AUTHOR : JAYOKI

DATE : 26/12/2023

Dealing with multiple credit cards[1] and their associated debts can be overwhelming, but the right payment processor can make the process of consolidating credit card debt in India much more manageable. In this comprehensive guide, we’ll explore the intricacies of credit card debt consolidation, the benefits it offers, and the key features to look for in a payment processor[2]. Let’s dive into the world of financial freedom and efficient debt management.

Introduction

Managing credit card debt is a common concern for many individuals in India. The multitude of credit cards, each with its own billing cycle and interest rates, can lead to confusion and financial stress. However, with the right payment processor, consolidating credit card debt becomes a streamlined and efficient process.

Understanding Credit Card Debt in India

Before delving into the solutions, it’s crucial to understand the landscape of credit card debt in India. Recent statistics highlight the rising trend of credit card usage, accompanied by an increase in debt levels. Many individuals find themselves juggling multiple credit cards, each contributing to their overall financial burden.

Benefits of Consolidating Credit Card Debt

Consolidating credit card debt offers a range of advantages. Firstly, it allows individuals to benefit from lower interest rates, reducing the overall cost of debt. Additionally, having a single monthly payment simplifies financial management[3], making it easier to stay on top of payments and avoid late fees.

Choosing the Right Payment Processor

Selecting the right payment processor is a crucial step in the credit card debt consolidation journey. Various criteria, such as security measures, user-friendliness, and integration with financial institutions, should be considered. Let’s explore how to make an informed choice among the available options.

Key Features to Look for in a Payment Processor

Security should be a top priority when choosing a payment processor for credit card debt consolidation. payment processor for Consolidate credit card debt in india Look for processors with robust encryption and authentication measures to ensure the safety of your financial information. A user-friendly interface is equally important, facilitating a seamless consolidation process. Integration with major banks and financial institutions ensures smooth transactions and reliable service.

Top Payment Processors for Credit Card Debt Consolidation in India

Several payment processors in India specialize in credit card debt consolidation. Each comes with its unique features, catering to different needs. Whether it’s the ease of use, competitive interest rates, or additional perks, there’s a processor for every individual. Let’s explore some of the top contenders in the market.

Step-by-Step Guide to Using a Payment Processor for Debt Consolidation

Once you’ve chosen a payment processor, the next steps are crucial. This section provides a step-by-step guide on how to use a payment processor for credit card debt consolidation. From the initial registration process to linking multiple credit cards and initiating consolidation transactions, we’ve got you covered.

Tips for Successful Credit Card Debt Consolidation

Consolidating credit card debt[4] is not just about the process; it’s also about maintaining financial discipline afterward. This section offers practical tips on managing finances post-consolidation and avoiding the accumulation of future debt.

Real-Life Success Stories

To inspire and motivate readers, this section includes real-life success stories from individuals who successfully consolidated their credit card debt. These testimonials provide a glimpse into the positive impact that efficient debt management can have on one’s financial well-being.

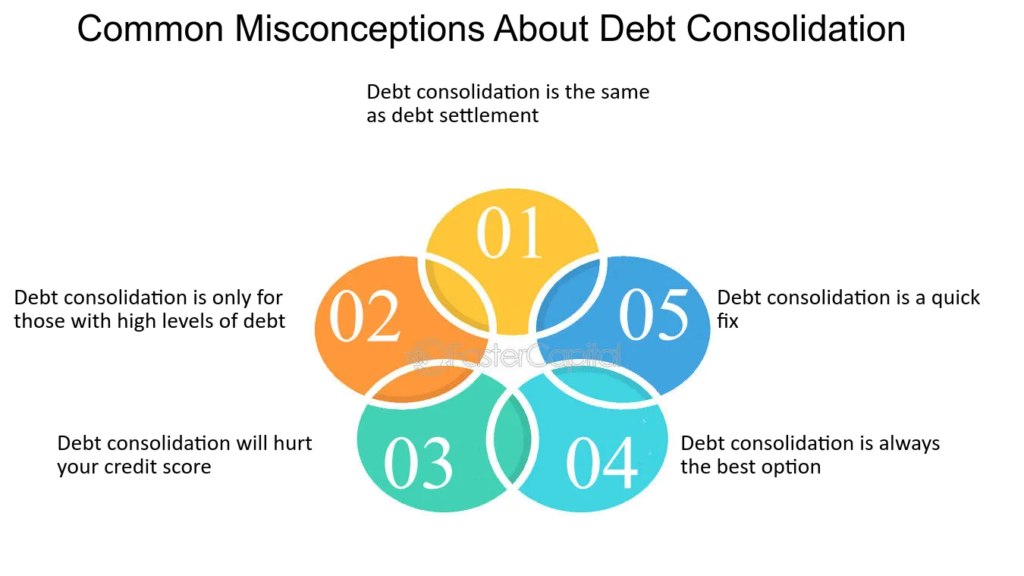

Common Misconceptions About Credit Card Debt Consolidation

Misinformation can hinder individuals from exploring credit card debt consolidation. In this section, we address common misconceptions and concerns, providing clarity on the realities of the process.

Future Trends in Credit Card Debt Consolidation

The financial landscape is continually evolving, and credit card debt consolidation is no exception. This section explores the future trends in debt consolidation, including technological advancements in payment processing and predictions for the industry’s future.

Case Study: A Successful Debt Consolidation Journey

For a more in-depth understanding, we present a case study detailing an individual’s successful journey towards financial freedom through credit card debt consolidation. This real-life example illustrates the practical steps and positive outcomes of the consolidation process.

Expert Advice on Credit Card Debt Management

Seeking advice from financial experts is invaluable. In this section, we share insights and tips from experts in the field, offering guidance on credit card debt management[5] and maintaining a healthy credit score.

Conclusion

In conclusion, choosing the right payment processor is the key to effective credit card debt consolidation. By considering the outlined criteria, exploring top processors, and following the step-by-step guide, individuals can take control of their finances and work towards a debt-free future.

FAQs

- What is the minimum credit score required for debt consolidation?

- The minimum credit score required for debt consolidation varies among processors, but a higher score generally improves eligibility.

- Can I consolidate debt without a payment processor?

- While it’s possible, using a payment processor streamlines the consolidation process and offers additional benefits.

- How long does the debt consolidation process take?

- The timeline varies, but consolidation can typically be completed within a few weeks, depending on the chosen processor.

- Are there any fees associated with using a payment processor for debt consolidation?

- Processor fees may apply; it’s crucial to understand the fee structure before initiating consolidation.

- Will debt consolidation affect my credit score?

- Initially, there may be a slight impact, but successfully managing consolidated debt can have positive long-term effects on your credit score