gateways on Delinquent Accounts

The benefits of implementing payment gateways for delinquent accounts are manifold. From improving cash flow to strengthening customer trust and streamlining financial processes, businesses can experience positive transformations by embracing these solutions.

Real-Life Success Stories

Examining real-life success stories provides insights into how businesses have overcome the challenges of delinquent accounts with the help of payment gateways. These stories serve as inspiration and practical examples for businesses seeking effective solutions

Future Trends in Payment Gateway Technology

As technology continues to evolve, so do payment gateways. This section explores the latest innovations and advancements in payment gateway technology, offering predictions for the future. Staying abreast of these trends is crucial for businesses aiming to remain competitive.

Choosing the Right Payment Gateway Provider

Selecting the right payment gateway provider is a critical decision for businesses. Factors such as transaction fees, security features, and customer support should be carefully considered. This section provides a guide for businesses to make informed choices.

Common Misconceptions about Payment Gateways and Delinquent Accounts

Addressing common misconceptions is essential for businesses considering the implementation of payment gateways. This section dispels myths and misunderstandings, providing clarity on how payment gateways can be effective tools in managing delinquent accounts.

Conclusion

In conclusion, the integration of payment gateways is a proactive and effective approach for businesses dealing with delinquent accounts. The outlined strategies, coupled with the security measures and customization options offered by payment gateways, position businesses for success in overcoming the challenges associated with overdue payments.

FAQs

- Is it legal to use payment gateways for managing delinquent accounts in India?

- Yes, using payment gateways is legal, but businesses must ensure compliance with Indian regulations.

- How can payment gateways improve cash flow for businesses?

- Payment gateways automate processes, send reminders, and offer flexible payment options, leading to faster and more consistent payments.

- Are there any risks associated with integrating payment gateways for delinquent accounts?

- While the risks are minimal, businesses must ensure secure integration and compliance with legal regulations to mitigate potential issues.

- What trends can businesses expect in payment gateway technology in the coming years?

- Future trends include increased personalization, enhanced security measures, and a shift towards decentralized payment systems.

- How can businesses choose the right payment gateway provider for their specific needs?

- Businesses should assess transaction fees, ease of integration, customer support, and align provider capabilities with their unique requirements.