AUTHOR : RIVA BLACKLEY

DATE : 11/12/2023

Introduction

In recent years, India has witnessed a significant surge in digital payments, with a myriad of payment processors facilitating transactions. This article explores the intricate world of Payment Processor Credit & Collections in India, shedding light on the challenges, innovations, and also the evolving landscape.

Overview of Payment Processors

India boasts a diverse range of payment processors, from traditional banks to emerging fintech startups. The industry has witnessed remarkable growth, fueled by the government’s push for a cashless economy and the widespread adoption of smartphones.

Credit and collections play a pivotal role in the smooth functioning of payment processors. Credit, often extended to users for purchases, requires a robust system for collections to ensure timely repayments. This dynamic is the backbone of secure and trustworthy financial transactions.

Challenges in Credit and Collections

Despite the progress, challenges persist. Regulatory hurdles, default risks, and fraud pose significant obstacles to efficient credit and collections management. Striking a balance between accessibility and also security remains a constant challenge for payment processors.

Evolution of Payment Technologies

The continuous evolution of payment technologies[1] has a profound impact on credit and collections[2]. Fintech innovations, such as blockchain and artificial intelligence, are reshaping the industry, introducing novel ways to manage Credit and Collections Software[3].

Government Initiatives

The promotion of Digital Payment Methods[4] has been significantly steered by the instrumental involvement of the Indian government. Policies supporting cashless transactions and incentives for payment processor[5]s have created an environment conducive to growth and innovation.

Role of Data Analytics

Collaborations and Partnerships

Data analytics has emerged as a game-changer in credit assessments and collections strategies. Payment processors leverage user data to make informed decisions, enhancing the efficiency of credit processes and minimizing default risks. Collaborations between payment processors and traditional financial institutions are on the rise. These partnerships aim to create synergies, ensuring efficient credit management and enhancing the overall stability of the financial ecosystem.

Customer Experience in Credit Transactions

Adoption of Contactless Payments

User experience is paramount in credit transactions. Streamlining the payment process, providing transparency in collections, and offering user-friendly interfaces contribute to building trust among users. The rise of contactless payments has revolutionized the way transactions occur. This section delves into the impact of contactless payments on credit and collections, exploring the benefits and challenges associated with this growing trend.

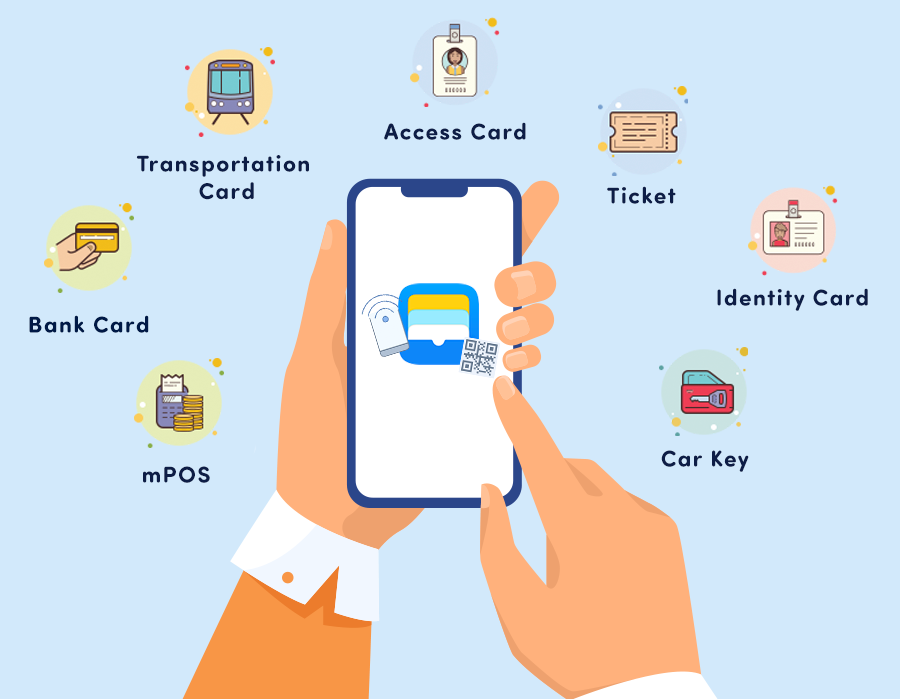

Mobile Wallets and Apps

Mobile wallets and apps have become integral to the payment landscape. This segment explores their influence on credit behavior and the unique challenges faced in collections from digital wallets.

Security Measures in Payment Processing

Future Outlook

With the increasing reliance on digital transactions, check the security of credit information is paramount. This section discusses the security measures implemented by payment processors to safeguard user data and build trust. As technology continues to advance, the future of payment processors in India holds exciting possibilities. Predictions for the industry’s trajectory and innovations in credit and collections are explored, offering insights into what lies ahead.

Conclusion

In conclusion, Payment Processor Credit & Collections in India is a multifaceted domain that requires a delicate balance between innovation, security, and customer experience. The industry’s growth is intricately linked to its ability to navigate challenges and adapt to the evolving needs of users.

FAQs

- How secure are digital transactions in India?

- Payment processors employ robust security measures to ensure the confidentiality and also integrity of digital transactions.

- What role does data analytics play in credit assessments?

- Data analytics is pivotal in making informed credit decisions by analyzing user behavior and also financial patterns.

- How is the government supporting digital payments?

- The government promotes digital payments through policies and also incentives for payment processors, fostering a cashless economy.

- Are contactless payments the future of transactions?

- The rise in contactless payments suggests a shift towards a more convenient and also efficient transaction method.