AUTHOR : EMILY PATHAK

DATE : 13 / 12 / 2023

Introduction:

In the dynamic landscape of personal finance, the intersection of payment providers and debt consolidation in India has become a pivotal point for individuals seeking financial stability. Payment providers, the backbone of modern financial transactions, play a crucial role in streamlining debt consolidation[1] processes In the intricate tapestry of existence, a symbiotic dance unfolds, where disparate entities intertwine in a unique alliance, exchanging vital elements to forge a harmonious coexistence.

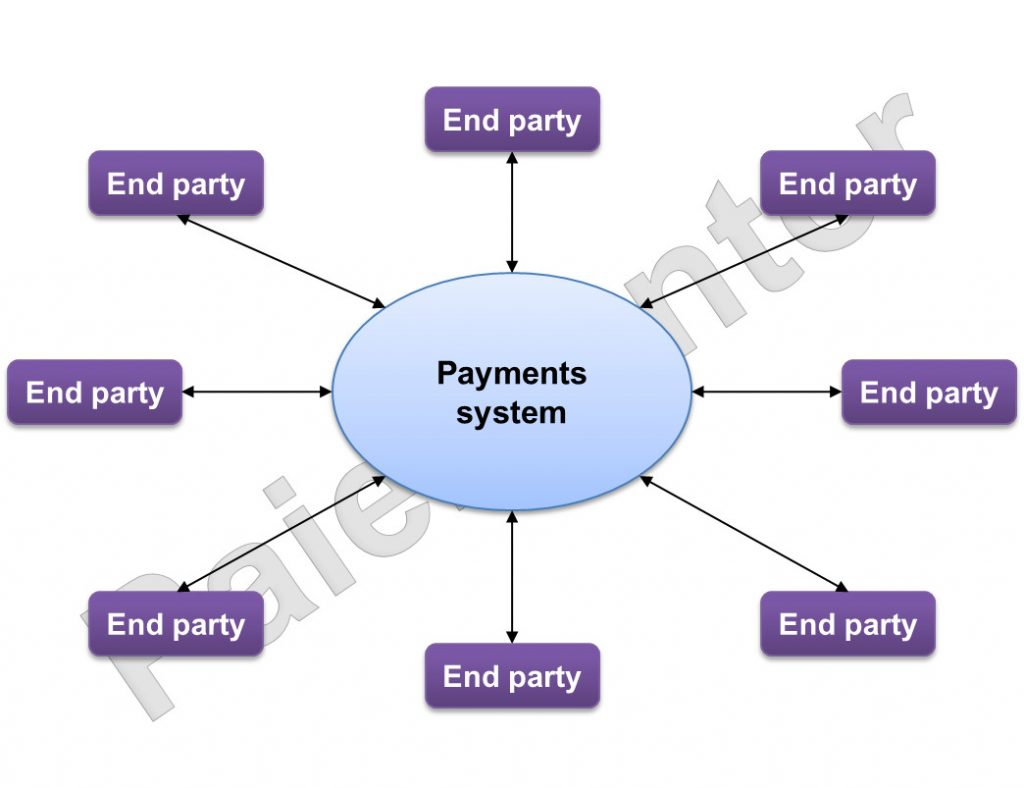

Importance of Efficient Payment Providers

Payment providers[2] are not just conduits for financial transactions; they are architects of efficiency in the monetary realm. By streamlining transactions and reducing costs, these entities become instrumental in shaping a seamless financial experience for consumers.

Challenges in the Current Payment System

However, the current payment system faces challenges, such as the lack of integration and also high transaction fees. These obstacles hinder the financial freedom[3] of individuals aiming to consolidate their debts effectively.

Role of Payment Providers in Debt Consolidation

In the realm of debt consolidation, payment providers emerge as catalysts for change. They facilitate seamless transactions and also offer customized solutions, empowering individuals to take control of their financial destinies.

Popular Payment Providers in India

In India, several payment providers stand out for their commitment to financial empowerment. XYZ Payment Solutions and ABC Financial Services have pioneered innovative approaches to make debt consolidation accessible to a wider audience.

Benefits of Debt Consolidation

Debt consolidation, when done right, brings a myriad of benefits, including lower interest rates and simplified repayment plans. It provides individuals with a lifeline to navigate their financial challenges effectively.

How Payment Providers Can Enhance Debt Consolidation

To enhance debt consolidation, payment providers need to integrate financial services seamlessly and also leverage technology-driven solutions. This not only simplifies the process but also ensures a more personalized approach to debt management.

Case Studies

Real-life success stories underscore the effectiveness of payment providers in debt consolidation. These case studies highlight the transformative impact on individuals who have successfully navigated the path to financial freedom.

Future Trends in Payment Provider-Driven Debt Consolidation

Looking ahead, the integration of blockchain technology and artificial intelligence holds immense promise for the future of payment provider-driven debt consolidation. These innovations are poised to revolutionize the financial landscape.

Tips for Choosing the Right Payment Providers for Debt Consolidation in India

Choosing the right payment provider is crucial for a successful debt consolidation journey. Factors such as reputation, trustworthiness, and customization options should be carefully considered.

Real-Life Experiences

Testimonials from individuals who have successfully consolidated their debts using payment providers offer valuable insights into the practical aspects of the process. Their experiences serve as a beacon for others navigating similar financial challenges.

