AUTHOR: RUBBY PATEL

DATE: 25/12/23

Introduction

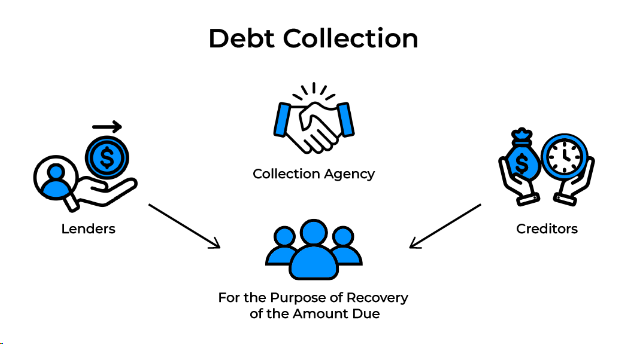

Debt collection is an essential aspect of financial management for businesses in India. Ensuring a smooth and reliable payment process is crucial for maintaining a healthy cash flow. In this article, we will explore the significance of using a payment processor specifically tailored for debt collection in India.

Understanding the Debt Collection Process in India

Before delving into the role of payment processors, it’s essential to understand the intricacies of the debt collection process in India. The legal landscape and specific challenges make it imperative for businesses to adopt efficient solutions.

Significance of a Payment Processor

A dedicated payment processor plays a pivotal role in streamlining the debt collection process. Beyond just facilitating transactions, these processors offer additional features that enhance efficiency and security. Essential Attributes to Seek in a Payment Processing Solution

When selecting a payment processor for debt collection, certain features should not be overlooked. Security measures, integration capabilities, and customization options are key aspects to consider.

Popular Payment Processors in India for Debt Collection

Several payment processors [1] cater to the unique needs of debt collection in India. A comparative analysis of these options can help businesses make informed decisions.

Given the strict regulatory environment, adherence to legal standards is paramount Payment processors play a crucial role in ensuring compliance with applicable laws.

Benefits of Using Payment Processors for Debt Collection

Challenges and Solutions

The advantages of using payment integrated solutions[2] extend beyond transaction facilitation. From efficiency and speed to enhanced security measures, businesses stand to gain significantly. Payment Processor for Debt Collection in India

While Debt collection[3] challenges, payment processors are equipped to address them effectively. Understanding common issues and their solutions is crucial for successful debt recovery.

Case Studies

Real-life examples showcase the tangible benefits of employing payment processors for debt collection. Examining real-world scenarios offers valuable perspectives on effective approaches and strategies that yield success.

Future Trends in the Debt Collection Process

Technological advancements are shaping the future of debt collection. From AI-driven solutions to predictive analytics, staying abreast of these trends is vital.

Opting for the Most Suitable Payment Processor for Your Company’s Financial transaction[4] Processor for Debt Collection in India

Every business is unique, and choosing the right payment processor requires careful consideration. Factors such as security, integration, and customization must align with business needs. Payment Processor for Debt Collection Services[5] in India

User Testimonials

Tips for Effective Debt Collection Using Payment Processors

Positive experiences from businesses that have successfully implemented payment processors for debt collection add credibility and provide insights for potential users.

Communication strategies and the use of automation for reminders are key tips for businesses looking to optimize their debt collection process.

Understanding the cost structures of different payment processors helps businesses find the best value for their money.

Choosing the Right Payment Processor for Your Business (Continued)

Selecting the appropriate payment processor is a critical decision that directly impacts the efficiency of debt collection. Beyond the general features, businesses should also consider factors such as customer support, ease of use, and the reputation of the payment processor within the industry. Payment Processor for Debt Collection in India

User Testimonials (Continued)

Real-world experiences shared by businesses that have successfully utilized payment processors for debt collection provide invaluable insights. These testimonials often highlight specific challenges faced by businesses and how the payment processor played a pivotal role in overcoming them. Payment Processor for Debt Collection in India

Conclusion

In conclusion, the efficient management of debt collection in India hinges on selecting the right payment processor. Businesses should explore options that align with their unique needs to ensure a seamless and secure process.

FAQs

- What makes a payment processor suitable for debt collection in India?

- A payment processor tailored for debt collection should offer advanced security measures, customization options, and seamless integration.

- How do payment processors ensure regulatory compliance in India?

- Payment processors adhere to legal standards through robust compliance measures and regular updates to stay in line with evolving regulations.

- Can payment processors handle both small and large-scale debt collections?

- Yes, many payment processors are scalable and cater to businesses of all sizes, ensuring flexibility in debt collection processes.

- Are there any specific challenges in debt collection that payment processors cannot address?

- While payment processors are powerful tools, effective debt collection also requires human-centric strategies, especially in delicate situations.

- How can businesses determine the right payment processor for their unique needs?

- Businesses should assess factors like security features, integration capabilities, and customization options to find the most suitable payment processor.