AUTHOR: KHOKHO

DATE: 27/12/2023

In the rapidly evolving landscape of cyber products in India, the need for a reliable and efficient payment processor is more crucial than ever. With the increasing prevalence of online transactions and digital services, businesses and consumers alike are seeking secure and seamless payment solutions. payment processor for Cyber products in India In this article, we delve into the world of payment processors tailored for cyber products, addressing challenges, exploring options, and guiding you toward making informed choices.

Introduction

In the digital era, where cyber products encompass a broad spectrum of services, the role of a payment processor becomes pivotal. The convenience and security of online transactions are paramount, making the choice of a suitable payment processor a critical decision for businesses operating in the cyber realm.

Current Payment Landscape

The traditional payment methods that have served us well for years are now facing limitations, especially when it comes to the unique demands of cyber products. Credit cards, bank transfers, and cash on delivery fall short of providing the level of security and efficiency required in the digital age.

Need for Specialized Payment Processors

Cyber products often involve intangible services, digital goods, and subscriptions, necessitating payment processors for Cyber products in India tailored to handle these transactions efficiently. A one-size-fits-all approach no longer suffices, leading to the demand for specialized solutions.

Challenges in Online Transactions

Security concerns loom large in the minds of consumers and businesses engaging in online transactions. The fear of data breaches, identity theft, and fraudulent activities poses a significant challenge to the growth of the cyber products industry.

