Author : Winnie Rogers

Introduction

The jewelry industry[1] has always been a dynamic and ever-evolving sector. As more and more jewelry businesses take their operations online, adopting seamless and secure payment methods becomes crucial. One of the most reliable and widely used payment methods is direct bank transfer payment processors for jewelry. This payment method not only offers security but also ensures fast transactions and reduced processing fees. In this guide, we will explore the concept of direct bank transfer payment processors for jewelry, their benefits, how they work, and the factors jewelry businesses should consider when choosing the right processor.

What Are Direct Bank Transfer Payment Processors for Jewelry?

Direct bank transfer[2] payment processors are platforms that facilitate online payments by transferring funds directly between the buyer’s and the seller’s bank accounts. Unlike traditional payment methods like credit card processors or third-party payment gateways (e.g., PayPal), direct bank transfer payment processors for jewelry allow customers to pay directly from their bank account to the jewelry seller without the need for an intermediary. This type of payment processing is increasingly popular in industries like jewelry because of its low fees, security[3]0, and transparency.

Benefits of Using Direct Bank Transfer Payment Processors for Jewelry

1. Lower Transaction Fees

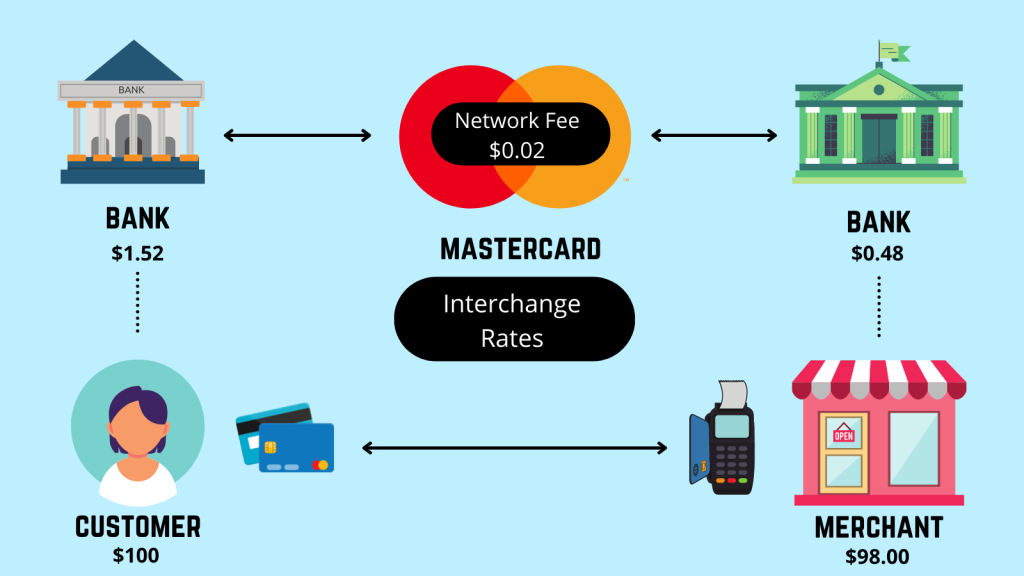

One of the key advantages of direct bank transfer payment processors[4] for jewelry is the significantly lower transaction fees compared to credit card processors or third-party payment gateways. These payment processors generally charge a fixed fee or a small percentage of the transaction, which makes them a cost-effective option for jewelry businesses.

2. Enhanced Security

Bank transfers are one of the most secure methods of payment available. Since the funds are transferred directly from the buyer’s bank to the seller’s account, the risk of chargebacks or fraud is minimized. This level of security is especially important for high-value transactions[5] commonly seen in the jewelry industry.

3. Faster Processing Times

Direct bank transfers typically offer faster transaction times compared to other forms of payment. With advanced technology and payment processing infrastructure, many direct bank transfer services provide instant or near-instant confirmation of payments, ensuring quicker fulfillment of orders.

