AUTHOR : ZOYA SHAH

DATE : 26-12-2023

Debt is a ubiquitous part of modern life, and for some, it can become overwhelming, especially when classified as high-risk PSP debt. In this article, we’ll delve into the world of high-risk PSP debt consolidation services in India, exploring the challenges faced by individuals, the emergence of specialized services and how these services work to provide tailored solutions. Let’s navigate the complex landscape of high-risk debt, understanding the nuances and seeking viable paths to financial recovery.

Introduction

Navigating the complexities of high-risk PSP debt can be daunting, and for individuals in India, the need for effective debt consolidation services has never been more pressing. As financial landscapes evolve, so do the challenges faced by those with high-risk debts. In this article, we’ll explore the nuances of high-risk PSP debt consolidation services, shedding light on the emerging trends in India.

Understanding High-Risk PSP Debt

High-risk PSP debt refers to debts categorized as particularly risky by payment service providers[1]. Various factors contribute to this classification, including a history of late payments, defaults, or other financial red flags. Understanding the characteristics of high-risk debt is crucial in evaluating the necessity for specialized debt consolidation [2] services

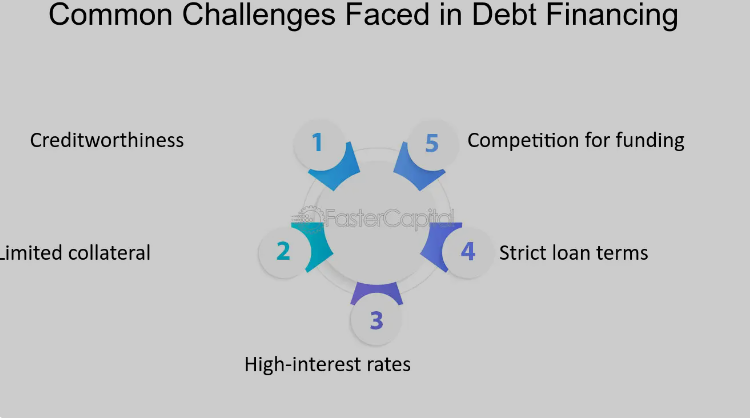

Challenges Faced by Individuals with High-Risk PSP Debt

For individuals with high-risk PSP debt, traditional debt consolidation avenues may be limited. Conventional financial institutions often hesitate to provide solutions for high-risk individuals, exacerbating the financial strain. Additionally, the impact on credit scores and overall financial well-being cannot be underestimated.

The Emergence of Specialized Services in India

Recognizing the growing need, specialized high-risk PSP debt consolidation services have entered the Indian market. These services are designed to address the unique challenges faced by individuals with high-risk debt, offering tailored solutions that traditional avenues may not provide.

How High-Risk PSP Debt Consolidation Works

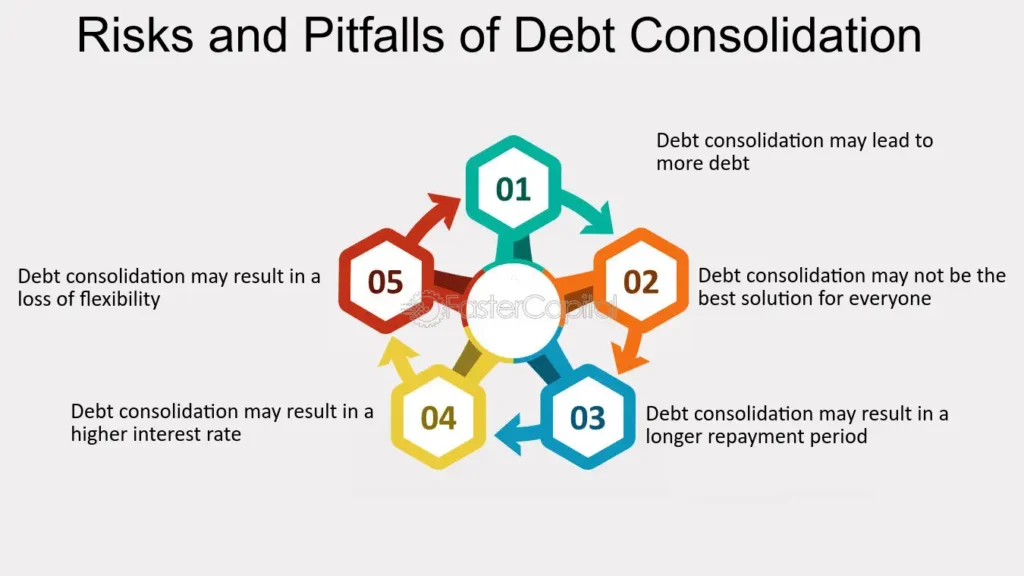

High-risk PSP debt consolidation involves the restructuring of debts to make them more manageable for individuals. The process typically includes negotiating with creditors, combining multiple debts into a single payment, and establishing a feasible repayment plan. While the benefits are evident, individuals must also be aware of potential drawbacks before opting for such services.

