AUTHOR: Ruby PATEL

DATE: 28/12/23

Introduction

In the dynamic landscape of e-commerce and digital services, the choice of a payment processor holds paramount importance especially when it comes to cloud-based products in India. This article delves into the intricacies of selecting the right payment processor, considering the unique challenges and opportunities in the Indian market

Importance of Payment Processors

Payment processors play a pivotal role in the seamless functioning of online transactions. Their significance lies not only in processing payments but also in enhancing the overall user experience. Streamlining transactions ensures that businesses can focus on their core competencies while leaving the complexities of payments to reliable processors.

Key Features of Ideal Payment Processors

For a payment processor to be considered ideal for cloud-based products, it must possess certain key features. Security is paramount, with robust measures in place to safeguard sensitive information. Integration capabilities with various platforms and support for multi-currency transactions are also essential for catering to a diverse user base.

Challenges in Cloud-Based Transactions

While cloud-based transactions [1] offer numerous advantages, they come with their own set of challenges. Security concerns, such as data breaches and unauthorized access, pose a threat. Additionally, transaction delays can hamper the user experience, necessitating the need for efficient payment processors.

Popular Payment Processors in India

India boasts a vibrant market, with several payment processors [2] vying for attention. Three prominent names in the industry are Razorpay, Paytm, and Instamojo. Each has its own unique features and caters to different business sizes and models.

Comparative Analysis

To make an informed decision, businesses [3] need to conduct a comparative analysis of the available payment processors. This includes an assessment of fees and charges, as well as user reviews and satisfaction ratings. A comprehensive understanding of each processor’s strengths and weaknesses is crucial for making the right choice.

Choosing the Right Payment Processor

The right payment processor is one that aligns with the specific needs of a business. Whether it’s the scale of transactions, the type of products, or the target audience, tailoring the choice to match these requirements ensures a seamless payment experience for both businesses and customers [4].

Integration with Cloud-Based Platforms

A crucial aspect often overlooked is the ease of integration with cloud-based platforms. The selected payment processor should offer a seamless connection, supported by well-documented APIs and robust developer support. This ensures that businesses can integrate the payment process without disrupting their existing systems.

Security Measures in Payment Processing

Given the rising cyber threats, security measures in payment processing cannot be overstated. Encryption protocols and two-factor authentication are non-negotiable features that instill confidence in users, making them more likely to engage in transactions without fear of data compromise.

Future Trends in Payment Processing

The landscape of payment processing is evolving, and businesses need to stay ahead of the curve. Future trends, such as the adoption of blockchain technology and the rise of contactless payments, should be considered when choosing a payment processor to ensure long-term compatibility [5].

User Experience and Interface

Beyond the technical aspects, user experience plays a crucial role. A user-friendly design and mobile responsiveness contribute to a positive experience, reducing friction in the payment process and increasing customer satisfaction.

Case Studies

Real-world examples of successful implementations in India highlight the impact a reliable payment processor can have on business growth. Case studies provide insights into how businesses have overcome challenges and achieved success by choosing the right payment processing solution.

Customer Support and Assistance

Prompt and effective customer support is indispensable in the world of payment processing. A 24/7 helpline, along with a comprehensive knowledge base and FAQs, ensures that businesses and users receive assistance whenever needed.

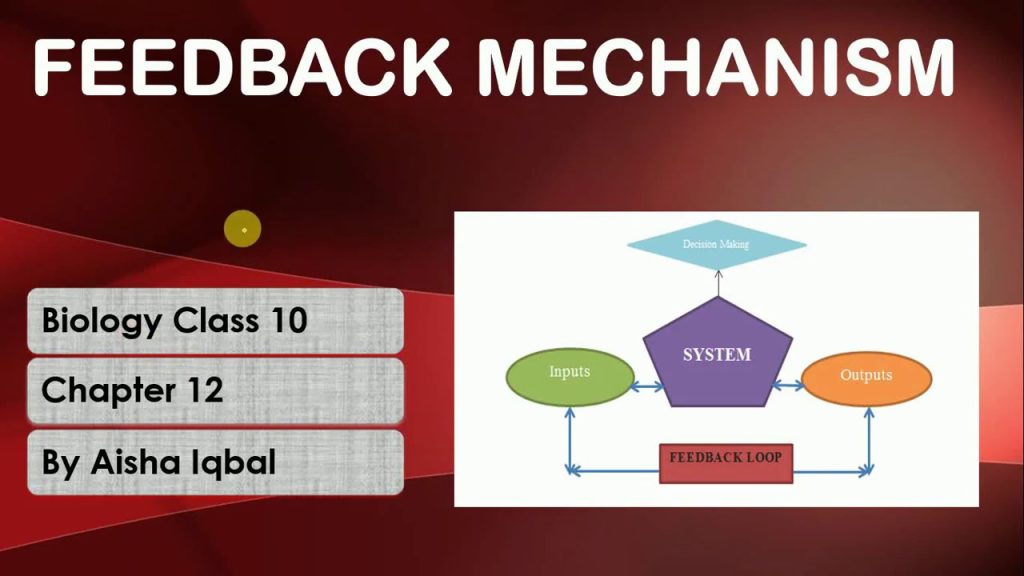

Feedback Mechanism

Continuous improvement is facilitated by a robust feedback mechanism. Businesses should actively seek and analyze customer feedback to identify areas for enhancement. This iterative process ensures that the payment processor evolves with changing needs.

Conclusion

In conclusion, the choice of a payment processor for cloud-based products in India is a critical decision that directly impacts the success of online ventures. By considering the outlined factors, businesses can navigate the complexities and make an informed choice that aligns with their unique requirements.

FAQs

- How do I choose the right payment processor for my business in India?

- Consider your business needs, scalability, and user reviews when making a choice.

- What security measures should I prioritize in a payment processor?

- Look for encryption protocols and two-factor authentication to ensure data security.

- Are there any upcoming trends in payment processing that I should be aware of?

- Blockchain technology and the rise of contactless payments are trends to watch for.

- How important is user experience in payment processing?

- A user-friendly design and mobile responsiveness contribute to a positive experience.

- Why is continuous improvement through customer feedback essential for payment processors?

- It ensures that the payment processor evolves to meet changing needs and expectations.