4. Transparency and Traceability

Another significant benefit is the transparency that comes with direct bank transfers. Both the buyer and the seller have access to detailed transaction records, which makes it easier to track payments and resolve any potential issues. This is especially beneficial for businesses in the jewelry sector, where large amounts of money are involved.

5. International Payments

For jewelry businesses that operate globally, direct bank transfer payment processors provide a viable way to accept international payments. With the ability to accept multiple currencies, jewelry merchants can easily reach a global market, making it easier for customers to pay from any part of the world.

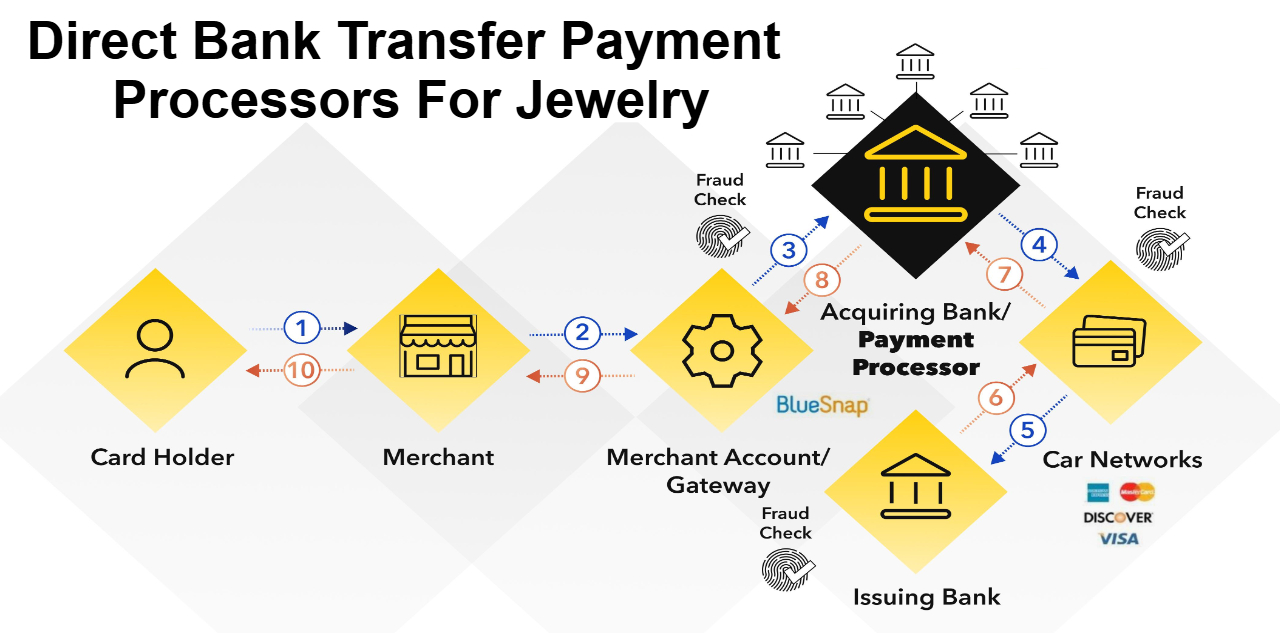

How Direct Bank Transfer Payment Processors Work for Jewelry Businesses

1. Customer Initiates the Payment

The process begins when a customer selects a piece of jewelry and decides to purchase it from an online store. Instead of using a credit card or digital wallet, the customer chooses the “direct bank transfer” option during the checkout process.

2. Customer Transfers Funds

Once the customer selects the bank transfer option, they are provided with the jewelry seller’s bank account details. The customer can then initiate the transfer from their bank, using either online banking or a mobile app, ensuring that the correct amount is sent to the jewelry business.

3. Confirmation of Payment

In many cases, direct bank transfer payment processors offer an automatic system to notify both the buyer and the seller once the payment has been confirmed. Some systems may allow sellers to manually verify the payment by checking their bank account, while others provide instant or near-instant confirmation via email or within the eCommerce platform.