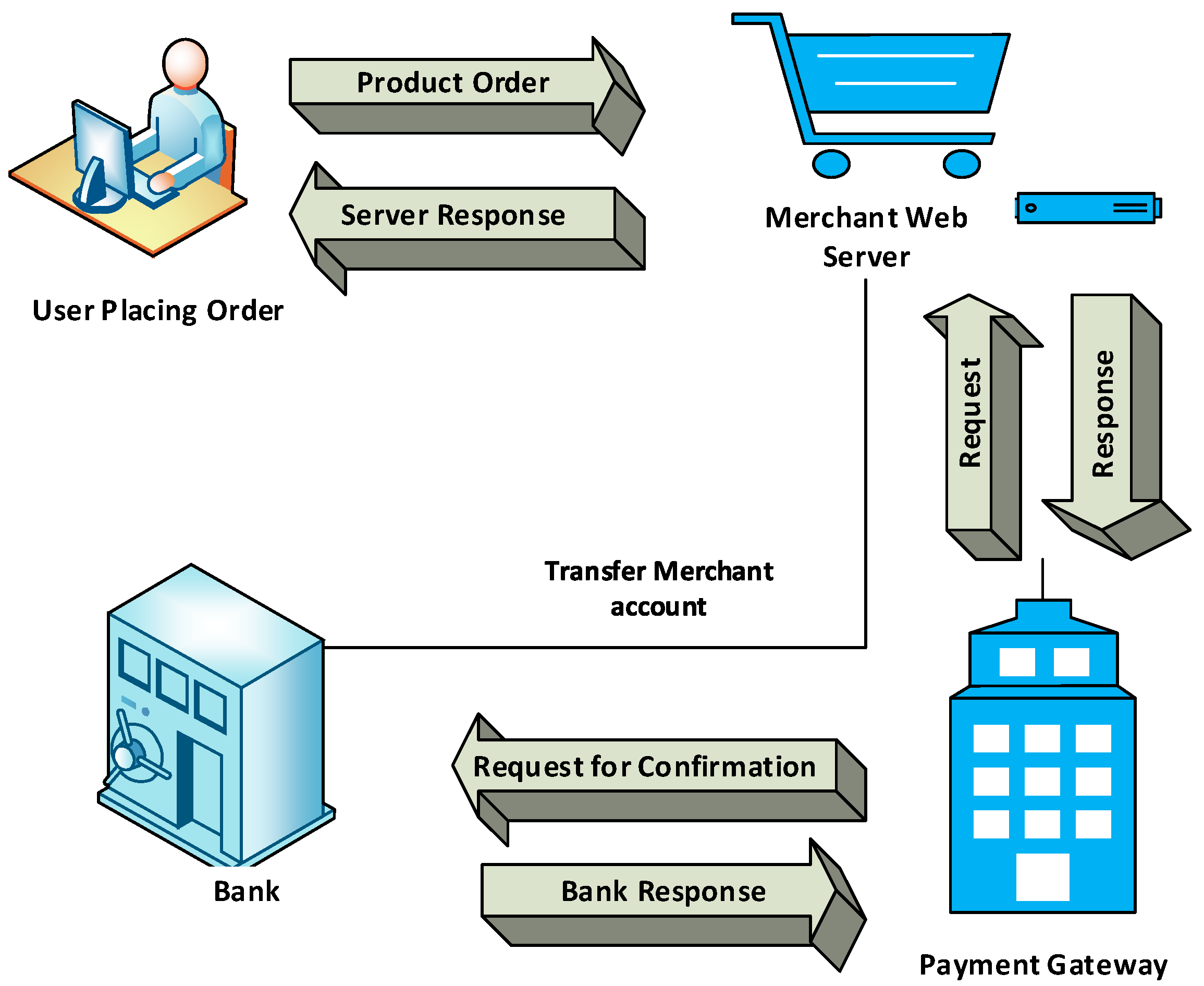

Role of Payment Processors in Cyber Security

Payment processors play a crucial role in fortifying the security of online transactions. Encrypted gateways, two-factor authentication, and robust fraud detection mechanisms are key features that instill confidence in users and businesses alike.

Popular Payment Processors in India

Several payment processors have stepped up to cater specifically to the needs of the cyber product industry. From established players to innovative startups, the market offers a diverse range of options.

Features to Look for in a Payment Processor

When choosing a payment processor for cyber products, certain features become non-negotiable. Seamless integration, robust security measures, and compatibility with various payment methods are essential for a hassle-free experience.

Benefits of Using a Payment Processor for Cyber Products

For businesses, the advantages of employing a specialized payment processor extend beyond security. Streamlined transactions, improved customer trust, and enhanced financial management are among the many benefits.

Integration of Payment Processors with E-commerce Platforms

Effortless integration with popular e-commerce platforms ensures a smooth customer experience. From shopping carts to checkout processes, a well-integrated payment processor enhances the overall efficiency of an online business.

Regulatory Compliance

Navigating the legal landscape is crucial when dealing with online transactions. Payment processors [1] must comply with local regulations to ensure a secure and legally sound financial environment for both businesses and consumers.

Choosing the Right Payment Processor

Selecting the right payment processor involves considering factors such as transaction fees, customer support [2], and scalability. A well-informed decision at this stage can significantly impact the success of your cyber product venture.

Case Studies

Examining real-world examples of businesses successfully utilizing payment processors provides valuable insights. These case studies showcase the practical applications and benefits of choosing the right payment [3] processing solution.

Customer Feedback

The voice of the customer is a powerful testament to the effectiveness of a payment processor [4]. Positive testimonials and feedback from users contribute to building trust and credibility for the chosen payment processing solution.

Future Trends in Payment Processing for Cyber Products

As technology continues to advance, the future of payment [5] processing holds exciting possibilities. From blockchain-based solutions to enhanced AI-driven security measures, staying abreast of these trends ensures businesses remain competitive in the ever-evolving digital landscape.

Conclusion

In the dynamic world of cyber products, a reliable payment processor is the linchpin that ensures smooth and secure transactions. By understanding the challenges, exploring available options, and staying attuned to emerging trends, businesses can make informed choices that foster growth and customer satisfaction.

FAQs

- Q: Are traditional payment methods still viable for cyber products?

- A: While traditional methods are used, specialized payment processors offer more tailored solutions.

- Q: How do payment processors enhance security for online transactions?

- Encryption, two-factor authentication, and fraud detection are key features ensuring secure transactions.

- Q: Can payment processors be integrated with any e-commerce platform?

- A: Most payment processors are designed for seamless integration with popular e-commerce platforms.

- Q: What role does regulatory compliance play in choosing a payment processor?

- A: Compliance ensures a secure and legally sound financial environment for businesses and consumers.

- Q: What are the future trends in payment processing for cyber products?

- Emerging trends include blockchain solutions, AI-driven security measures, and enhanced user experiences