AUTHOR : BELLA

DATE : FEBRUARY 23, 2024

Introduction to Payment Processor Integrated Marketing

In the dynamic realm of commerce, where digital transactions are becoming increasingly prevalent, payment processor-integrated marketing plays a pivotal role. It involves the harmonious alignment of marketing efforts with payment processing services to optimize customer acquisition, engagement, and retention. This article delves into the significance of integrated marketing within the payment processing landscape, particularly focusing on the context of India’s burgeoning market.

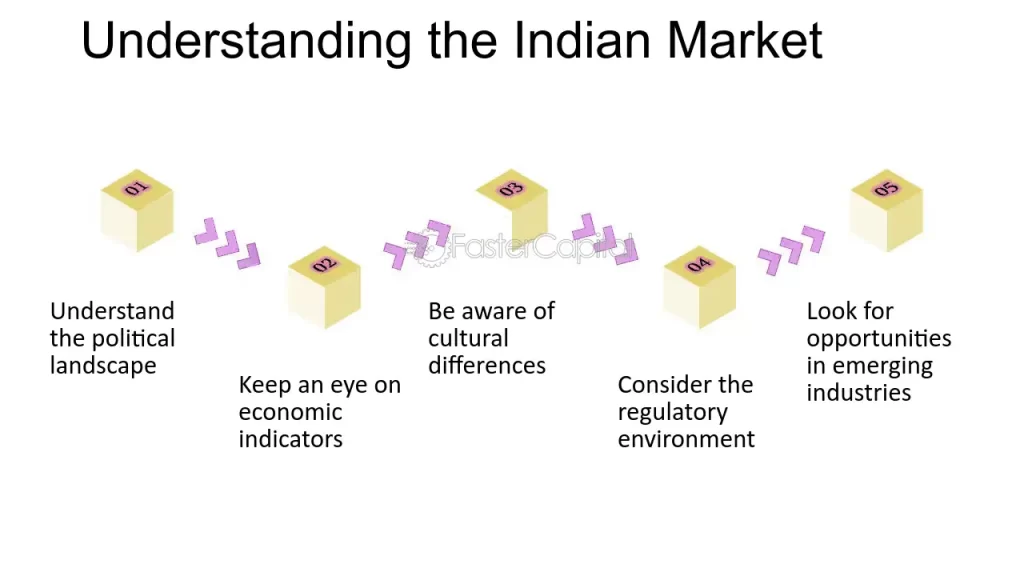

Understanding the Indian Market

India, with its vast population and rapidly growing economy, presents a fertile ground for payment processing ventures. However, navigating the intricacies of the Indian market requires a nuanced understanding of its diverse demographics, cultural nuances, and regulatory frameworks. Despite challenges, India offers immense potential for innovative payment solutions, driven by factors such as increasing smartphone penetration and government initiatives promoting digital payments.

The Role of Payment Processors in India

In India’s evolving payment ecosystem, several players have emerged as key stakeholders, including banks, fintech startups, and established payment processors. With the advent of the Unified Payments Interface (UPI) and other digital payment platforms, the landscape has witnessed a paradigm shift towards cashless transactions. Payment processors facilitate seamless transactions between merchants and consumers, driving the adoption of digital payment methods across various sectors.

Benefits of Integrated Marketing

Integrated marketing empowers payment processors amplify their brand presence and forge deeper connections with their target audience. Payment processors can use social media, email marketing, and content creation to create effective campaigns that connect with consumers. Furthermore, integrated marketing fosters[1] customer loyalty by delivering personalized experiences tailored to individual preferences and behaviors.

Strategies for Effective Integrated Marketing

To maximize the impact of integrated marketing efforts[2], payment processors should prioritize the creation of a seamless omnichannel experience. By ensuring consistency across different touchpoints, they can enhance user engagement and streamline the purchasing journey. Using data analytics helps payment processors understand consumer behavior better, improving marketing strategies.

Successful Integrated Marketing Campaigns

Several payment processors in India have successfully implemented integrated[3] marketing strategies to drive business growth and customer engagement. Paytm grows its user base through social media, influencers, and targeted promotions, while Razorpay establishes itself as a fintech thought leader with content marketing and webinars.

Challenges and Solutions

Despite the immense opportunities, payment gateway[4] processors in India face various challenges, including regulatory uncertainties and cybersecurity risks. To mitigate these challenges, companies must prioritize compliance with regulatory guidelines and invest in robust security measures. Additionally, fostering partnerships with regulatory bodies and industry stakeholders can help navigate complex regulatory landscapes and foster trust among consumers.

Future Trends and Innovations

Looking ahead, the future of payment processor-integrated marketing in India is poised for further innovation and disruption. Blockchain, AI, and machine learning can revolutionize payment processing and enhance consumer experiences. Moreover, as payment e-commerce[5] continues to proliferate, payment processors must adapt to evolving consumer preferences.

Conclusion

In conclusion, payment processor-integrated marketing instrumental in driving growth and innovation within India’s burgeoning payment ecosystem. By embracing integrated marketing strategies, payment processors can effectively navigate the complexities of the Indian market, enhance brand visibility, and cultivate lasting relationships with customers. As India transitions towards a cashless economy, integrated marketing will continue to play a pivotal role in shaping the future of payments.

FAQs

- What distinguishes integrated marketing from traditional marketing?

Integrated marketing entails the seamless coordination of various marketing channels and touchpoints to deliver a unified brand experience, whereas traditional marketing often involves disparate, standalone campaigns. - How can payment processors leverage data analytics for marketing purposes?

By analyzing customer data, payment processors can gain valuable insights into consumer behavior, preferences, and trends, allowing for more targeted and personalized marketing campaigns. - What are some regulatory challenges faced by payment processors in India?

Payment processors in India must navigate a complex regulatory landscape governed by entities such as the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI). Compliance with stringent regulations regarding data security and customer privacy poses significant challenges. - What role does customer experience play in integrated marketing for payment processors?

Customer experience is paramount in integrated marketing, as it directly influences brand perception and customer loyalty. Payment processors must prioritize delivering seamless, intuitive experiences across all touchpoints to enhance customer satisfaction. - How can payment processors stay ahead of emerging trends in the industry?

By fostering a culture of innovation and agility, payment processors can adapt to evolving consumer preferences and technological advancements.