AUTHOR : LISA WEBB

DATE : FEBRUARY 24, 2024

Introduction

In the fast-paced world of commerce, where seamless transactions are the backbone of business, the role of payment processors cannot be overstated. This article delves into the intricacies of Payment Processor Telemarketing in India, shedding light on its importance and the burgeoning market it operates.

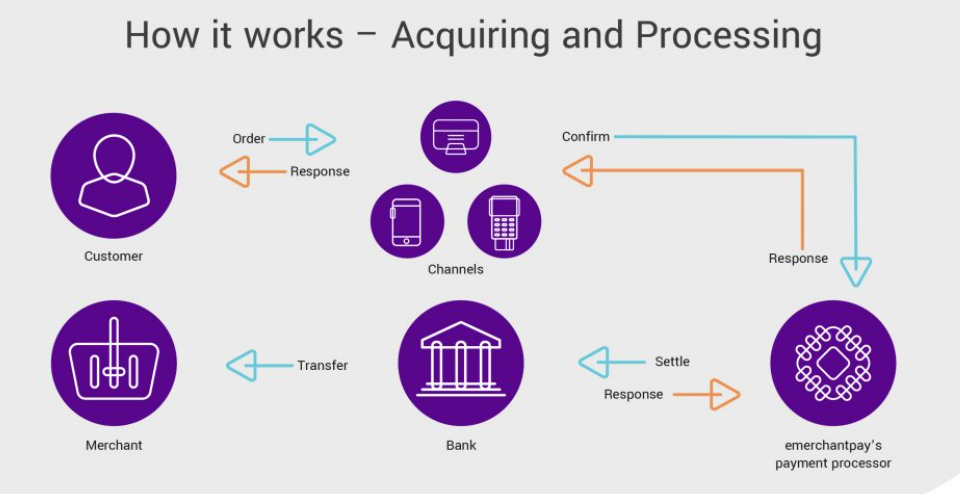

Understanding Payment Processors

Payment processors act as the bridge between businesses and also financial institutions, ensuring swift and secure transactions. Their features and also benefits make them indispensable in today’s digital economy, streamlining payment processes and also enhancing overall efficiency.

Telemarketing in the Digital Era

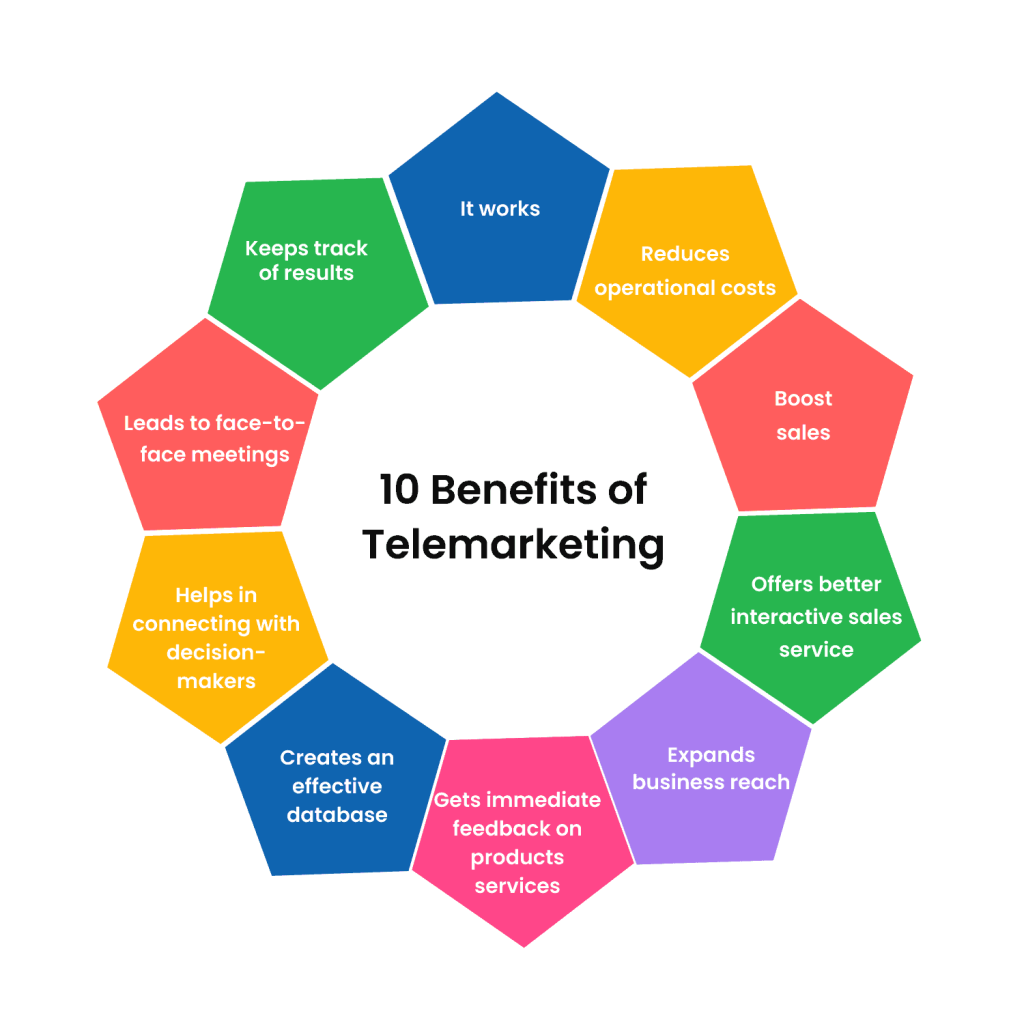

Telemarketing has evolved alongside technology, leveraging digital platforms to reach a wider audience. In the context of payment processors, telemarketing plays a crucial role in educating businesses about the advantages of adopting efficient payment solutions.

