AUTHOR: KHOKHO

DATE: 27/12/2023

Introduction

In the fast-paced world of e-commerce, a reliable payment processor[1] is the backbone of successful electronic transactions. In India, where the digital revolution is transforming consumer habits, selecting the right payment processor for electronic goods is crucial for businesses. Let’s delve into the landscape of payment processors, focusing on their significance, popular choices, key features, and the future of electronic goods payments.

Definition of a payment processor

In simple terms, a payment processor is a service that facilitates electronic transactions between buyers and sellers. It acts as an intermediary, ensuring a secure flow of funds. Payment Processor for Electronic Goods in India

Importance of payment processors for electronic goods in India

With the surge in online purchases, the role of payment processors is pivotal. They enable businesses to accept payments seamlessly, providing a positive experience for customers buying electronic goods[2].

Popular Payment Processors in India

Paytm

One of the frontrunners in the Indian digital payment[3] scene, Paytm offers a comprehensive platform for businesses to receive payments. From mobile recharges to electronic goods, Paytm’s versatility makes it a popular choice. Payment Processor for Electronic Goods in India

Razorpay

Razorpay stands out for its user-friendly interface and a range of features catering specifically to electronic transactions[4]. It has gained traction among businesses seeking a reliable and efficient payment processor.

Instamojo

Instamojo, a champion for small businesses, provides a hassle-free payment processing solution. Its emphasis on empowering entrepreneurs has made it a go-to option for electronic goods sellers.

Factors to Consider When Choosing a Payment Processor

Transaction fees

While many payment processors offer competitive rates, it’s crucial to consider transaction fees, especially for businesses with high sales volumes. Payment Processor for Electronic Goods in India

Security features

Security is paramount in electronic transactions. Look for processors with robust encryption and fraud prevention measures to safeguard customer information.

Integration options

The ease of integration with your e-commerce platform[5] or website is a key factor. Choose a payment processor that seamlessly integrates with your business setup.

Paytm: A Comprehensive Overview

Company Background

Founded in 2010, Paytm has evolved into a multifaceted platform, offering services beyond payments, including e-commerce and financial products.

Services offered

Paytm provides a range of services, from mobile recharges and bill payments to online shopping and booking tickets. Its diverse offerings make it a one-stop solution for consumers.

User experience

With a user-friendly app and website interface, Paytm ensures a smooth experience for both buyers and sellers. Quick transactions and a secure payment environment contribute to its popularity.

Razorpay Streamlines Electronic Payments

Overview of Razorpay

Established in 2014, Razorpay focuses on simplifying online payments. Its emphasis on ease of use and a robust set of features make it a preferred choice for businesses dealing in electronic goods.

Features and Benefits

Razorpay offers features like easy integration, international payments, and subscription billing. These features cater specifically to the needs of businesses in the electronic goods sector.

Client testimonials

Positive feedback from businesses using Razorpay highlights its effectiveness in streamlining payment processes and enhancing the overall customer experience.

Instamojo: Empowering Small Businesses

Introduction to Instamojo

Founded in 2012, Instamojo is dedicated to empowering small businesses and individual sellers. It provides a platform for easy payment collection and business management.

Unique selling points

Instamojo stands out with its user-friendly interface, quick setup, and tools designed for small businesses. It allows sellers to create an online store and accept payments without a website.

Success stories

Numerous success stories showcase how Instamojo has helped small businesses grow by simplifying their payment processes and reaching a wider audience.

Trends in Electronic Goods Payments

The rise of digital transactions

The increasing preference for digital transactions over traditional methods is a significant trend. Electronic goods buyers are more inclined towards quick and secure online payments.

Mobile wallet usage

Mobile wallets, like those provided by payment processors, are gaining popularity. Consumers appreciate the convenience of storing funds digitally for their electronic purchases.

Future advancements

The future holds exciting possibilities, with advancements such as blockchain technology and contactless payments expected to further revolutionize electronic goods payments.

Security Measures in Electronic Payments

Encryption technologies

Payment processors employ advanced encryption technologies to secure transactions and protect sensitive information. Understanding these measures is essential for businesses and consumers alike.

