AUTHOR: BABLI

DATE: 27/12/23

Introduction

In the intricate tapestry of personal finance, the term “high-risk PSP debt” often casts a looming shadow on individuals. But fear not, as the financial landscape of India offers various alternatives for debt consolidation, providing a lifeline for those entangled in the complexities of high-risk debt.

Understanding High-risk PSP Debt

High-risk PSP debt, often a result of financial struggles or unforeseen circumstances, poses unique challenges. Understanding the factors that contribute to this status is crucial to exploring effective solutions.

Challenges Faced by Individuals with High-risk PSP Debt

Navigating the world of high-risk debt comes with its own set of challenges, including limited borrowing options, higher interest rates, and a significant impact on credit scores. These challenges can be daunting, but they are not insurmountable.

Benefits of Debt Consolidation

Debt consolidation emerges as a beacon of hope, offering lower interest rates, a single monthly payment, and the prospect of rebuilding a tarnished credit score. High-risk PSP Debt Consolidation Alternatives in India But what is the starting point for this expedition?

Popular Debt Consolidation Alternatives in India

India’s financial landscape provides several avenues for debt consolidation[1], such as personal loans, secured loans, and peer-to-peer lending. Every choice brings forth a distinct array of benefits and factors to take into account.

Considerations Before Opting for Debt Consolidation

Before taking the plunge, it’s essential to assess your financial situation, research potential lenders, and understand the terms and conditions. High-risk PSP Debt Consolidation Alternatives in India A well-informed decision is the first step toward financial freedom[2].

Steps to Secure a Debt Consolidation Loan

Gathering the necessary documents, navigating the application process, and awaiting approval are integral steps in securing a debt consolidation loan. Let’s delve into the procedural aspects.

Tips for Successful Debt Consolidation

Creating a budget, avoiding new debt, and seeking professional advice are pivotal in ensuring the success of a debt consolidation plan[3]. Practical tips can make a significant difference in the journey to financial recovery.

Case Studies: Success Stories of Debt Consolidation

Real-life stories of individuals who have successfully navigated high-risk debt and emerged stronger serve as inspiration. These case studies shed light on the positive impact of debt consolidation.

Common Misconceptions About Debt Consolidation

Dispelling myths and addressing concerns surrounding debt consolidation is crucial. By separating fact from fiction, individuals can make informed decisions about their financial future.

Comparing Debt Consolidation Options

Comparing interest rates, repayment terms, and additional fees is essential in choosing the right debt consolidation option. A thorough analysis ensures that the chosen path aligns with financial goals.[4]

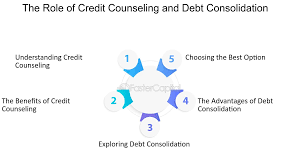

The significance of credit counseling in the realm of debt consolidation cannot be overstated.

Professional guidance through credit counseling plays a vital role in the debt consolidation process. Understanding how credit counseling[5] works can provide individuals with the support needed for success.

Testimonials from Individuals Who Have Benefited

Hearing firsthand accounts of individuals who have successfully navigated high-risk debt and emerged on the other side provides valuable insights and encouragement.

Future Trends in Debt Consolidation

As technology evolves and policies change, the landscape of debt consolidation is also expected to shift. Understanding future trends can help individuals make forward-thinking decisions.

Conclusion

In conclusion, high-risk PSP debt need not be a permanent burden. Debt consolidation in India offers a pathway to financial recovery, providing individuals with the tools they need to break free from the shackles of debt.

FAQs

- Is debt consolidation suitable for everyone, regardless of their financial situation? Debt consolidation is a viable option for many, but it’s essential to assess individual circumstances. Consulting with a financial advisor can provide personalized insights.

- How quickly can one see improvements in their credit score after debt consolidation? The timeline for credit score improvement varies, but responsible financial management post-consolidation can lead to positive changes over time.

- Are there government-backed debt consolidation programs in India? While there may not be direct government programs, certain financial institutions collaborate with government initiatives to offer favorable terms for debt consolidation.

- Can I consolidate different types of debts, such as credit cards and personal loans, into one consolidation plan? Yes, debt consolidation often allows for the merging of various types of debt into a single, manageable payment.

- What happens if I miss a payment after consolidating my debts? Missing payments can have adverse effects, including potential damage to your credit score. It’s crucial to adhere to the agreed-upon repayment plan.