Payment Providers in India

Role of Payment Providers in the Indian Economy

Payment providers play a pivotal role in India’s shift toward a cashless economy. Giants like Paytm, Razorpay, and PhonePe have transformed how Indians transact, but their rapid growth often comes with financial challenges.

Financial Challenges Faced by Payment Providers

Operating costs, compliance with regulations, and competition demand significant financial resources. Accumulating debts from various sources can strain their cash flow, necessitating effective debt management solutions[4]

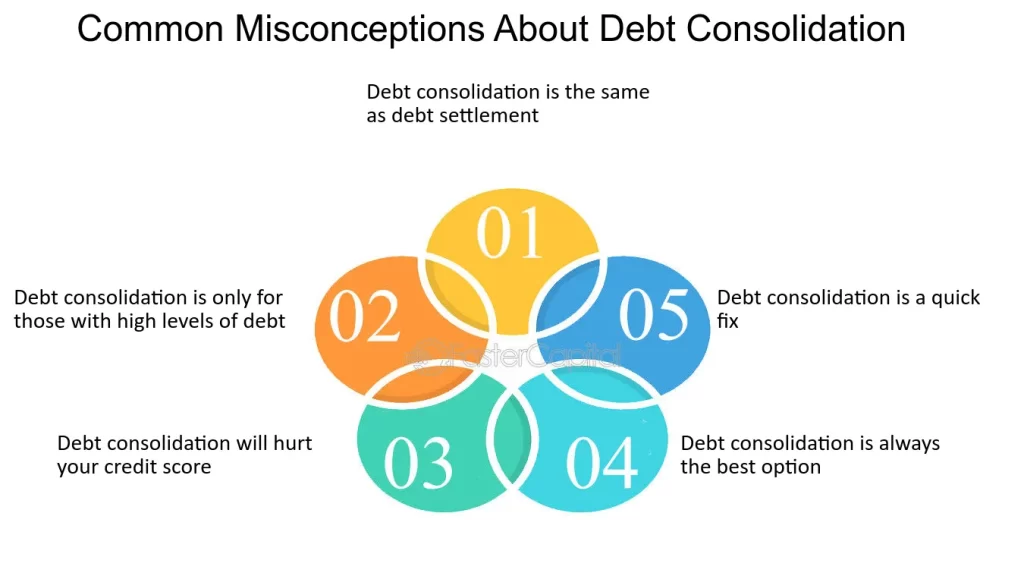

Common Misconceptions About Payment Provider Debt Consolidation:

Dispelling myths and providing clarity on common misconceptions surrounding payment provider debt consolidation is essential. Understanding the truth behind these myths empowers individuals to make informed financial decisions.

The Regulatory Landscape:

Government regulations play a significant role in shaping the operations of payment providers. Compliance with security measures ensures a safe and secure environment for individuals entrusting their financial information to these entities.

The Future of Payment Providers for Debt Consolidation in India

Looking forward, the ongoing evolution of payment provider-driven debt consolidation promises exciting developments. Technological advancements, regulatory frameworks, and also changing consumer needs will continue to shape the landscape.

Blockchain Technology: One of the key areas where blockchain technology will leave its mark is in ensuring secure, transparent, and also tamper-proof financial transactions. The decentralized nature of blockchain makes it an ideal candidate for enhancing the security of payment provider systems.

The growing adoption of digital payment platforms[5] in India has made debt consolidation more accessible, especially with providers offering user-friendly interfaces and robust security measures. Payment gateways such as Razorpay, PayU, and CCAvenue are among the popular choices, helping borrowers streamline their finances. By consolidating debts through trusted payment providers, individuals can lower interest rates, avoid late fees, and improve their credit scores over time.

Empowering Financial Freedom

In the ever-evolving world of payment providers and debt consolidation, the vision for tomorrow is clear – empowering financial freedom for all. As technology continues to advance, and also as payment providers adapt to meet the changing needs of consumers, the accessibility and efficiency of debt consolidation services will reach new heights.

Conclusion:

In conclusion, the synergy between payment providers and debt consolidation in India is a testament to the transformative power of financial innovation. As individuals strive for financial stability, the role of payment providers becomes increasingly pivotal in shaping a more accessible and also efficient financial landscape.

FAQs

Q1: What is payment provider debt consolidation?

Payment provider debt consolidation is a financial strategy that involves combining multiple debts into a single payment, simplifying the repayment process for these entities.

Q2: How does debt consolidation benefit payment providers?

Debt consolidation benefits payment providers by streamlining their financial obligations, leading to lower interest rates and reduced monthly payments, ultimately improving overall financial management.

Q3: Are there any risks associated with debt consolidation?

While debt consolidation offers benefits, there are potential risks, including the possibility of accruing additional fees or negatively impacting credit scores. Careful consideration and understanding of terms are essential.

Q4: How long does the debt consolidation process take?

The duration of the debt consolidation process varies, depending on factors such as the chosen consolidation option and the complexity of the payment provider’s financial situation.

Q5: Can payment providers with poor credit history qualify for consolidation?

Payment providers with poor credit history may still qualify for consolidation, but the terms and conditions, including interest rates, may be less favorable. It’s crucial to explore options and consult with financial experts.