AUTHOR: NORA

DATE: 24-02-2024

Introduction

High-risk PSP transactions for industries perceived as high-risk, such as online gaming, adult entertainment, or often through telemarketing channels. These industries face greater regulatory scrutiny due to the increased likelihood of chargeback fraud and compliance violations.

Understanding the Regulatory Landscape in India

India operates within a regulatory framework for high-risk telemarketing established by entities like the Reserve Bank of India (RBI) and the Telecom Regulatory Authority of India (TRAI). Compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) and the Telecom Commercial Communications Customer Preference is to avoid penalties and maintain trust

Challenges Faced by High-Risk PSP Telemarketing Companies

Compliance Issues

Ensuring compliance with regulatory requirements can be challenging due to the nature of regulations and the complex nature of industries. Companies must invest in robust High-Risk compliance management systems and stay updated with regulatory changes to risks effectively.

High Chargeback Rates

High-risk industries are prone to theft, primarily due to customer disputes, activities, or products or services. Managing requires proactive measures such as strict refund policies customer support, and technology for fraud

Limited Payment Processing Options

High-risk industries find it difficult to obtain payment processing services as banks and processors steer clear of associated risks, resulting in few options and pushing for the exploration of alternatives like banking or

Strategies for Mitigating Risks

Robust Compliance Measures

Implementing robust compliance measures, including Know Your Customer (KYC) procedures, transaction monitoring, High-Risk PSP Telemarketing and regulatory guidelines, is essential for

Effective Fraud Prevention Techniques

High-risk Telemarketing sectors[1] encounter hurdles in payment processing services as banks and processors avoid the risks involved, resulting in few options and exploration of alternatives like banking or payment

Diversification of Payment Channels

Diversifying payment channels by offering multiple payment options, including a single channel, enhances flexibility for customers and is thereby associated with payment processing.

importance of Customer Verification

Implementing robust customer processes, including identity age, is crucial for transactions, regulatory requirements, and trust with customers.

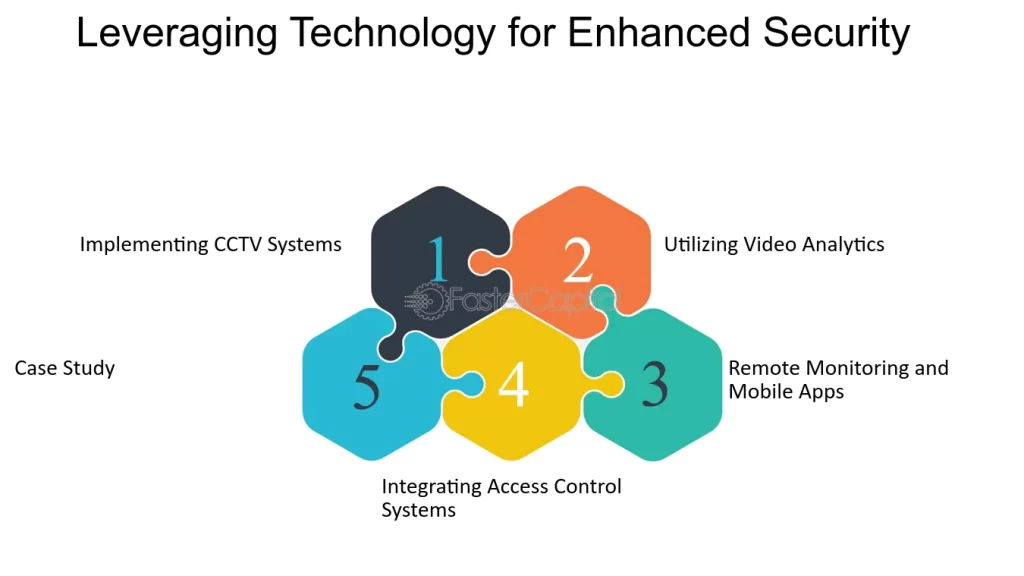

Leveraging Technology for Enhanced Security

AI-Powered Fraud Detection Systems

Deploying AI-powered fraud detection systems that analyze data in real time can identify suspicious patterns and anomalies indicative of fraudulent activity, enabling prompt intervention and reducing risks[2].

Biometric Authentication

Implementing biometric authentication, like fingerprint or facial recognition, PSP Telemarketing[4] enhances transaction security by mitigating the risk unauthorized[3] access or identity theft

Building Trust with Customers

Creating transparent communication, clear terms, and excellent customer service builds trust, fosters relationships, and reduces disputes with customers

Emerging Trends in High-Risk PSP Telemarketing

With technological advancements, high-risk PSP telemarketing sees trends like blockchain for secure transactions, voice biometrics for identity verification, and AI for personalized customer experiences and fraud prevention.

Case Studies: Successful High-Risk PSP Telemarketing Companies

Exploring case studies of successful High-Risk[5] PSP companies can provide valuable insights into best practices, innovative strategies, and lessons learned, encouraging others in the industry to emulate their success.

Future Outlook

Despite challenges, the future of high-risk PSP telemarketing in India looks bright, fueled by advancements in technology, regulatory updates, and increasing consumer demand. Companies adapting proactively to these shifts, prioritizing security and compliance, are poised to succeed in this competitive arena

Conclusion

Despite challenges, the future of high-risk PSP telemarketing in India shines with tech advancements, regulatory updates, and growing demand. By embracing technology, implementing robust risk strategies, and earning customer trust, companies can navigate successfully for sustainable growth.

FAQs:

- Is high-risk PSP telemarketing legal in India?

- Yes, high-risk PSP telemarketing is legal in India, but it is subject to strict regulatory and compliance requirements.

- How can high-risk PSPs mitigate chargeback risks?

- High-risk PSPs can mitigate chargeback risks by implementing strict refund policies, enhancing fraud detection measures, and diversifying payment channels.

- What role does customer verification play in high-risk PSP telemarketing?

- Customer verification is essential in high-risk PSPs to prevent fraudulent transactions, comply with regulations, and build trust with customers.

- What are some emerging trends in high-risk PSP telemarketing?

- Emerging trends in high-risk PSP telemarketing include the adoption of blockchain technology, voice biometrics for identity verification, and AI-powered fraud detection systems.

- How can high-risk PSPs build trust with customers?

- High-risk PSPs can build trust with customers by providing transparent communication, clear terms and conditions, and exceptional customer service.