4. Order Fulfillment

Once the payment has been confirmed, the jewelry business proceeds with processing the order, packaging the jewelry, and shipping it to the customer. Since the funds have already been securely transferred, the risk of payment disputes is significantly reduced.

Key Considerations When Choosing Direct Bank Transfer Payment Processors for Jewelry

1. Compatibility with Your Business Model

Not all direct bank transfer payment processors are suitable for every jewelry business. It’s important to choose one that integrates smoothly with your eCommerce platform, whether it’s a large online store or a smaller boutique website. Many direct bank transfer systems are customizable, allowing you to align the payment flow with your specific business needs.

2. Geographic Reach

If your jewelry business has international customers, you must choose a direct bank transfer payment processor for jewelry that can handle cross-border transactions. Some payment processors specialize in international transfers, supporting a wide range of currencies and payment methods.

3. Security Features

While direct bank transfers are generally secure, it’s still important to choose a payment processor that has advanced fraud prevention tools, encryption, and multi-factor authentication (MFA) to ensure a high level of security for both the buyer and the seller.

4. Customer Support

Having reliable customer support is critical in case of issues with payments or transactions. Look for direct bank transfer payment processors for jewelry that offer 24/7 support via chat, email, or phone.

5. Fees and Payment Timeliness

While the fees for direct bank transfers are often lower than other methods, it’s important to review all costs associated with the processor. Ensure you understand any setup fees, transaction charges, or other hidden costs. Additionally, assess the payment timelines to ensure that payments will be transferred in a timely manner to maintain cash flow.

Popular Direct Bank Transfer Payment Processors for Jewelry Businesses

Here are a few notable direct bank transfer payment processors that jewelry businesses can consider:

1. TransferWise (now Wise)

Wise is known for offering low-cost international bank transfers and supports direct bank payments in multiple currencies. It is a popular choice for businesses selling high-value items like jewelry, as it is efficient, secure, and highly regarded for its transparent pricing.

2. Stripe

While Stripe is traditionally known for credit card processing, it also supports ACH (Automated Clearing House) payments and direct bank transfers. This makes it a versatile option for jewelry businesses looking for a well-established payment processor.

3. Payoneer

Payoneer provides direct bank transfers and is widely used for international transactions. It is a great option for jewelry businesses that deal with customers around the world. It supports various currencies and can help streamline global sales.

4. Square

Square offers ACH bank transfers as part of its suite of payment solutions. Its direct bank transfer option can be seamlessly integrated into your eCommerce platform, making it ideal for small to medium-sized jewelry businesses.

Conclusion

Direct bank transfer payment processors for jewelry are a great choice for jewelry businesses looking to reduce transaction costs, increase payment security, and streamline operations. By choosing the right processor, jewelry merchants can enjoy faster transactions, better cash flow, and improved customer satisfaction.

FAQs

1. Is it safe to use direct bank transfers for jewelry purchases?

Yes, direct bank transfers are one of the safest payment methods available. They offer robust security features such as encryption and fraud protection, reducing the risk of payment fraud.

2. How long does it take for payments to be processed?

The processing time for direct bank transfers can vary, but many processors offer instant or near-instant confirmation. However, international payments may take a few days to complete, depending on the bank and country.

3. Can I accept international payments using direct bank transfer?

Yes, many direct bank transfer payment processors for jewelry support international payments. Ensure that the payment processor you choose can handle multiple currencies and international transfers.

4. Are there any fees associated with direct bank transfers?

Yes, while the fees are generally lower than credit card processors, there may still be transaction fees involved. Be sure to review the processor’s fee structure before committing.

5. What are the disadvantages of using direct bank transfer payment processors?

The main disadvantage of using direct bank transfers is that they lack the same level of buyer protection offered by credit card processors or third-party payment gateways.