AUTHOR: BABLI GUPTA

DATE: 04/01/24

Introduction

Database marketing has become a cornerstone for payment providers in India, transforming the way they engage with users and shape their marketing strategies. As digital payments continue to surge, understanding the nuances of database marketing becomes crucial for sustained success in the competitive landscape.

Evolution of Payment Providers in India

In the not-so-distant past, traditional banking methods dominated India’s financial landscape. However, with the advent of digitalization, payment provider have undergone a remarkable evolution. The convenience offered by digital payment platforms has led to a significant shift in consumer behavior, paving the way for innovative marketing approaches.

Significance of Database Marketing

In the realm of payment providers database marketing plays a pivotal role. It involves the systematic collection and analysis of user data to formulate targeted marketing strategies. By understanding user behavior, payment providers can tailor their offerings to meet the specific needs and preferences of their customer base.

Challenges in Payment Provider Database Marketing

Despite its advantages, database marketing in the payment sector comes with its own set of challenges. Privacy concerns and security issues loom large, demanding a delicate balance between personalized marketing and safeguarding sensitive information. Navigating these challenges is crucial to building and maintaining consumer trust.

Role of Technology in Database Marketing

Technological advancements, particularly in artificial intelligence (AI) and machine learning, have reshaped database marketing for payment providers. These tools enable the analysis of vast amounts of data, allowing for the creation of personalized marketing[1] campaigns that resonate with individual users. Data analytics further refine marketing strategies, ensuring relevance and effectiveness.

Case Studies of Successful Database Marketing Campaigns

multiple payment method[2] providers in India have successfully leveraged database marketing to enhance user engagement. Through targeted campaigns based on user preferences and behaviors, these providers have witnessed significant improvements in customer retention and satisfaction. The success stories serve as valuable lessons for others in the industry.

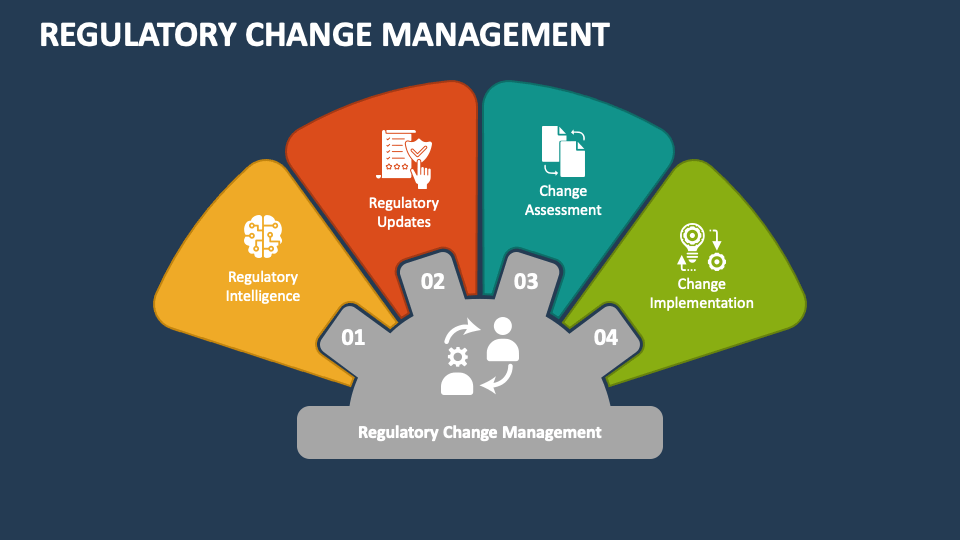

Adapting to Regulatory Changes

With an increased focus on data protection and privacy, payment providers must navigate a complex regulatory landscape. Adhering to data protection laws is not only a legal requirement but also a means of building trust with consumers. Compliance becomes a crucial aspect of database marketing strategies.[3]