Customized Solutions for Varied Needs

One size does not fit all in the realm of high-risk debt consolidation. Service providers recognize the importance of tailoring their approaches to individual circumstances. Personalized plans take into account the specific financial situation[3] of the client, ensuring a more effective and sustainable path to debt relief.

Navigating Regulatory Framework

Understanding the legal aspects of dangerous debt consolidation in India is vital. Clients should be aware of the regulatory framework governing these services to ensure compliance and consumer protection. Transparent communication from service providers regarding legal considerations is essential for building trust.

Choosing the Right Service Provider

Selecting the right dangerous debt consolidation service provider is a critical decision. Factors such as reputation, track record, and client testimonials should be carefully considered. Thorough research and due diligence are essential to ensure that the chosen service provider aligns with the client’s needs and expectations.

Success Stories: Real-Life Experiences

Real-life success stories serve as testaments to the effectiveness of dangerous PSP debt consolidation services. Case studies illustrating positive outcomes for individuals in India can provide hope and inspiration for those considering debt consolidation.

Common Misconceptions Debunked

Misconceptions surrounding dangerous debt consolidation can deter individuals from seeking help. Addressing these myths and clarifying doubts is crucial for potential clients to make informed decisions about their financial future.

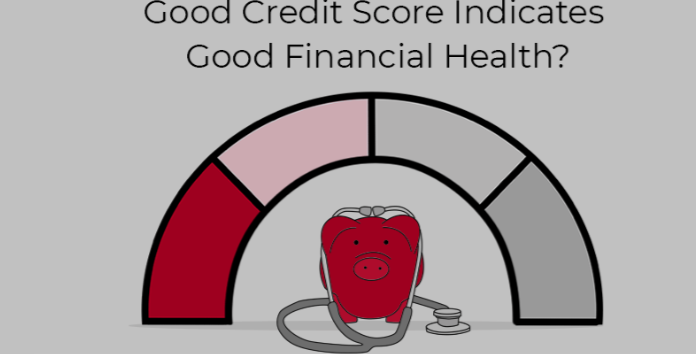

Impact on Credit Scores and Financial Health

Beyond immediate debt relief[4], it’s essential to analyze the long-term effects of dangerous debt consolidation on credit scores and overall financial health. Understanding these impacts can guide individuals in making informed choices regarding their financial recovery.

Tips for Managing High-Risk Debt After Consolidation

Successfully consolidating dangerous debt is just the first step. Managing finances post-consolidation requires discipline and strategic planning. Budgeting tips and financial advice can empower individuals to stay on track and avoid falling back into the cycle of dangerous debt.

Future Trends in High-Risk Debt Consolidation

As technology continues to advance, the landscape of dangerous debt consolidation is expected to evolve. Anticipating future trends can help individuals make proactive choices, aligning themselves with emerging opportunities in the debt consolidation space.

Community Support and Financial Education

In addition to professional services, community support and financial education play pivotal roles in the journey to debt recovery[5]. Building a support network and acquiring financial literacy can empower individuals to make sound financial decisions, reducing the likelihood of falling into high-risk debt again.

Conclusion

In conclusion, dangerous PSP debt consolidation services in India offer a ray of hope for individuals facing financial challenges. By understanding the intricacies of dangerous debt, exploring available solutions, and making informed decisions, individuals can pave the way for a more secure financial future.

FAQs

- How does dangerous debt consolidation affect credit scores?

- High-risk debt consolidation can initially impact credit scores, but it provides an opportunity for gradual improvement. Timely payments and responsible financial management post-consolidation contribute positively to credit scores over time.

- Are there government regulations overseeing high-risk debt consolidation in India?

- Yes, there are regulatory frameworks in place to govern dangerous debt consolidation services in India. Clients should be aware of these regulations to ensure a transparent and legal process.

- What makes a debt consolidation service provider reputable?

- A reputable debt consolidation service provider has a track record of successful cases, positive client testimonials, and transparent communication. Researching and reading reviews can help in assessing their credibility.

- Can I consolidate high-risk debts on my own without professional help?

- While some individuals may attempt to consolidate debts independently, professional assistance is advisable for dangerous debts. Debt consolidation experts possess the experience and negotiation skills necessary for successful outcomes.