AUTHOR: ROSE KELLY

DATE: 23/02/2023

In the dynamic landscape of digital commerce, the synergy between payment processors and inbound marketing strategies has become increasingly vital, particularly in a burgeoning market like India. As businesses navigate the complexities of online transactions and customer engagement, understanding the intersection of payment processing and inbound marketing is crucial for success.

Introduction to Payment Processors

Payment processors play a pivotal role in facilitating online transactions by acting as intermediaries between merchants and customers. They enable secure and efficient electronic payments, ranging from credit card transactions to digital wallets and UPI payments.

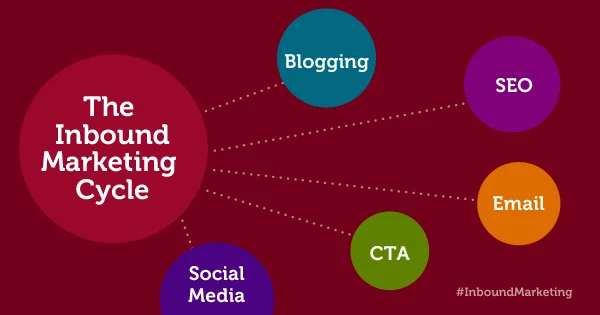

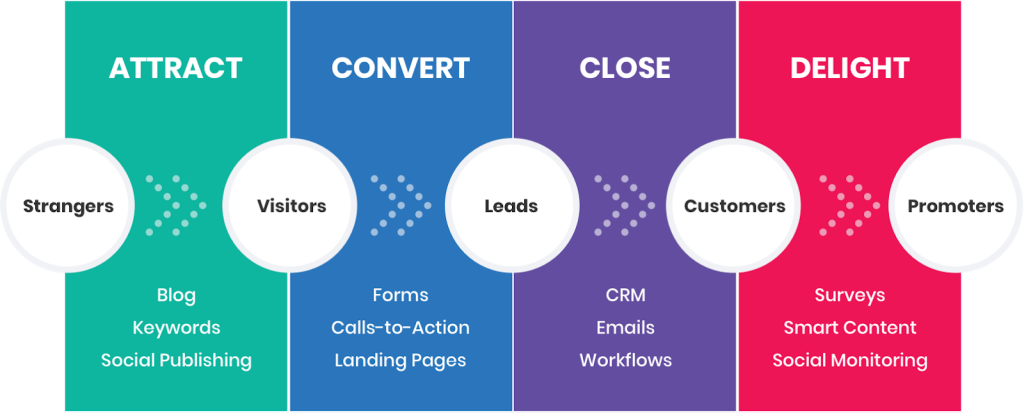

Importance of Inbound Marketing

Inbound marketing focuses on attracting, engaging, and delighting customers through valuable content and experiences. Unlike traditional outbound marketing, which interrupts audiences with promotional messages, inbound marketing seeks to organically draw prospects to a brand by providing relevant and helpful information.

Understanding Inbound Marketing in India

Cultural Nuances

India’s diverse cultural landscape presents unique challenges and opportunities for inbound marketers. Tailoring content and messaging to resonate with different regional preferences and languages is essential for effective engagement.

Market Trends

With the proliferation of smartphones and internet connectivity, India has witnessed a significant shift towards online shopping and digital payments. This trend has accelerated further, especially in the wake of the COVID-19 pandemic, as consumers prioritize convenience and safety.

The Role of Payment Processors in Inbound Marketing

Seamless Transactions

Integration with reliable payment processors ensures a smooth and hassle-free checkout experience for customers, reducing cart abandonment rates and enhancing user satisfaction.

Building Trust

Secure payment processing services[1] instill confidence in consumers, addressing concerns related to data privacy and financial security. Trust is a cornerstone of inbound marketing, and seamless payment experiences contribute to fostering long-term customer relationships.

Strategies for Effective Inbound Marketing with Payment Processors

Content Creation

Producing high-quality, informative content is key to attracting and engaging target audiences. From blog posts and articles to videos and infographics, compelling content drives traffic and cultivates brand loyalty.

Social Media Engagement

Active participation on social media platforms allows brands to connect with customers on a personal level, fostering community engagement and brand advocacy. Payment processors can leverage social media channels to share valuable insights, promote special offers, and address customer queries.

SEO Optimization

Optimizing content for search engines enhances visibility and drives organic traffic to a website. By incorporating relevant keywords, optimizing meta tags, and improving site structure, businesses can improve their search engine rankings and attract qualified leads.

Case Studies of Successful Inbound Marketing Campaigns in India

Several Indian companies have effectively implemented inbound marketing strategies[2] in conjunction with payment processors to achieve remarkable results. Case studies highlighting these success stories provide valuable insights into best practices and actionable tactics.

Challenges and Solutions

Regulatory Compliance

Navigating regulatory frameworks and compliance requirements can pose challenges for businesses operating in India’s digital ecosystem. Partnering payment processors[3] that prioritize regulatory adherence and compliance helps mitigate risks and ensure legal compliance.

Competition

The competitive landscape in India’s e-commerce[4] sector fierce, with numerous players vying for market share. Differentiating through innovative marketing strategies and superior customer experiences is essential for staying ahead of the competition.

Future Trends and Innovations

As technology continues to evolve, the future of payment processor inbound marketing in India[5] holds immense potential for innovaion. Emerging trends such as AI-driven personalization, voice commerce, and blockchain-based payments are poised to reshape the digital commerce landscape.

Conclusion

In conclusion, the convergence of payment processing and inbound marketing presents unparalleled opportunities for businesses seeking to thrive in India’s digital economy. By prioritizing seamless transactions, building trust, and implementing effective marketing strategies, companies can unlock growth and drive sustainable success.

FAQs

- What are payment processors? Payment processors are companies that facilitate electronic transactions between merchants and customers, ensuring secure and efficient payment processing.

- How does inbound marketing differ from outbound marketing? Inbound marketing focuses on attracting customers through valuable content and experiences, whereas outbound marketing relies on promotional messages to reach audiences.

- Why is trust important in payment processing? Trust is essential in payment processing as it reassures customers about the security of their financial transactions, fostering long-term relationships and loyalty.

- What are some regulatory challenges in India’s digital ecosystem? Regulatory challenges in India’s digital ecosystem include compliance with data protection laws, taxation policies, and foreign investment regulations.

- What role does social media play in inbound marketing with payment processors? Social media serves as a valuable channel for engaging customers, sharing content, and promoting special offers, enhancing brand visibility and customer engagement.