AUTHOR: RUBBY PATEL

DATE: 27/12/23

Introduction

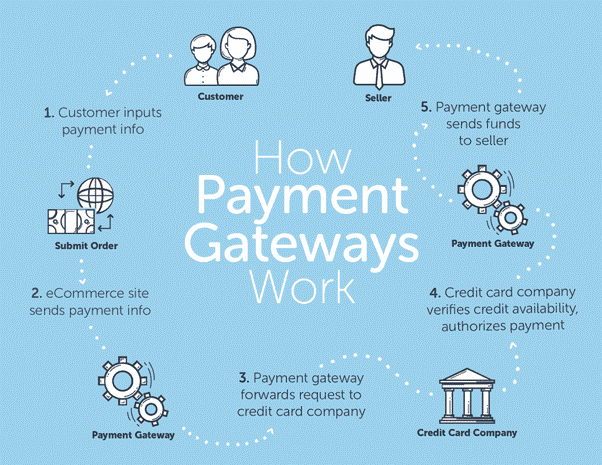

In the fast-paced world of electronic commerce, the backbone of successful transactions is undoubtedly the payment gateway. In the Indian market where the demand for electronic goods is soaring, the role of payment gateways becomes even more crucial. This article delves into the intricate details of payment gateways for electronic goods in India, exploring their evolution, features, challenges, and impact on businesses.

Evolution of Payment Gateways in India

The journey of payment gateways in India has been nothing short of remarkable. From the initial days of limited online transactions to the current era of seamless electronic payments[1], the evolution has been driven by both technological advancements and changing consumer behaviors.

Key Features of Payment Gateways

Security takes the front seat when it comes to payment gateways[2]. Robust security measures, coupled with integration capabilities and user-friendly interfaces, define the success of these digital transaction facilitators.

Popular Payment Gateways in India

In a diverse market like India, several payment gateways compete for dominance. Understanding the market share and user base of these gateways is essential for businesses aiming to provide convenient payment options[3].

Challenges in the Payment Gateway Landscape

While payment gateways have streamlined digital transactions[4], challenges such as regulatory hurdles, security concerns, and transaction failures persist. Overcoming these challenges is vital for sustained growth in the electronic goods market.

Impact on E-Commerce for Electronic Goods

The surge in online shopping for electronic goods is intertwined with the efficiency of payment gateways. Examining growth trends and consumer preferences sheds light on the symbiotic relationship between e-commerce and payment gateways.

Advantages for Merchants

For merchants, the advantages of integrating reliable payment gateways are immense. Faster transactions, an expanded customer base, and reduced fraud contribute to the overall success of businesses.

Innovations in Payment Gateway Technology

The landscape of payment gateways is dynamic, with continuous innovations shaping the future. From mobile wallets to cryptocurrency integration and biometric authentication, the industry is at the forefront of technological advancements.

Comparison of Payment Gateway Providers

Choosing the right payment gateway provider can make or break a business. This section provides a detailed comparison of the pros and cons of leading providers, offering insights into the factors businesses should consider.

Case Studies

Real-world examples of businesses leveraging payment gateways provide valuable lessons. Success stories inspire, while failures offer crucial insights into pitfalls that businesses should avoid.

Future Trends in Payment Gateways

The future of payment gateways holds exciting possibilities. Artificial intelligence in payment processing, enhanced security measures, and seamless cross-border transactions are just a glimpse of what lies ahead.

Consumer Education on Safe Transactions

Educating consumers about safe online transactions[5] is a shared responsibility. This section highlights the importance of secure payment practices and provides tips for safe electronic transactions.

The Role of Payment Gateways in Digital India

In alignment with government initiatives, payment gateways play a pivotal role in advancing the vision of Digital India. Their contribution to financial inclusion through digital payments is a testament to their significance.

Expert Opinions

Insights from industry experts offer a deeper understanding of the evolving landscape. Recommendations for businesses and consumers guide stakeholders in navigating the complex world of payment gateways.

Conclusion

In conclusion, payment gateways for electronic goods in India are not just transaction facilitators; they are enablers of progress. Adapting to evolving payment technologies is not an option but a necessity for businesses looking to thrive in the digital era.

FAQs

- Are all payment gateways equally secure for electronic transactions?

- Security measures vary among payment gateways, and businesses should carefully assess the security features before integration.

- How do payment gateways contribute to the growth of e-commerce?

- Payment gateways facilitate seamless transactions, contributing to the growth of e-commerce by providing convenient payment options.

- What role does government policy play in shaping the payment gateway landscape in India?

- Government policies influence the regulatory environment, impacting the operation and growth of payment gateways in India.

- Is it necessary for small businesses to integrate advanced payment gateway features?

- While not mandatory, integrating advanced features can enhance the efficiency and security of transactions, benefiting small businesses.

- How can consumers ensure the safety of their electronic transactions through payment gateways?

- Consumers can ensure safety by using secure networks, updating their devices, and being cautious about sharing sensitive information online.