AUTHOR : AMILY PATHAK

DATE : 13/12/2023

The world of commerce has undergone a revolutionary transformation, with digital goods becoming an integral part of everyday transactions. In India, the landscape is evolving rapidly, marked by a surge in the demand for digital products and services. As the digital goods[1]market expands, the role of payment providers becomes increasingly crucial.

Evolution of Payment Providers

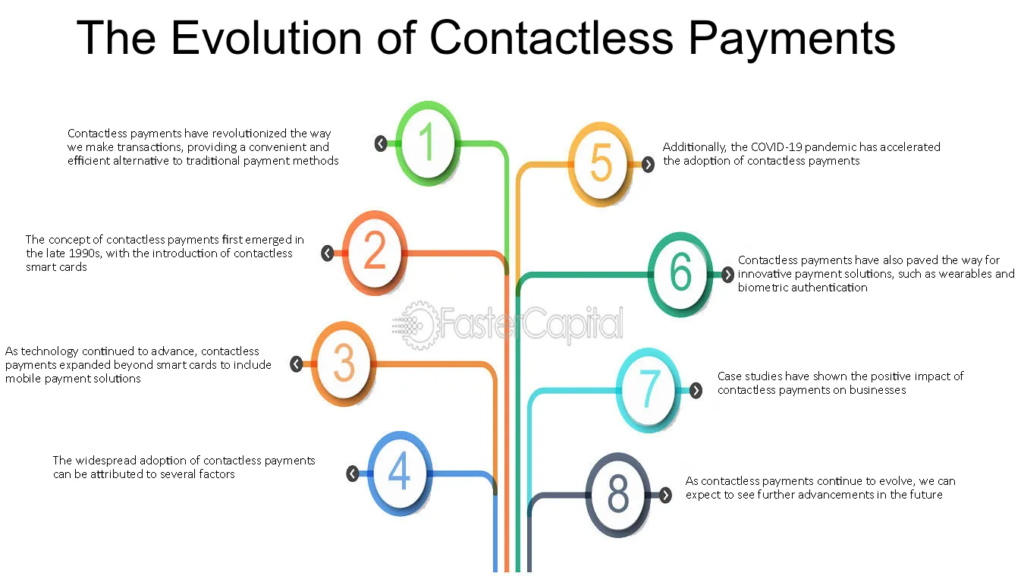

In the not-so-distant past, traditional methods of payment dominated the scene. However, with the advent of technology, payment providers[2] have adapted and evolved, offering innovative solutions that cater to the demands of the digital age.

The Rise of Digital Goods in India

India has witnessed a significant shift in consumer behavior, with a growing preference for digital goods. E-commerce platforms[3] and online services have played a pivotal role in driving this change, creating a need for robust payment solutions.

Challenges Faced by Consumers

Despite the convenience offered by digital goods, consumers face challenges such as security concerns, accessibility issues, and suboptimal user experiences. Reliable payment providers address these issues, instilling trust and ensuring seamless transactions[4].

Importance of Reliable

Building trust is paramount in the digital realm. Payment providers act as intermediaries, ensuring the security of transactions and enhancing the overall consumer experience. Their role extends beyond facilitating payments to establishing a sense of security among users.

Key Features

Successful payment providers in the Indian market offer features such as seamless integration[5] with popular digital platforms, robust security measures, and customized solutions tailored to the diverse landscape of digital goods.

Popular Payment Providers in India

A competitive market has given rise to several key players in the payment industry. A comparative analysis of their services helps businesses choose the right partner for their digital transactions.

Case Studies

Examining success stories of businesses that have effectively leveraged digital goods and payment providers provides valuable insights. These case studies highlight best practices and lessons learned.

Future Trends in Payment Provider Digital Goods in India

Anticipating future trends is essential for businesses to stay ahead. Emerging technologies and shifts in consumer behavior are expected to shape the future of digital payments for goods.

Strategies for Businesses

Optimizing digital goods for the Indian market requires strategic planning. Collaborating with reliable payment providers is a key strategy for businesses to succeed in this dynamic environment.

User Experience and Interface

The importance of a user-friendly interface cannot be overstated. Streamlining the purchasing process enhances the overall user experience and encourages continued use of digital goods.

Security Measures in Payment Provider Digital Goods in India

Ensuring the security of payment processing is a top priority. Encryption, data protection, and compliance with regulatory standards are crucial elements in safeguarding user information.

Impact of Government Regulations

Government regulations play a significant role in shaping the digital goods landscape. An overview of existing regulations and potential changes provides businesses with insights into compliance requirements.

Customer Support and Conflict Resolution

Responsive customer support is essential for resolving payment-related issues promptly. Businesses that prioritize customer satisfaction contribute to building a positive reputation in the market.

Personalization and Customization

User experience is a cornerstone of success in the digital goods market. Payment providers offering personalized and customized solutions enhance the overall experience for consumers, making them more likely to return for future transactions.

Streamlining the Purchasing Process

A convoluted purchasing process can deter potential customers. Streamlining the user journey, from product selection to payment confirmation, ensures a frictionless experience and contributes to higher conversion rates.

Conclusion

In conclusion, the symbiotic relationship between payment providers and digital goods is reshaping the way transactions occur in India. As the market continues to evolve, businesses must adapt to emerging trends and embrace innovative strategies for success.

Frequently Asked Questions (FAQs)

- Q: How do payment providers enhance security for digital transactions?

- A: Payment providers employ advanced encryption and data protection measures to ensure the security of digital transactions.

- Q: What are the key features businesses should look for in payment providers?

- A: Businesses should prioritize integration with digital platforms, robust security measures, and customized solutions tailored to the digital goods landscape.

- Q: How can businesses optimize digital goods for the Indian market?

- A: Optimizing digital goods involves understanding local preferences and collaborating with reliable payment providers.

- Q: What role do government regulations play in the digital goods industry?

- A: Government regulations impact compliance requirements for businesses operating in the digital goods sector.

- Q: How important is customer support in the digital goods and payment provider relationship?