AUTHOR : JAYOKI

DATE : 28/12/2023

Intr/oduction

The Indian business ecosystem has witnessed a paradigm shift with the advent of online payment solutions. In a world that is increasingly reliant on digital interactions, businesses are recognizing the need for reliable payment providers that offer secure, user-friendly, and integrated solutions.

Evolution of Payment Providers

Historically, India has seen various payment systems evolve, from traditional cash transactions to the widespread use of credit and debit cards. However, the real game-changer has been the transition to online payment software, marking a revolutionary step towards a cashless economy.

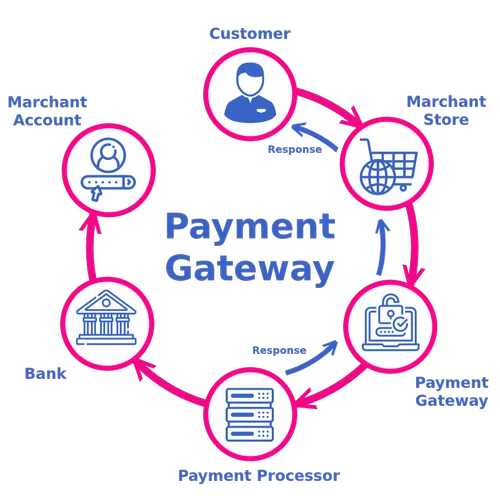

Key Features of Payment Providers

Online payment providers distinguish themselves through robust security measures, user-friendly interfaces, and the ability to seamlessly integrate with a variety of platforms. These features ensure a smooth and trustworthy payment experience for both businesses and consumers.

Popular Online Payment Software in India

Several payment providers have gained prominence in the Indian market. payment provider Online software in india A comparative analysis of their features helps businesses make informed decisions based on their specific needs payment provider online software[1]** in India.

Advantages for Businesses

Implementing online payment solutions offers a myriad of advantages for businesses. From streamlined transactions to enhanced customer trust, the positive impact on the efficiency of financial operations is undeniable.

Challenges and Solutions

While the benefits are evident, challenges such as security concerns persist. This section explores strategies for overcoming these challenges and maintaining the integrity of online payment systems[2].

How to Choose the Right Payment Provider

Selecting the right payment provider is crucial for businesses. Factors such as security, reliability, and integration capabilities need to be considered. providing a unique and valuable perspective on the practical applications and positive outcomes of various business strategies.India’s digital transformation has created a thriving market for software-as-a-service (SaaS) and other online software solutions[3]. To support seamless transactions, payment providers offer tailored solutions for businesses selling software online. Here’s a brief guide to the top payment providers and their features.

Importance of Online Software in Business Growth

Adopting online payment software[4] goes beyond transactional convenience. It positively impacts revenue and customer satisfaction, aligning businesses with changing consumer behaviors.

Future Trends in Payment Solutions

The landscape of payment solutions is ever-evolving. Emerging technologies, such as blockchain and artificial intelligence, are reshaping the future of online payment providers. This section explores predictions and innovations on the horizon.

Case Studies

Real-world examples demonstrate how businesses [5] across various industries have reaped the benefits of implementing online payment solutions, showcasing the versatility and adaptability of these platforms.

User Testimonials

Direct feedback businesses using online payment providers adds a personal touch to the article. Testimonials highlight the practical implications and success stories of integrating these solutions.

Integrating Payment Solutions in Different Industries

Tailoring payment software to specific industries is essential. Success stories from sectors like e-commerce, healthcare, and hospitality illustrate the diverse applications of online payment solutions.

Cost-Benefit Analysis

Evaluating the return on investment in online payment solutions is crucial for businesses. This section breaks down the costs and benefits, helping businesses make informed decisions.

Regulatory Compliance

Adhering to financial regulations is paramount for online payment providers. This section explores how these entities ensure compliance, contributing to the overall trustworthiness of the industry.

E-commerce Adaptation

For e-commerce, the focus is on ensuring a frictionless checkout process with multiple payment options catering to diverse customer preferences. The adaptability of online payment providers allows e-commerce businesses to stay ahead in a competitive market.

Conclusion

In conclusion, the article provides a comprehensive overview of payment providers and their role in shaping the future of business transactions in India. From the evolution of payment systems to the advantages, challenges, and future trends, businesses are encouraged to embrace the opportunities offered by reliable online payment software.

FAQs

- What makes online payment providers in India unique?

- Online payment providers in India offer a blend of security, user-friendliness, and integration capabilities, setting them apart in the global market.

- How do businesses benefit from adopting online payment solutions?

- Businesses experience streamlined transactions, enhanced customer trust, and increased efficiency in financial operations, leading to overall growth.

- What challenges do businesses face in implementing online payment software?

- Security concerns are a primary challenge, but the article provides strategies for overcoming these challenges and ensuring the integrity of payment systems.

- What are the future trends in online payment solutions?

- Emerging technologies like blockchain and artificial intelligence are shaping the future of payment providers, with predictions pointing toward increased innovation.

- How can businesses ensure regulatory compliance when using online payment providers?

- The article discusses the importance of adhering to financial regulations and how payment providers ensure compliance, ensuring trustworthiness in the industry.