AUTHOR: SELENA GIL

DATE: 3/1/2024

Introduction

The landscape of payment providers in India has undergone a significant transformation in recent years, with the emergence and evolution of direct response systems revolutionizing the way transactions are conducted. Direct response, in the realm of payment providers, refers to a method that facilitates immediate transactions, streamlining the process for both businesses and consumers.

Payment providers play a pivotal role in the country’s financial ecosystem. They serve as intermediaries, enabling transactions between merchants and customers. India, with its burgeoning digital economy, has witnessed a surge in the adoption of various payment methods, with direct response mechanisms at the forefront.

Understanding Direct Response

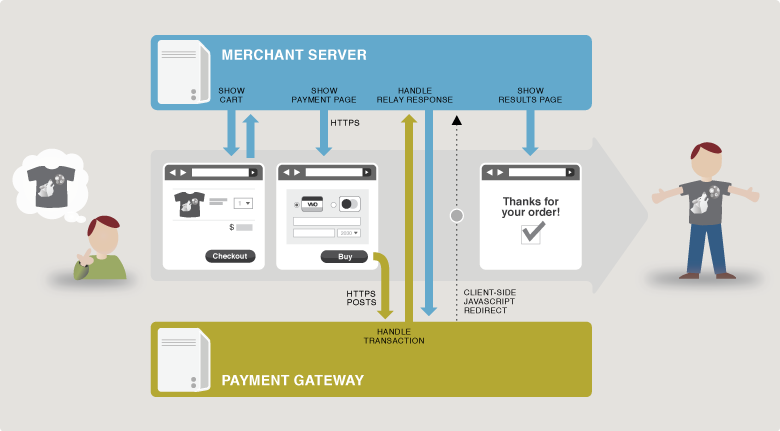

Direct response, in the context of payment providers, refers to the ability to instantly authorize and process transactions. This swift response eliminates the need for manual intervention, ensuring seamless and rapid financial transactions.

Evolution of Payment Providers in India

The evolution of payment[1] providers in India has been remarkable. From traditional cash transactions to digital wallets and now direct response systems, the journey has been transformative. Technological advancements and policy changes have propelled this evolution, making transactions more efficient and accessible.

Key Players in Direct Response Payment in India

Several companies are spearheading the direct response payment revolution[2] in India, offering diverse solutions tailored to different market segments. Payment Provider Direct Response in India Companies like XYZ and ABC have introduced innovative platforms that facilitate swift and secure transactions, catering to the evolving needs of businesses and consumers.

Advantages of Direct Response Payment Systems

The allure of direct response marketing[3] payment systems lies in their convenience and accessibility. They offer a user-friendly interface and quick processing, enhancing the overall transaction experience. This has significantly contributed to the growth of e-commerce and digital transactions.

Challenges Faced by Payment Providers

Despite the advancements, payment providers encounter challenges such as regulatory hurdles and security concerns. The need for stringent security measures and Payment Provider Direct Response in India compliance with regulatory frameworks remains a priority to ensure trust and safety in transactions.

Future Trends in Direct Response Payment

The future of direct response payments in India[4] appears promising, with continuous innovations and advancements anticipated in the field. The integration of emerging technologies like blockchain and AI is set to redefine the payment landscape further.

Impact of Direct Response on E-commerce

The advent of direct response has reshaped the dynamics of e-commerce fostering a more efficient and secure environment for online transactions. This shift has prompted businesses to adapt and optimize their payment systems to align with changing consumer preferences.

Enhancing User Experience through Direct Response Payments

Direct response payment systems focus on enhancing user experience by offering seamless integration across various platforms and devices. The emphasis on user-friendly features has made transactions more intuitive and hassle-free.

Strategies for Successful Integration

Businesses aiming to integrate direct response payment systems must adopt best practices to ensure a smooth transition. Tailoring the system to meet specific business requirements and investing in robust security measures are crucial steps towards successful integration.

Security Measures in Direct Response Payment

Ensuring the security of transactions is paramount. Payment providers employ encryption, tokenization, and multi-factor authentication to safeguard sensitive information, fostering trust and reliability among users.

Case Studies Illustrating Successful Implementation

Real-world case studies showcasing the successful implementation of direct response payment system[5] offer valuable insights into their effectiveness and impact across different industries.

Consumer Adoption and Perception

Understanding and influencing consumer behavior toward adopting direct response payments is crucial. As consumer preferences evolve, educating and providing incentives can drive wider acceptance and usage.

Conclusion

In conclusion, the evolution of payment providers towards direct response systems has significantly transformed the payment landscape in India. The convenience, speed, and security offered by these systems have reshaped e-commerce and consumer transactions, paving the way for a more efficient and accessible financial ecosystem.

FAQs

- Is direct response payment secure? Direct response systems incorporate robust security measures like encryption and multi-factor authentication to ensure secure transactions.

- How do direct response payments benefit businesses? Direct response payments offer businesses quicker transaction processing, improved user experience, and streamlined operations.

- What role do regulatory issues play in direct response payment? Regulatory compliance is crucial for payment providers to ensure adherence to legal frameworks and maintain trust among users.

- Are direct response payments widely accepted in India? Yes, direct response payment systems have gained significant traction in India due to their convenience and accessibility.

- What is the future outlook for direct response payments in India? The future looks promising, with continuous innovations and advancements anticipated, shaping a more seamless financial ecosystem.