AUTHOR : SELENA GIL

DATE : 29/12/2023

In the vast landscape[1] of digital commerce[2], the emergence of high-risk payment[3] service providers (PSPs) dealing with cyber products has stirred both innovation and concern. Understanding the nuances and impact of these entities in the Indian market[4] is crucial to navigating the complexities of cybersecurity and financial transactions[5].

Introduction

Payment service providers (PSPs) play a pivotal role in facilitating online transactions, encompassing a broad spectrum of financial services. Cyber products, within this context, refer to digital offerings susceptible to heightened risks associated with security breaches, fraud, or regulatory non-compliance.Not all PSPs or cyber products bear the same level of risk. Categories such as payment gateways, cryptocurrency platforms, and online gaming and betting portals often fall under the umbrella of high-risk due to their inherent susceptibility to cyber threats and regulatory scrutiny.

Challenges and Risks in the Indian Market

Regulatory Landscape

The Indian market presents a labyrinth of regulations governing financial transactions and cybersecurity. Navigating through these norms while operating as a high-risk PSP poses significant challenges, necessitating a comprehensive understanding of compliance measures.

Security Concerns and Vulnerabilities

Amidst rapid digitization, security concerns loom large. High-risk PSPs are particularly vulnerable to cyber threats, necessitating robust security protocols to safeguard sensitive consumer data and financial transactions.

Key Features and Types of High-Risk PSP Cyber Products

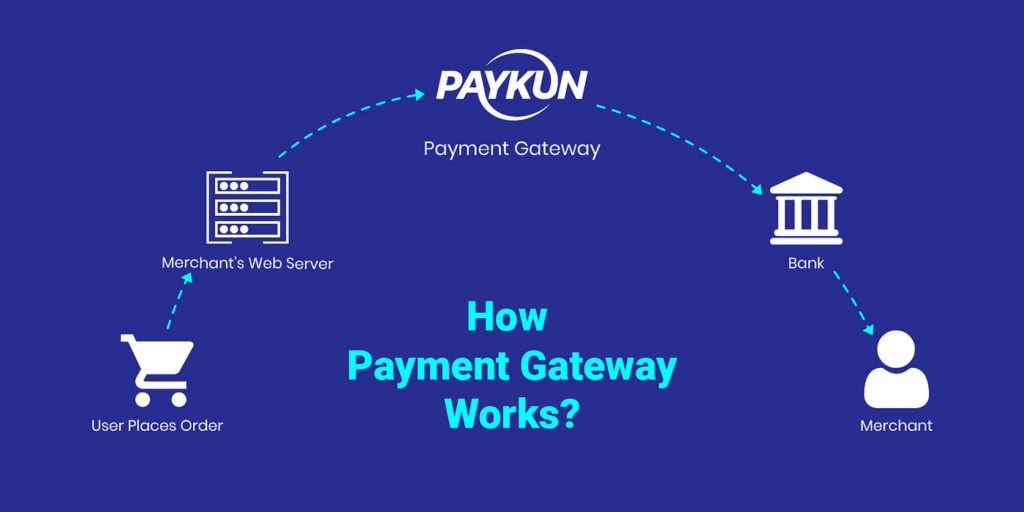

Payment Gateways

These gateways serve as the bridge between merchants and financial institutions, handling sensitive transaction data. Their high-risk nature demands stringent security measures to prevent breaches.

Cryptocurrency Platforms

In India, the burgeoning interest in cryptocurrencies has given rise to platforms offering digital asset services. The decentralized and pseudonymous nature of cryptocurrencies poses unique challenges in terms of regulatory compliance and security.

Online Gaming and Betting Portals

The realm of online gaming and betting portals, while lucrative, is fraught with risks related to fraudulent activities, necessitating stringent authentication and transactional security measures.

The Impact on Businesses and Consumers

Business Operations and Transactions

High-risk PSP cyber products profoundly influence how businesses conduct transactions and manage financial operations. The efficiency and security of these processes significantly impact the bottom line.

Consumer Security and Data Privacy

From a consumer perspective, entrusting sensitive information to high-risk PSPs underscores the criticality of data privacy and security. Any breach can lead to financial loss and compromise personal information.

Regulatory Measures and Compliance

RBI Guidelines

The Reserve Bank of India (RBI) has laid down specific guidelines and compliance requirements for PSPs, especially those dealing with high-risk cyber products. Adhering to these directives is paramount for sustainable operations.

Compliance Framework for High-Risk PSPs

Developing and administering a robust compliance framework is essential for high-risk PSPs to ensure adherence to regulatory standards and mitigate potential risks.

Mitigation Strategies for High-Risk Cyber Products

Enhanced Security Protocols

Implementing state-of-the-art security protocols, including encipher, multi-factor authentication[1], and regular security audits, is vital to fortifying against cyber threats.

Third-Party Audits and Certifications

Seeking third-party audits and certifications can bolster credibility and trust, assuring stakeholders of the PSP’s commitment to security and compliance.

Future Trends and Innovations

Evolving Technologies

Advancements in technology[2], such as AI-driven security measures and blockchain integration, hold promise for fortifying high-risk PSPs against emerging threats.

Predictions for High-Risk PSPs

Forecasts suggest an increasing reliance on high-risk PSPs, persuasion, continued innovation, and an enhanced focus on security measures and compliance[3].

Understanding High-Risk PSPs

Defining High-Risk Payment Service Providers

High-risk PSPs refer to entities that operate in sectors prone to elevated financial and regulatory risks. These entities often deal with industries such as online gaming, gambling, adult entertainment, and certain financial services that pose higher risks due to various factors.

Factors Contributing to High-Risk Designation

Several factors contribute to the classification of PSPs as high-risk entities. These include a higher likelihood of potential fraud, changing regulatory environments, and operating in industries with a history of deceitful activities.

High-Risk PSP Cyber Products in India

India’s payment landscape has undergone a dynamic shift towards digital transactions. High-risk PSPs operating in the country offer various cyber products to diverse sectors. However, their operations are subject to regulations imposed by the Reserve Bank of India (RBI) and other regulatory bodies.

Overview of the Indian Payment Landscape

The Indian payment ecosystem is a blend of traditional banking and modern fintech innovations. High-risk PSPs contribute to this landscape[4] by providing services to specific industries but face challenges due to the advanced regulatory framework.

Regulatory Framework for High-Risk PSPs

The RBI has orthodox, comprehensive guidelines and regulations to govern the operations of PSPs. These regulations focus on risk management, cybersecurity, anti-money laundering (AML), and Know Your Customer[5] (KYC) norms to ensure a secure financial environment.

Conclusion

Navigating the realm of PSP cyber products in India demands a delicate balance between innovation and security. Adherence to regulatory guidelines, the implementation of robust security measures, and risk strategies are required for sustainable operations and consumer trust.

FAQs

- Are all PSPs in India considered high-risk?

- What measures can consumers take to protect their data while using high-risk PSPs?

- How do regulatory changes impact the operations of high-risk PSPs?

- What role does encryption play in securing high-risk cyber products?

- Are there specific trends shaping the future of high-risk PSPs in India?