AUTHOR : SOFI PARK

DATE : 28/12/2023

Introduction

In the dynamic landscape of digital transactions, Payment Provider Web-Based Products have emerged as a basis for businesses in India. These solutions offer a seamless and secure way for individuals and projects to handle financial transactions over the internet. In this article, we’ll delve into the evolution, key features, impact, challenges, and future trends of web-based payment products in the Indian market.

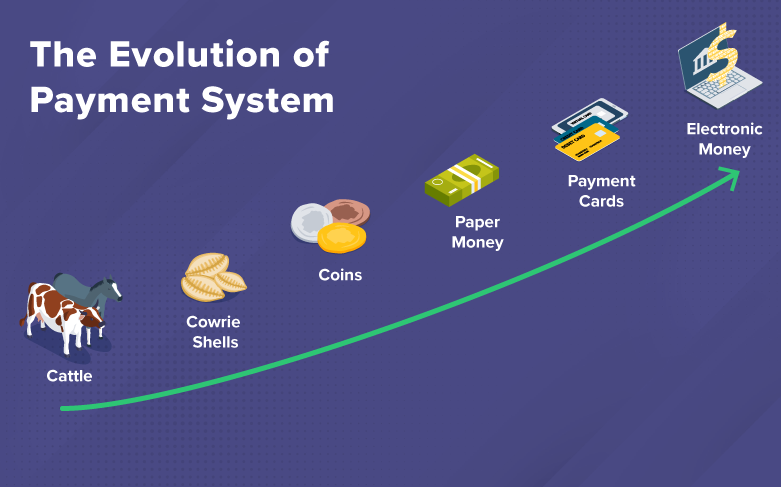

Evolution of Payment Provider Products

In the nascent stages, payment solutions were limited to traditional methods. However, with the advent of technology, web-based platforms gained prominence. The shift towards web-based platforms brought about a revolution in how payments were processed, making transactions more efficient and accessible. Today, India boasts a vibrant ecosystem of payment providers[1] offering a wide array of services, catering to diverse consumer needs.

Key Features of Web-Based Payment Products

One of the defining features is the user-friendly interface, ensuring a smooth experience for both consumers and businesses. Robust security measures, including encryption and multi-factor authentication, play a pivotal role in instilling trust among users. Web-based payment products[2] seamlessly integrate with various business platforms, enhancing overall operational efficiency.

Popular Payment Providers in India

Major players like XYZ Payments, ABC Wallet, and PQR Transactions dominate the market, each offering unique services. Understanding the distinctive features of leading payment providers helps businesses make informed choices aligning with their requirements.

Impact on Indian Businesses

The rise of web-based payment products has significantly influenced the growth of the e-commerce sector, providing a secure and efficient payment gateway for online transactions. SMEs benefit from the accessibility and cost-effectiveness of these solutions, facilitating smoother financial operations. From the consumer’s standpoint, the convenience of making transactions online has reshaped the way individuals engage with businesses.

Regulatory Landscape

The regulatory environment plays a crucial role in shaping the operations of payment providers. Understanding and complying with regulations is imperative for sustained success. Navigating through compliance challenges is an ongoing process, and payment providers must stay vigilant to adhere to the evolving regulatory landscape. The government’s stance on digital payments[3] and its future initiatives indicate a positive trajectory for the industry.

Advantages of Web-Based Payment Products

The convenience offered by these products, allowing users to make transactions from the comfort of their homes, is a key driver of their popularity. Web-based payment solutions facilitate quick and efficient transactions, reducing the time involved in financial processes. For businesses, the cost-effectiveness of these solutions compared to traditional methods contributes to enhanced profitability.

Challenges and Solutions

Addressing security concerns is paramount. Continuous investment in cybersecurity measures and educating users can mitigate potential risks. While technical issues are unavoidable, effective precautions and prompt customer support can significantly reduce their effect on the user experience. Efficient customer support is pivotal in resolving issues promptly and maintaining a positive relationship with users.

Future Trends

Emerging technologies like artificial intelligence and blockchain are poised to transform the payment industry, opening the door to unprecedented opportunities.

Emerging Business Models: Innovative business models, such as subscription-based payment services[4], are likely to gain traction, offering flexibility to consumers.

International Collaboration: Collaboration between Indian payment providers [5] and international counterparts is anticipated to foster global financial integration.

Tips for Choosing a Payment Provider

Assessing Business Needs: Businesses must evaluate their specific requirements and choose a payment provider that aligns with their operational goals.

Considering Scalability: Scalability is crucial for businesses to accommodate growth. Choosing a provider capable of scaling with the business is essential.

User Experience Stories

Positive Experiences: Real-life positive experiences shared by users highlight the effectiveness and reliability of web-based payment products. Challenges Faced and Overcome: Exploring challenges faced by users and how they were successfully overcome adds a human touch to the narrative.

Expert Opinions

Insights from Industry Leaders: Industry leaders’ perspectives provide valuable insights into the current state of the industry and future trends. Vision for the Future: Understanding the vision of industry experts helps businesses align their strategies with the evolving landscape.

Conclusion

payment provider web-based products have reshaped the financial landscape in India, offering convenience, security, and efficiency. The future looks promising, with technological advancements and collaborative efforts poised to drive further innovation.

FAQs

- Are web-based payment products secure?

- Yes, web-based payment products incorporate robust security measures to ensure the safety of transactions.

- How do these products benefit small businesses?

- Small businesses benefit from the accessibility and cost-effectiveness of web-based payment solutions, streamlining financial processes.

- What role do government regulations play in the industry?

- Government regulations shape the operational landscape, and compliance is crucial for sustained success.

- Can web-based payment products handle international transactions?

- Many web-based payment providers offer international transaction capabilities, fostering global financial integration.

- How can businesses choose the right payment provider?

- Assessing business needs, considering scalability, and evaluating customer support are key factors in choosing the right payment provider.