AUTHOR: RUBBY PATEL

DATE: 23/12/23

Introduction

In the dynamic landscape of credit reporting in India, the role of payment processors has become increasingly crucial. As individuals seek to access their credit reports securely and efficiently, the need for specialized payment processors tailored to the unique requirements of credit transactions has emerged. This article explores the current payment processing methods for credit reports in India, the advantages of using specialized payment processors, and a guide on choosing the right one for your needs.

Current Landscape of Credit Reports in India

In India, credit reporting plays a pivotal role in financial transactions, influencing everything from loan approvals to interest rates. The existing payment processing methods, however, often come with limitations and challenges, leading to a growing demand for more streamlined solutions.

The Need for Specialized Payment Processors

To address the perplexities associated with credit report[1] payments, specialized payment processors are designed to cater to the unique requirements of this financial landscape. These processors aim to simplify the payment process, ensuring users can access their credit reports swiftly and securely.

Advantages of Using Payment Processors for Credit Reports

One of the key advantages of using payment processors [2] is the enhanced security measures they offer. Transactions are fortified with advanced encryption standards, providing users with peace of mind regarding the confidentiality of their financial information. Moreover, the streamlined nature of these processors ensures faster and more efficient transactions, ultimately contributing to an improved overall user experience. Payment Processor For Credit Report In India

Critical Attributes to Consider in a Payment Processor

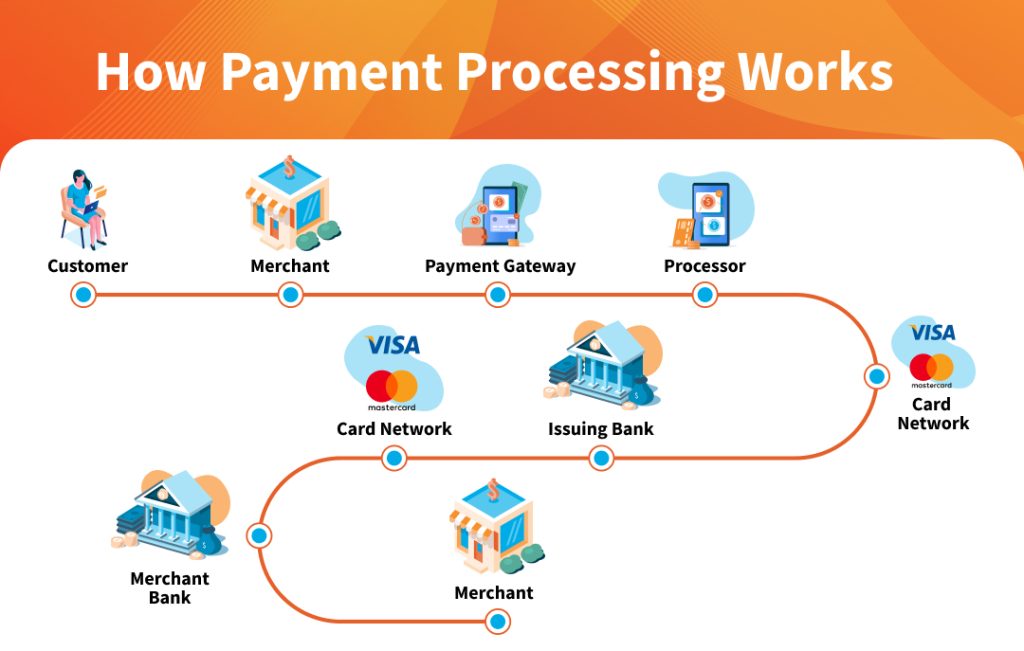

When choosing a Payment Processing Systems[3] for credit reports, it’s essential to consider specific features. Integration capabilities with credit reporting agencies, robust security protocols, and a user-friendly interface are paramount in ensuring a seamless experience for users.

Popular Payment Processors for Credit Reports in India

Several companies offer specialized payment processors for Credit score[4] reports in India. Company A, for instance, boasts unique features that set it apart, while Company B focuses on cost-effectiveness and then reliability. Company C, on the other hand, may have specific offerings catering to diverse user needs. Payment Processor For Credit Report In India

How to Choose the Right Payment Processor for Your Needs

Selecting the right E-commerce payment system[5] processor involves a careful evaluation of your specific requirements. Reading user reviews, considering costs and fees, and then ensuring compatibility with credit reporting agencies are crucial steps in makin an informed decision.

Steps to Use a Payment Processor for Credit Reports

Using a payment processor for credit reports involves simple steps. Users typically start by creating an account, linking it to their preferred credit reporting agencies, and then proceeding with secure and straightforward transactions. Payment Processor For Credit Report In India

Common Misconceptions about Payment Processors for Credit Reports

Addressing misconceptions is vital in promoting understanding and then trust. Debunking myths about security concerns, hidden fees, and accessibility issues can help users make informed decisions about utilizing payment processors for their credit reports

Future Trends in Payment Processing for Credit Reports

As technology continues to advance, payment processors are likely to evolve as well. Integration with emerging financial technologies and then potential regulatory changes may shape the future landscape of payment processing for credit reports in India.

Users Benefiting from Payment Processors

Real-life success stories highlight the positive impact of payment processors on credit report transactions. Users share their experiences, emphasizing the convenience, security, and then efficiency offered by these specialized solutions. Payment Processor For Credit Report In India

Industry Expert Insights

In exclusive interviews with experts in credit reporting and payment processing, industry leaders share their views on the future of payment processors for credit reports. Insights from these experts provide valuable perspectives on upcoming trends and then innovations in the field.

Conclusion

In conclusion, payment processors play a pivotal role in streamlining credit report transactions in India. As the demand for efficient and secure access to credit information grows, specialized payment processors continue to offer solutions tailored to the unique needs of users. Exploring the options available and choosing the right payment processor is a crucial step toward financial wellness. Payment Processor For Credit Report In India

FAQs

- What is a payment processor for credit reports?

A payment processor for credit reports is a specialized service that facilitates secure and then efficient transactions for individuals seeking to access their credit information. - How does using a payment processor enhance security?

Payment processors enhance security through advanced encryption standards, safeguarding the confidentiality of users’ financial information during transactions. - Are there any hidden fees associated with payment processors?

It’s essential to review the terms and conditions of each payment processor, but reputable ones are transparent about their costs, minimizing the risk of hidden fees. - Can I use any payment processor with all credit reporting agencies?

While many processors aim for compatibility, it’s crucial to verify specific integrations to ensure seamless transactions across your preferred credit reporting agencies. - How do payment processors contribute to a better user experience?

Payment processors contribute to a better user experience by offering a streamlined and secure process for accessing credit reports, ensuring efficiency and then peace of mind for users.