AUTHOR : NORA

DATE : 13-12-23

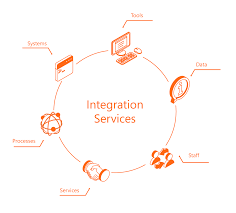

In the vibrant landscape of India’s digital economy[1], payment integration services have become integral for businesses seeking to thrive in the online marketplace. As the demand for and rises, the role of India becomes paramount

The Landscape of Payment Providers

Why does integration matter?

services play a pivotal role in the dynamic landscape of India’s digital economy; by seamlessly linking various financial components, they not only streamline online transactions[2] but also significantly contribute to making it easier for businesses to manage payments efficiently, providing a hassle-free experience for customers in the ever-evolving world of e-commerce

Types of Payment Integration Services

In navigating the landscape of payment integration services[3], businesses encounter a myriad of options, encompassing API-based solutions, hosted payment gateways, and more, requiring a discerning evaluation to select the optimal solution for their specific operational needs. Selecting the right service tailored to specific business needs is crucial for a successful integration.

Advantages of Payment Integration

Efficiency gains and error reductions are among the primary benefits of payment integration. Businesses witness improved operational workflows and heightened security in online transactions, fostering trust among customers.

Challenges in Payment Integration

While the benefits are substantial, businesses often face challenges during the process of integration. Common issues include technical complexities, compatibility concerns, and regulatory compliance. However, proactive solutions can help overcome these obstacles.

Trends in Payment Integration Services

The payment integration landscape is dynamic, with ongoing technological advancements influencing the industry. Contactless payments, artificial intelligence, and blockchain are among the trends shaping the future of payment services in India.

Selecting the Right Payment Provider

Choosing the right payment provider is a critical decision for businesses. Factors such as transaction fees, user interface, and customer support play a pivotal role. Real-world case studies can provide insights into successful integration stories.

Case Studies

Examining case studies from various industries sheds light on the practical aspects of payment integration. Successful businesses share their experiences, providing valuable lessons for others considering similar steps.

Future Outlook

The future of payment integration services in India

holds promise. Anticipated advancements include increased personalization, enhanced security measures, and a broader range of supported payment methods.

How to Implement Payment Integration

For businesses contemplating payment integration, a step-by-step guide is essential. Avoiding common mistakes and understanding the intricacies of the implementation process are crucial for a smooth transition.

Cost Analysis

Understanding the financial implications of payment integration[4] is imperative for businesses of all sizes. A comprehensive cost analysis helps in budgeting and assessing the potential return on investment.

User Experience and Payment Integration

A seamless user experience is a key factor in customer satisfaction. Businesses must prioritize user-friendly interfaces and efficient payment processes[4] to enhance the overall experience for their clientele.

Security Measures

Ensuring the security of financial information is non-negotiable. Compliance with industry standards and regulations, along with robust security measures, is vital to instilling confidence in customers.

Conclusion

In conclusion, payment integration services in India are pivotal for businesses aiming to stay competitive in the digital landscape. Embracing these services not only streamlines operations but also enhances customer trust and satisfaction.

FAQs

- Q: Are payment integration services only for large businesses?

- A: No, payment integration services cater to businesses of all sizes, offering scalable solutions.

- Q: How long does it take to implement payment integration?

- The timeline varies based on the complexity of the integration, but with proper planning, it can be a relatively swift process.

- Q: What security measures should businesses prioritize during payment integration?

- A: Businesses should focus on encryption, secure APIs, and compliance with industry regulations to ensure the security of financial information.

- Q: Can payment integration services be customized for specific business needs?

- A: Yes, many payment providers offer customizable solutions to meet the unique requirements of different businesses.

- Q: Are there any hidden costs associated with payment integration?

- A: It’s crucial for businesses to conduct a thorough cost analysis to identify any potential hidden fees associated with payment integration.