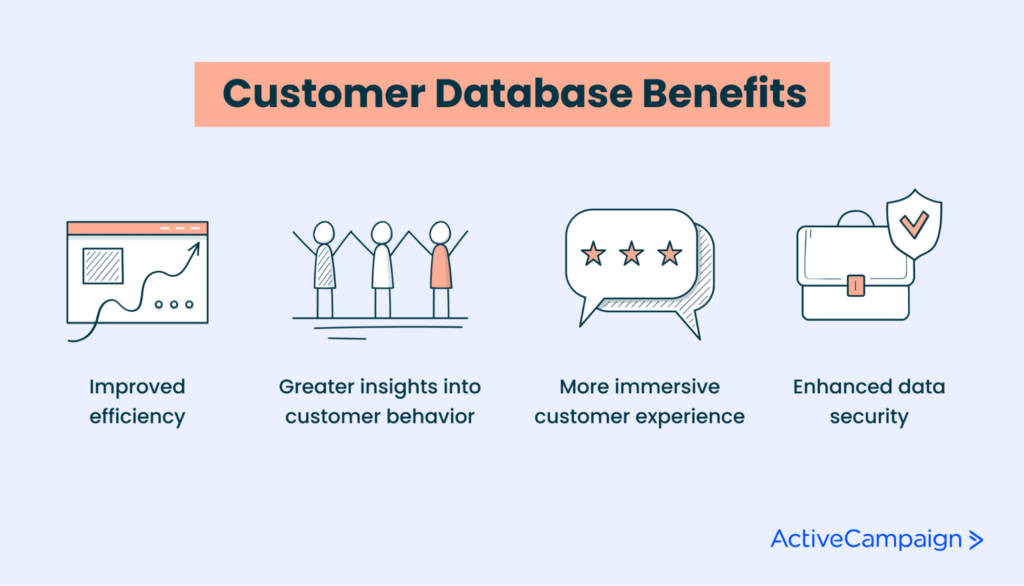

Consumer Insights through Database Marketing

One of the key benefits of database marketing is the wealth of insights it provides into consumer behavior.Payment Provider[4] Database Marketing in India By analyzing this data, payment providers can gain a deeper understanding of user preferences, allowing for the customization of services and the development of targeted promotional campaigns.

Building Customer Loyalty

Database marketing goes beyond acquiring new customers; it plays a vital role in retaining existing ones. Loyalty programs, personalized incentives, and a seamless user experience contribute to building strong and lasting relationships with consumers.

Collaboration and Partnerships

Collaborations between payment providers and other industries can amplify the impact of database marketing[5]. Cross-industry partnerships open new avenues for targeted marketing and can result in mutually beneficial outcomes for all parties involved.

Educating Consumers on Database Usage

Promoting awareness among consumer about how their data is used is a critical aspect of responsible database marketing. Payment providers must be transparent in their practices, ensuring that users are informed and empowered to make informed decisions regarding their data.

Measuring the Success of Database Marketing

Key performance indicators (KPIs) are essential for evaluating the success of database marketing campaigns. Constant monitoring and analysis of KPIs allow payment providers to refine their strategies, ensuring continuous improvement and adaptability to changing market dynamics.

The Competitive Edge

In a crowded market, standing out is paramount. Database marketing provides payment providers with a unique competitive edge. By delivering personalized experiences, understanding consumer needs, and differentiating themselves through effective marketing, providers can carve a niche for themselves in the industry.

Conclusion

Payment provider database marketing in India is not just a trend but a necessity in today’s digital age. The ability to harness the power of data for personalized marketing is a game-changer, and providers that embrace this strategy are likely to thrive in the dynamic and competitive landscape. As technology continues to advance and consumer expectations evolve, payment providers must stay agile, adapting their database marketing strategies to meet the ever-changing demands of the market.

FAQs

- Is database marketing safe for users in the payment sector?

- Payment providers prioritize user safety and employ stringent security measures to protect customer data.

- How do payment providers ensure compliance with data protection laws?

- Payment providers have dedicated teams to ensure compliance with local and international data protection regulations.

- What role does AI play in personalized marketing for payment providers?

- AI analyzes user data to identify patterns, enabling payment providers to create highly targeted and effective marketing campaigns.

- Are loyalty programs effective in retaining customers in the payment industry?

- Yes, loyalty programs, coupled with personalized incentives, contribute significantly to customer retention.

- What are the upcoming trends in payment provider database marketing?

- Emerging trends include the integration of blockchain technology and the rise of decentralized finance in payment provider marketing strategies.