Regulatory issues

The electronic goods payment industry in India faces regulatory challenges that impact the operations of payment processors. Keeping abreast of regulatory changes is crucial for businesses to ensure compliance and avoid disruptions.

Consumer trust concerns

Building and maintaining consumer trust is vital in the electronic goods payment sector Businesses need to transparently communicate security measures and data protection policies to alleviate customer concerns.

Technological challenges

As technology evolves, payment processors and businesses encounter new technological challenges. Staying ahead of these challenges is essential for providing a seamless and reliable payment experience for electronic goods buyers.

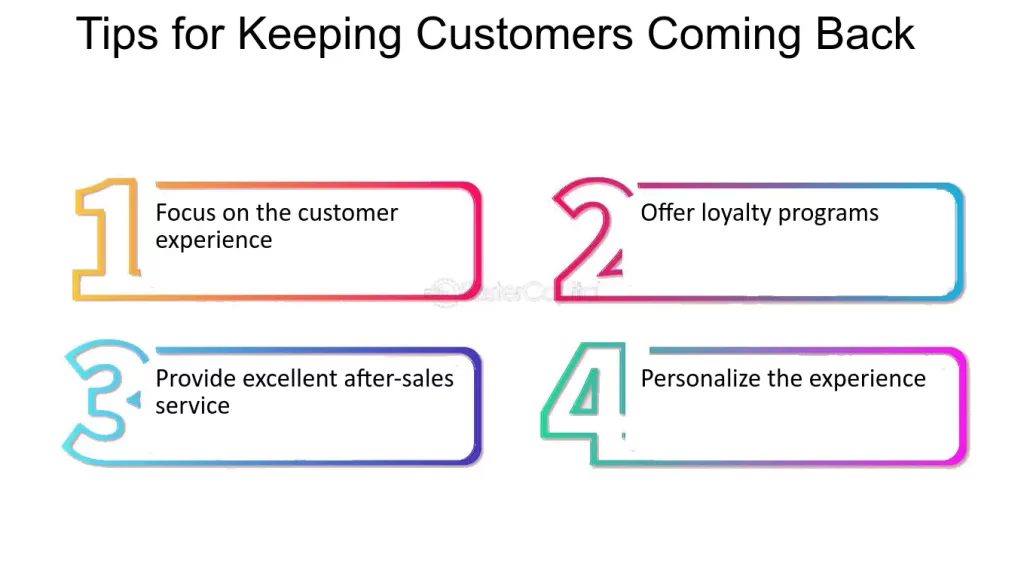

Tips for Successful Electronic Goods Transactions

Clear product descriptions

Providing clear and detailed product descriptions is essential to helping buyers make informed decisions. Clearly outlining specifications, features, and usage instructions enhances the customer’s understanding and satisfaction.

Streamlined checkout process

A streamlined checkout process is crucial for reducing cart abandonment. Minimize the number of steps required to complete a purchase and ensure a user-friendly interface to enhance the overall buying experience

Conclusion

Recap of key points

In conclusion, selecting the right payment processor is paramount for businesses dealing with electronic goods. Paytm, Razorpay, and Instamojo are prominent choices, each offering unique features catering to different business needs.

Importance of choosing the right payment processor

The importance of choosing a payment processor that aligns with your business requirements cannot be overstated. It not only impacts the efficiency of transactions but also influences customer trust and satisfaction.

FAQs

1: How secure are electronic payments in India?

Electronic payments in India are secure, with payment processors employing advanced encryption and fraud prevention measures to safeguard transactions and customer information.

2: What sets Paytm apart from other payment processors?

Paytm stands out for its versatility, offering a wide range of services beyond payments. Its user-friendly interface and extensive user base make it a popular choice.

3: Are there any hidden fees with Razorpay?

Razorpay is transparent about its fee structure. Businesses should review the pricing details to ensure they understand any associated fees and choose a plan that suits their needs.

4 How can small businesses benefit from Instamojo?

Instamojo is designed to empower small businesses by providing a user-friendly platform for payment collection and business management. It allows sellers to create an online presence without the need for a website.

5: What advancements can we expect in electronic payments?

The future of electronic payments holds exciting advancements, including the integration of blockchain technology, contactless payments, and further enhancements in security measures.