AURHOR : SELENA GIL

DATE : 25/12/2023

Introduction

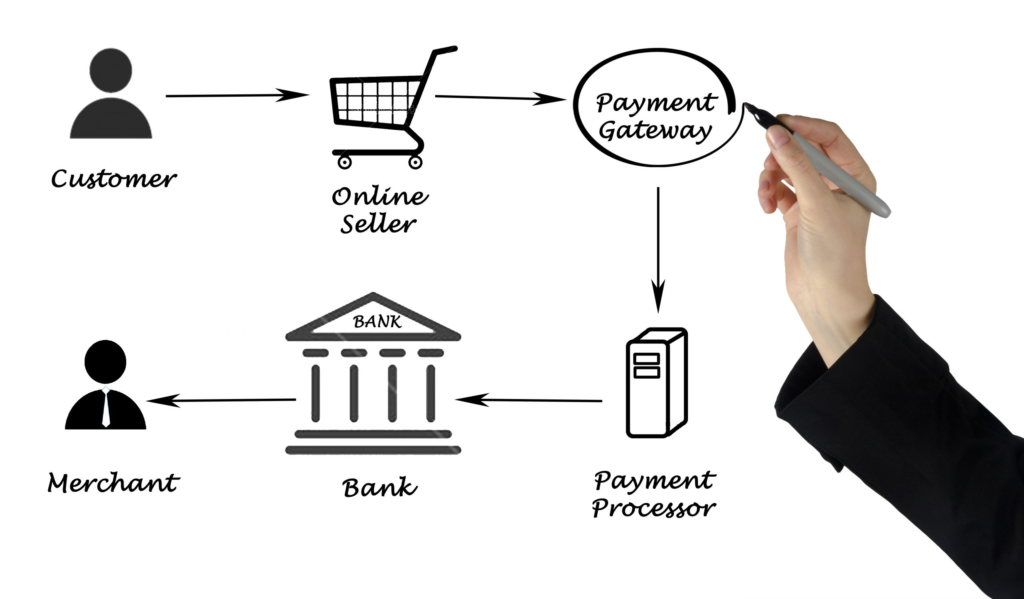

In a rapidly evolving financial landscape, credit counseling has become a pivotal service for individuals seeking financial stability. Managing debt, understanding credit scores, and strategizing financial goals necessitate guidance. Within this context, the role of payment processors in facilitating credit counseling transactions holds significant importance.

Challenges in Credit Counseling Payment Processing

However, the integration of payment processing credit counseling services presents several challenges. Regulatory frameworks, stringent compliance measures, security concerns, and the intricacies of financial transactions complicate the payment process.

Significance of Reliable Payment Processors

Reliable payment processors address these challenges by offering streamlined and secure transactions. Their comprehensive security features and customized solutions cater specifically to the nuances of credit counseling transactions, ensuring efficiency and trust.

Criteria for Selecting a Payment Processor

Selecting an appropriate payment processor involves stringent criteria. Compliance with regulations, robust data security protocols, and flexibility in transactions are crucial factors to consider.

Top Payment Processors for Credit Counseling in India

In the Indian market, several payment processors stand out for their exceptional services tailored to credit counseling needs. Let’s delve deeper into the unique offerings of these processors: Processor A boasts a user-friendly interface, simplifying complex transactions for both counselors and clients. Its comprehensive suite of services covers various payment methods[1], ensuring convenience and accessibility. Moreover, the processor’s efficient customer support enhances the overall experience, addressing queries promptly.

Seamless Integration and Advantages

Processor B excels in its seamless integration capabilities with existing counseling systems. This processor offers advantages such as lower transaction fees and quicker processing times, making it an attractive option for counseling firms aiming to optimize their financial operations.

Uniqueness and Client Satisfaction

Processor C sets itself apart through unique offerings tailored explicitly to the Credit Counselor[2] niche. Its emphasis on personalized solutions and high client satisfaction rates positions it as a preferred choice among counseling professionals seeking a tailored approach to financial transactions.

Comparative Analysis of Payment Processors

To assist in making an informed decision, it’s crucial to analyze these payment processors[3] in detail: Processor A may offer competitive rates for certain transaction types, while Processor B might provide tiered pricing models, catering to various transaction volumes. Processor C might focus on value-added services, bundling them with competitive pricing.

Integration Capabilities

The ease of integration differs among processors. Processor A might offer seamless API integration, while Processor B might provide customizable solutions adaptable to specific Online counseling[4] platforms. Processor C might excel in plug-and-play features, simplifying the integration process.

Customer Support

Processor A might provide 24/7 customer support, ensuring immediate assistance. Processor B might offer dedicated account managers, while Processor C might emphasize community forums and extensive knowledge bases. The optimal choice of payment processor depends on the unique requirements of credit counseling services[5]. Implementing best practices ensures a smooth transition and effective utilization of the selected processor’s capabilities.

Deep-Dive into Comparative Analysis

Fee Structures

Processor A might offer competitive rates for specific transaction types, while Processor B could provide tiered pricing models catering to various transaction volumes. Processor C might focus on value-added services bundled with competitive pricing.

Integration Capabilities

Processor A’s seamless API integration, Processor B’s customizable solutions, and Processor C’s plug-and-play features offer varying degrees of ease for integrating with counseling platforms.

Processor A might ensure round-the-clock customer support, Processor B could offer dedicated account managers, and Processor C might prioritize community forums and extensive knowledge bases.

Conclusion

In conclusion, the role of payment processors in credit counseling is pivotal. Choosing a reliable and efficient processor is essential for ensuring secure and seamless transactions, contributing significantly to the effectiveness of credit counseling services in India.

FAQs

- Can I use any payment processor for credit counseling?

- While some processors specialize in credit counseling transactions, not all may cater specifically to these needs. It’s crucial to choose a processor with relevant features.

- How do payment processors enhance security in credit counseling transactions?

- Processors employ encryption, secure gateways, and compliance with industry standards to ensure the confidentiality and integrity of transactions.

- Are there any legal implications in using specific payment processors for credit counseling in India?

- Yes, compliance with Indian financial regulations is crucial. Ensure selected processors align with local laws.

- What factors differentiate one payment processor from another in credit counseling?

- Fee structures, user interfaces, customer support, and integration capabilities are key differentiators among payment processors.

- Can I switch payment processors once integrated into credit counseling services?

- While possible, it may involve complexities. It’s advisable to thoroughly research and plan before making such transitions.