AUTHOR : NORA

DATE : 30-12-12

Introduction

A. Definition of Payment Gateways

Payment gateways serve as the digital intermediar[1] facilitating online transactions[1] They ensure secure and seamless financial exchanges between buyers and sellers[2] in the virtual realm.

B .Significance of Payment Gateways in E-commerce

The exponential growth of e-commerce[3] relies heavily on the efficiency and reliability of payment gateways[4] They form the backbone of online transactions, providing a bridge between consumers and businesses.

Evolution of Payment Gateways

A. Early Systems

In the nascent stages, payment gateways were rudimentary, posing challenges[5] in terms of security and speed. Transactions were often cumbersome, limiting the growth of online commerce.

B. Transition to Digital Payments

With the advent of digitalization, payment gateways underwent a transformative phase. The integration of secure protocols and encryption technologies paved[3] the way for more efficient and secure transactions[2]

C. Rise of Virtual Assets

Simultaneously, the rise of virtual assets, such as cryptocurrencies and digital wallets[4] added a new dimension to financial transactions[5] These virtual assets provided users with alternative means of conducting transactions beyond traditional currencies.

Payment Gateway Landscape in India

A. Current Scenario

India’s payment gateway landscape has witnessed significant growth, with a myriad of providers catering to diverse business needs The market is dynamic, reflecting the country’s rapid digitalization Payment Gateway Virtual Assets In India

B. Major Players

Key players in the Indian payment gateway scene include industry giants and innovative startups. Each brings unique features and services, contributing to the diverse options available to businesses Payment Gateway Virtual Assets In India

C. Regulatory Framework

To ensure the security and reliability of payment gateways, India has established a robust regulatory framework. Compliance with these regulations is imperative for businesses operating in the digital payments space.

Virtual Assets in India

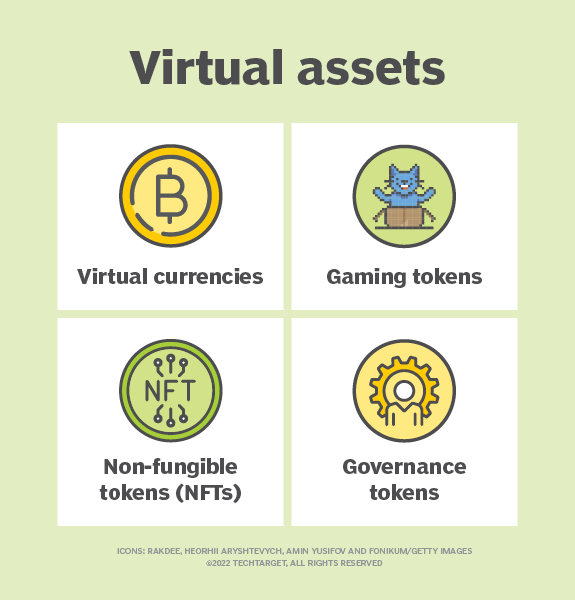

A. Overview of Virtual Assets

Virtual assets encompass a wide range of digital currencies and tokens. The popularity of cryptocurrencies like Bitcoin and Ethereum has paved the way for a decentralized financial ecosystem.

B. Adoption Trends

The adoption of virtual assets in India has seen both challenges and successes. While some remain skeptical, others embrace the benefits of borderless and decentralized transactions.

C. Challenges and Opportunities

The intersection of virtual assets and traditional payment gateways brings forth challenges related to regulatory compliance and security. However, it also opens doors to new opportunities for businesses exploring innovative financial solutions. Intersection of Payment Gateways and Virtual Assets

A. Integration Strategies

Businesses are increasingly exploring strategies to seamlessly integrate virtual assets into their payment gateways. This involves creating user-friendly interfaces and ensuring compatibility with various virtual currencies.

B. Enhancing User Experience

The synergy between payment gateways and virtual assets aims to enhance user experience, making transactions smoother and more accessible. User-friendly interfaces and swift processing times contribute to customer satisfaction.

C. Security Concerns

Addressing security concerns is paramount in the integration of virtual assets. Robust encryption and authentication measures are implemented to safeguard user data and financial transactions.

Challenges in Virtual Asset Transactions

A. Security Risks

While virtual assets offer heightened security, the digital landscape poses risks such as hacking and fraud. Payment gateways must continuously evolve to counter emerging threats.

B. Regulatory Compliance

Navigating the complex regulatory landscape surrounding virtual assets is a challenge. Payment gateways must stay abreast of regulatory changes to ensure compliance.

Future Trends

A. Innovations in Payment Technologies

The future promises exciting innovations in payment technologies, including the use of artificial intelligence and blockchain. These innovations aim to further streamline and secure financial transactions.

B. Emerging Virtual Asset Trends

Virtual assets are likely to witness continued evolution, with new cryptocurrencies and blockchain applications emerging. Businesses need to stay informed to harness these emerging trends.

C. Regulatory Developments

Regulatory frameworks governing virtual assets are expected to evolve. Businesses must adapt to these changes, ensuring continued compliance with the legal landscape.

Case Studies

A. Successful Integration Stories

Examining successful case studies of businesses integrating virtual assets with payment gateways provides valuable insights. Learning from these experiences can guide others in their adoption journey.

B. Lessons Learned

Analyzing challenges faced by early adopters offers valuable lessons for businesses looking to integrate virtual assets. Learning from the experiences of others can mitigate potential pitfalls.

Tips for Businesses

A. Choosing the Right Payment Gateway

Selecting a payment gateway that aligns with the business’s needs and future goals is crucial. Consider factors such as fees, security features, and integration options.

B. Ensuring Security in Virtual Transactions

Prioritize robust security measures when integrating virtual assets. Regular audits and updates to security protocols are essential in safeguarding user data.gal requirements.

Conclusion

In conclusion, the synergy between payment gateways and virtual assets marks a transformative phase in the world of financial transactions, particularly in India. The journey from early payment systems to the current landscape involves overcoming challenges and embracing opportunities.

FAQs (Frequently Asked Questions)

Are virtual assets safe for online transactions?

Yes, virtual assets can be secure when proper encryption and authentication measures are in place. It’s essential for businesses to choose reputable payment gateways and stay vigilant against emerging security threats.

How can businesses navigate regulatory challenges in virtual transactions?

Staying informed about regulatory changes, engaging with industry forums, and seeking legal counsel are crucial steps for businesses to navigate the complex regulatory landscape surrounding virtual assets.

What role do payment gateways play in ensuring the security of virtual transactions?

Payment gateways act as intermediaries, implementing robust security measures to safeguard user data and financial transactions. Their role is critical in enhancing the overall security of virtual transactions.

How can businesses choose the right payment gateway for virtual transactions?

Choosing the right payment gateway involves considering factors such as fees, security features, and integration options. Businesses should align their choice with their specific needs and future goals.

What are the future trends in payment technologies?

The future promises innovations such as artificial intelligence and blockchain in payment technologies. These advancements aim to streamline and secure financial transactions, offering exciting prospects for businesses.