AUTHOR : NORA

DATE : 27-12-23

Introduction

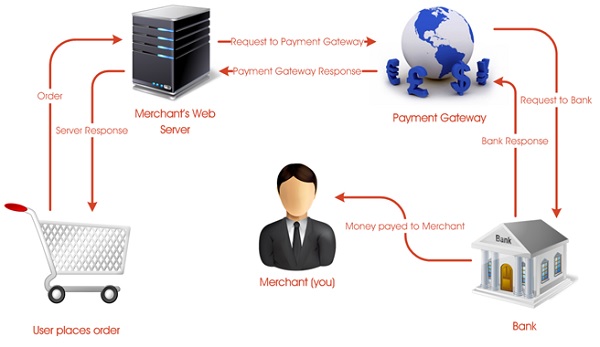

In the ever-evolving landscape of e-commerce the role of payment gateways has become increasingly crucial, especially concerning the sale of electronic goods, or e-goods, in India. These gateways serve as the digital checkpoints that facilitate secure and seamless transactions, ensuring a smooth exchange of goods and services in the online marketplace

Evolution of Payment Gateways in India

Early Challenges

When e-commerce first emerged in India, payment gateways faced numerous challenge Issues such as security concerns, lack of technological infrastructure[1] and limited consumer trust presented obstacles to their widespread adoption. However, with time, these challenges spurred[2] innovation and development.

Technological Advancements

As technology advanced [3] payment gateways in India underwent significant transformations[4]The integration of cutting-edge security measures, user-friendly interfaces[5]and mobile-responsive designs became standard practices, contributing to the growth of the e-commerce sector. Payment Gateway E-Goods In India

Growth of E-Commerce

The exponential growth of e-commerce platforms in India further propelled the importance of payment portal. With an increasing number of consumers turning to online shopping, the demand for secure and efficient payment options skyrocketed

Key Features of Payment Gateways for E-Goods

Security measures, such as encryption and tokenization, ensure the protection of sensitive information during transactions. User-friendly interfaces enhance the overall shopping experience, making it easy for customers to navigate and complete purchases. Seamless integration options allow e-goods platforms to integrate payment gateways E-Goods In India effortlessly, streamlining the transaction process. Additionally, mobile responsiveness ensures accessibility for users on various devices

Popular Payment Gateways in India

Several payment portal dominate the Indian market, each offering distinct features and benefits. From industry giants to emerging players, the competition has led to continuous improvements and innovations in payment processing.

Comparative analysis reveals variations in transaction fees, security protocols, and integration capabilities. Merchants often choose payment portal based on their specific business needs, customer base, and the types of e-goods they offer.

Challenges in Payment Gateway Integration

Despite the advancements in payment gateway technology, integration can pose challenges for businesses. Regulatory issues, technical complexities, and establishing consumer trust are common hurdles faced by e-goods vendors Payment Gateway E-Goods In India

Regulatory compliance is crucial in the dynamic landscape of online transactions. Navigating the intricate web of regulations requires diligence and adherence to industry standards. Technical challenges may arise during the integration process, demanding a collaborative effort between e-goods platforms and payment gateway providers. Building and maintaining consumer trust is an ongoing effort, emphasizing the importance of transparent and secure transactions.

Advantages of Using Payment Gateways for E-Goods

The adoption of payment portal for e-goods transactions brings forth several advantages for both businesses and consumers Payment Gateway for E-Goods in India.Payment Gateway E-Goods In India

Enhanced Security

Payment Gateway E-Goods In IndiaSecurity is paramount in the digital realm, and payment portal play a pivotal role in ensuring the confidentiality and integrity of transactions. Advanced encryption techniques and secure authentication processes safeguard sensitive information, fostering trust among consumers.

Streamlined Transactions

Payment gateways streamline the entire transaction process, reducing friction and enhancing the overall customer experience. With swift and efficient payment processing, e-goods vendors can focus on delivering quality products and services Payment Gateway E-Goods In India

Global Accessibility

Payment gateways enable businesses to reach a global audience by supporting various currencies and payment methods. This global accessibility opens up new markets for e-goods vendors, expanding their customer base beyond geographical boundaries.

Trends in E-Goods Purchases

The landscape of e-goods purchases is continuously evolving, driven by changing consumer preferences and technological advancements.

The rise of digital products, including software, e-books, and online courses, has significantly influenced the e-goods market. Consumers increasingly favor digital over physical goods, emphasizing convenience and accessibility. This shift in preference has a direct impact on the choice of payment portal, with vendors opting for platforms that align with the nature of their e-goods.

Best Practices for Secure Transactions

Ensuring the security of online transactions is a shared responsibility between e-goods vendors and payment gateway providers. Implementing best practices is essential to maintaining the integrity of the payment ecosystem.

SSL Certificates

Secure Sockets Layer (SSL) certificates encrypt data transmitted between the user’s browser and the e-goods platform, adding an extra layer of security. E-goods vendors should prioritize obtaining and regularly updating SSL certificates to protect customer information.

Two-Factor Authentication

Implementing two-factor authentication adds an additional layer of security by requiring users to verify their identity through multiple means. This extra step reduces the risk of unauthorized access and enhances the overall security of transactions.

Regular Security Updates

Staying vigilant against evolving threats is crucial for both e-goods vendors and payment gateway providers. Regular security updates and patches help address vulnerabilities promptly, ensuring a secure environment for online transactions.

Case Studies

Examining real-world examples of successful payment gateway implementation in e-goods

Handling Payment-Related Issues

Anticipating and proactively addressing payment-related issues is essential for e-goods vendors. Clear communication regarding refund processes, transaction statuses, and troubleshooting steps can prevent potential frustrations for customers. Transparency builds trust and reinforces a positive relationship between vendors and buyers.

Conclusion

In conclusion, the symbiotic relationship between payment door and e-goods transactions is reshaping the landscape of digital commerce in India. The evolution of payment portal, coupled with advancements in technology, has paved the way for secure, efficient, and global transactions. As the e-goods market continues to thrive, businesses must prioritize the integration of reliable payment portal, focusing on user experience, security, and adaptability.

FAQs

- What are the security measures in place for payment portal?

- Payment portal implement encryption, tokenization, and two-factor authentication to ensure secure transactions.

- How do payment portal impact the user experience?

- Payment door play a crucial role in providing a seamless and secure transaction process, enhancing user satisfaction.

- Can I use any payment gateway for my e-goods business?

- While there are various options, it’s crucial to choose a payment gateway that aligns with your business needs and offers robust security features.

- What trends are shaping the future of payment portal?

- Emerging trends include the integration of blockchain, artificial intelligence, and biometric authentication for more secure and efficient transactions.

- How can businesses overcome challenges in payment gateway integration?

- Collaboration between e-goods platforms and gateway providers, adherence to regulatory standards, and regular updates help overcome integration challenges.