The Indian Market Dynamics

of the payment industry in India is essential for crafting successful telemarketing strategies. However, it comes with its own set of challenges and also opportunities.

Strategies for Effective Telemarketing

Crafting a successful telemarketing campaign[1] involves building a targeted customer database, creating compelling scripts, and also leveraging technology for optimal outreach. These strategies form the foundation for a successful telemarketing endeavor in the payment processing domain.

Compliance and Security Measures

Operating in the financial sector requires strict adherence to regulations and also robust security measures. Payment processor telemarketing[2] campaigns must prioritize compliance and also security to ensure trust and reliability in the eyes of businesses and also consumers.

Case Studies

Examining successful payment processor telemarketing campaigns[3] in India provides valuable insights. Real-world examples showcase effective strategies and also highlight the potential pitfalls to avoid in this dynamic landscape.

Future Trends

As technology continues to advance, the future of payment[4] processor telemarketing holds exciting prospects. From embracing artificial intelligence to adapting to changing consumer behaviors, staying ahead of the curve is crucial for sustained success.

Advantages for Businesses

For businesses, adopting payment processor telemarketing brings about cost-effectiveness and also increased market reach. The article explores how this strategy can be a game-changer for businesses of all sizes.

Tips for Telemarketers

Effective communication strategies and also adept handling of objections are essential skills for telemarketers. This section provides practical tips to enhance telemarketing proficiency.

Training and Development

Continuous learning and also skill enhancement processor[5] play a vital role in the success of payment processor telemarketers. Investing in training and also development ensures a skilled and also adaptable workforce.

Role of AI in Telemarketing

Artificial intelligence is transforming telemarketing, offering automation solutions that enhance efficiency and also the customer experience. Exploring the role of AI in payment processor telemarketing is crucial for staying competitive in the industry.

Client Testimonials

Positive experiences from businesses that have benefited from payment processor telemarketing add credibility to the strategy. Customer feedback builds trust and also serves as a powerful tool for attracting new clients.

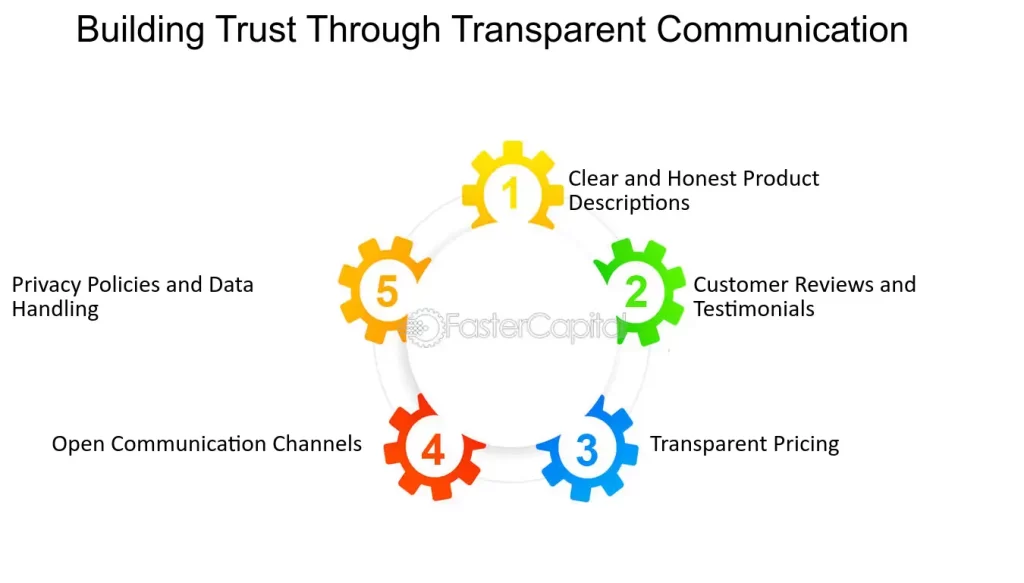

Building Trust through Transparent Practices

Trust is the cornerstone of successful telemarketing. This section explores how businesses can build and maintain trust with their audience through transparent practices.

Transparent Communication

Open and honest communication is paramount. Clearly conveying the benefits of payment processor solutions, along with their potential limitations, fosters trust. Avoiding jargon and providing straightforward information establishes credibility.

Testimonials and Case Studies

Featuring client testimonials and case studies in telemarketing efforts provides tangible evidence of successful collaborations. Real-world examples resonate with potential clients, demonstrating the practical benefits of choosing a particular payment processor.

Conclusion

The world of payment processor telemarketing in India is a dynamic arena where the convergence of traditional methods and also digital strategies opens up new avenues for success. By embracing innovation, adhering to regulations, building trust, and also staying adaptable, businesses can thrive in this competitive landscape.

FAQs

- Is payment processor telemarketing only for large businesses?

- No, payment processor telemarketing is beneficial for businesses of all sizes, offering cost-effective solutions.

- How can businesses ensure the security of transactions in telemarketing?

- Implementing robust security measures and adhering to regulations are key to ensuring secure transactions.

- Are there specific regulations for payment processor telemarketing in India?

- Yes, businesses must comply with existing regulations governing financial transactions and telemarketing practices.

- What role does customer feedback play in building trust for payment processor telemarketing?

- Positive customer testimonials contribute significantly to building credibility and trust in telemarketing campaigns.

- How can businesses stay updated on the latest trends in payment processor telemarketing?

- Continuous learning through training programs and staying informed about technological advancements is crucial for staying updated.